Where Do We Go From Here?

Last week, Darius joined Erik Townsend from Macro Voices to discuss the Stock Market, Credit, Inflation, and more.

Here are the three biggest takeaways from the interview that are critical for managing risk:

1) The Stock Market Always Rallies Sharply Leading Up to Recessions

When we evaluate the S&P 500 performance a year before its peak preceding a recession, we usually see it in the green, up on a median basis by +16%.

This year’s rally is not abnormal.

Our expectation is that the coming recession could kick off by the end of this year or early next year.

Moreover, we evaluated the S&P 500’s behavior in and around recessions since 1948, and our research shows the index, on a median basis, typically experiences a drawdown of -24%.

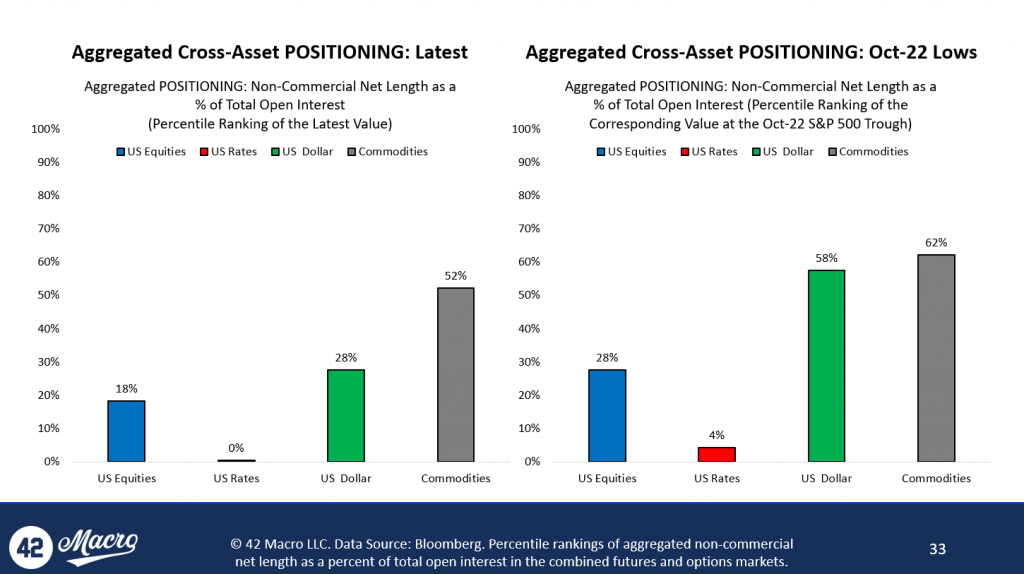

What triggers these rallies are not just macro fundamentals but also how investors are positioned in relation to potential outcomes.

Right now, we believe the current positioning dynamics may push the market higher in the short term because investors remain underweight equities to an extreme degree.

Understanding these positioning cycles is essential for getting the investment game right.

2) We Believe That A Phase 2 Credit Cycle Downturn Is Still On The Horizon.

The Silicon Valley Bank crisis, despite its impact, does not suffice as the Phase 2 Credit Cycle Downturn that we expect to see.

We believe there was a substantial decline in credit and lending standards already evident in January’s senior loan officer survey report.

The crisis did trigger further degradation, but only marginally.

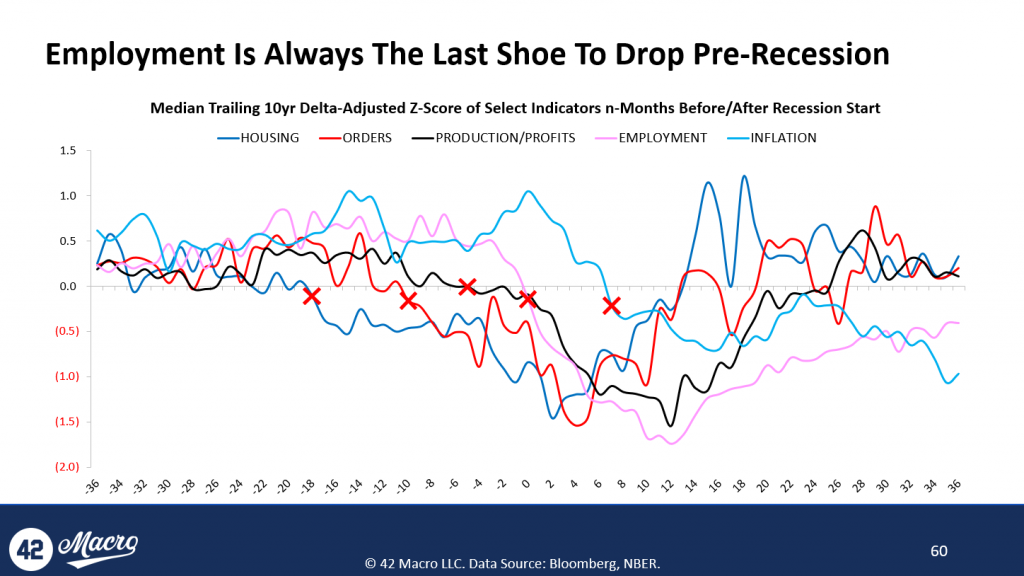

Additionally, we review five key cycles as part of our 42M research – housing, orders, production and profits, employment, and inflation.

The current data indicates a very regular business cycle, with housing, orders, and production and profits already breaking down.

Employment and inflation have yet to break down, and typically do not until the start of (employment) or well into (inflation) a recession, meaning we likely have not seen the start of the recession yet.

As such, the Phase 2 credit cycle downturn is yet to come and recommend incremental patience in terms of respecting the x-axis.

3) Immaculate Disinflation In The US Economy Is Likely To Conclude In 2H23

Over the past few months, we have seen substantial declines in measures of underlying inflation like median CPI, trimmed mean CPI, median PCE, trimmed mean PCE, super core CPI, and super core PCE.

This immaculate disinflation has contributed to the “transitory Goldilocks” theme we’ve observed in asset markets.

We refer to this inflation as ‘Immaculate’ because inflation normally breaks down 6 to 8 months after a recession; here it has meaningfully broken down beforehand.

For a variety of cyclical and structural reasons, we anticipate immaculate disinflation is nearing its end and that we will likely see inflation firm up in 2H23 – relative to expectations and potentially on an absolute basis as well.

We expect soft landing expectations to peak before the “immaculate disinflation” narrative is overtaken by our “resilient US economy = resilient US inflation” theme, contributing a blowoff top that leaves the stock market vulnerable to Phase 2.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!