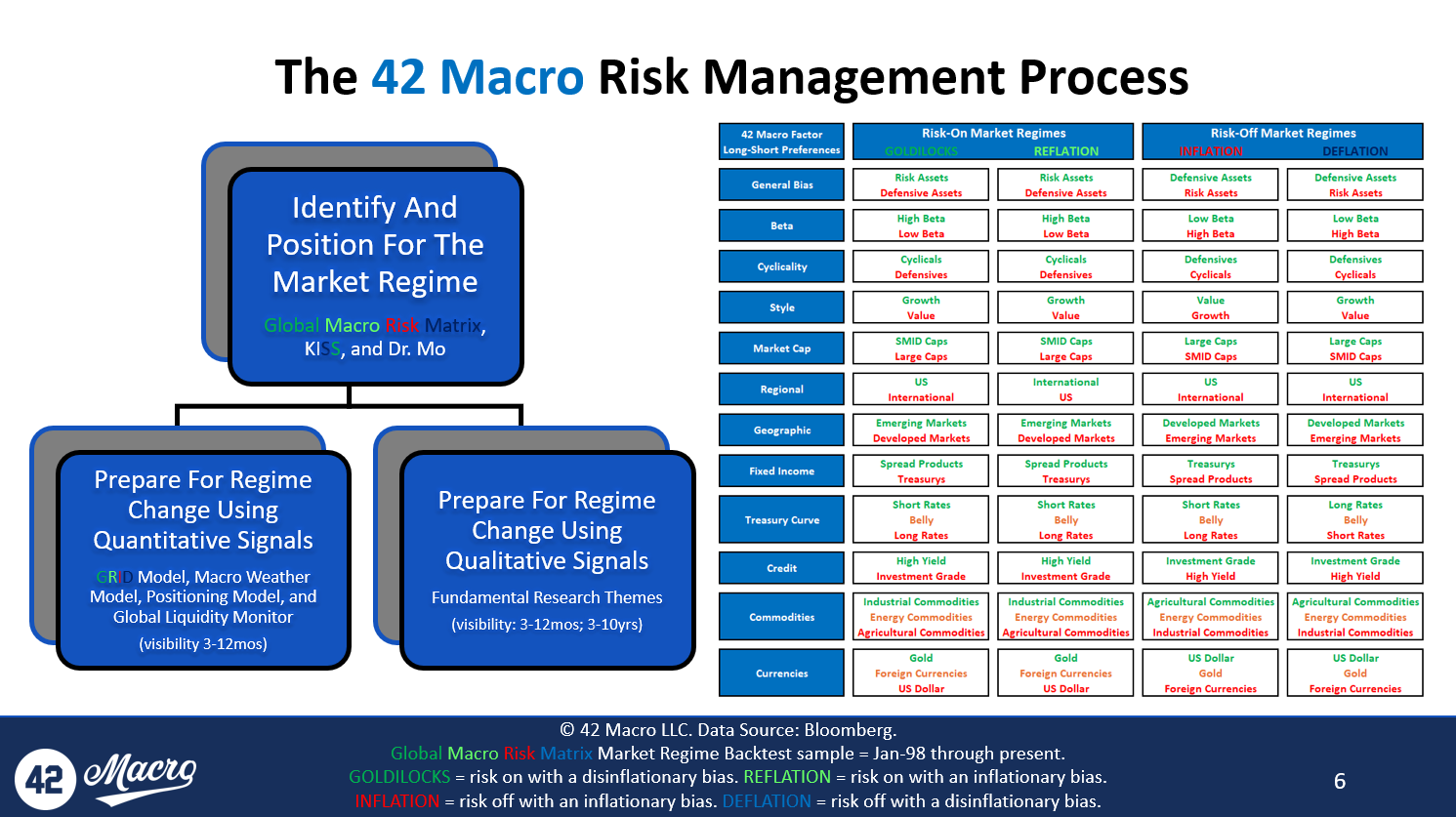

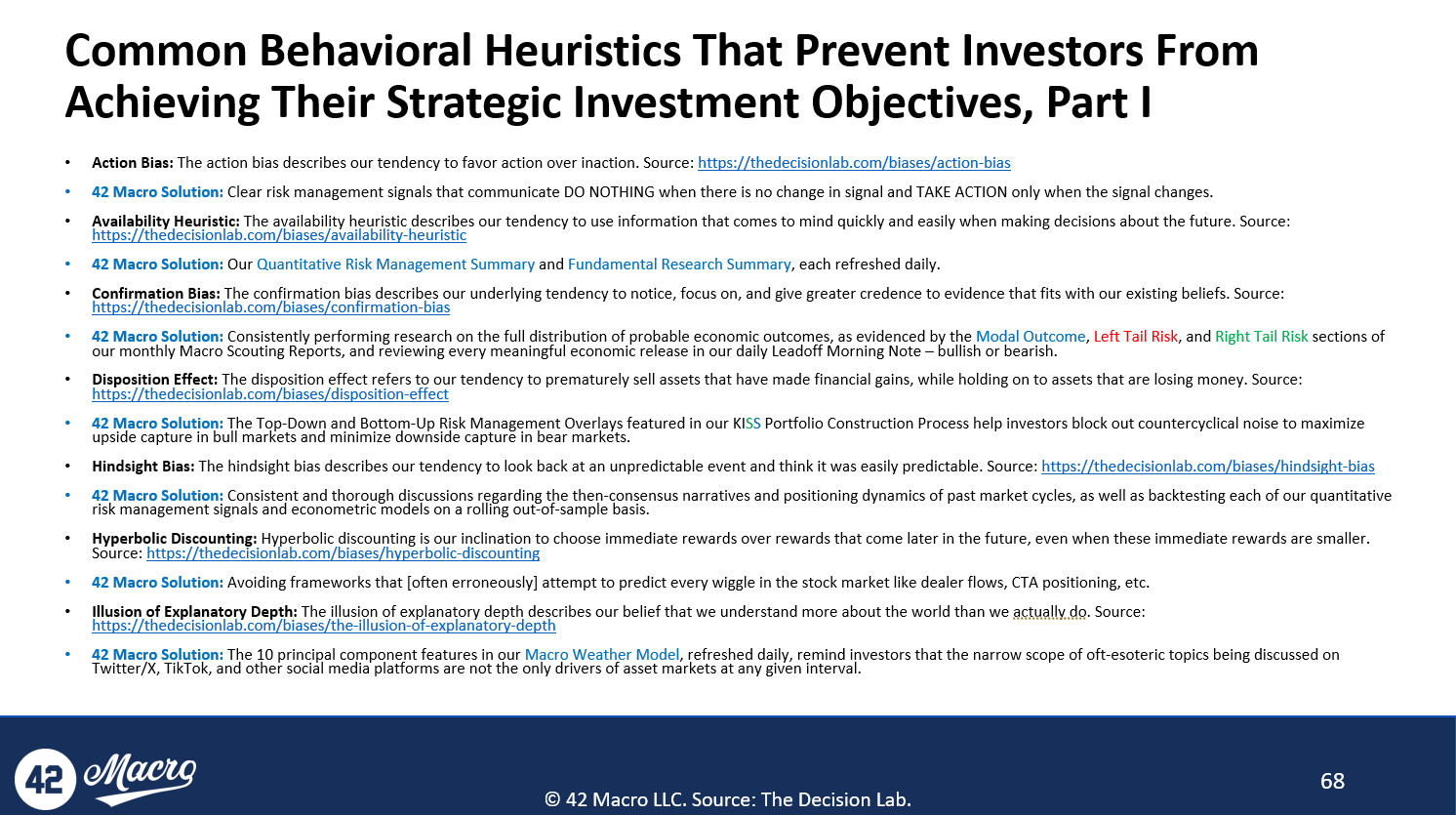

In a world where there is so much data and so many talking head narratives to parse through, it’s important to understand what data really matters so you’re not wasting your valuable time and energy getting whipped around by data and narratives that really don’t have an effect on the longer term trajectory of the business cycle and

financial markets.

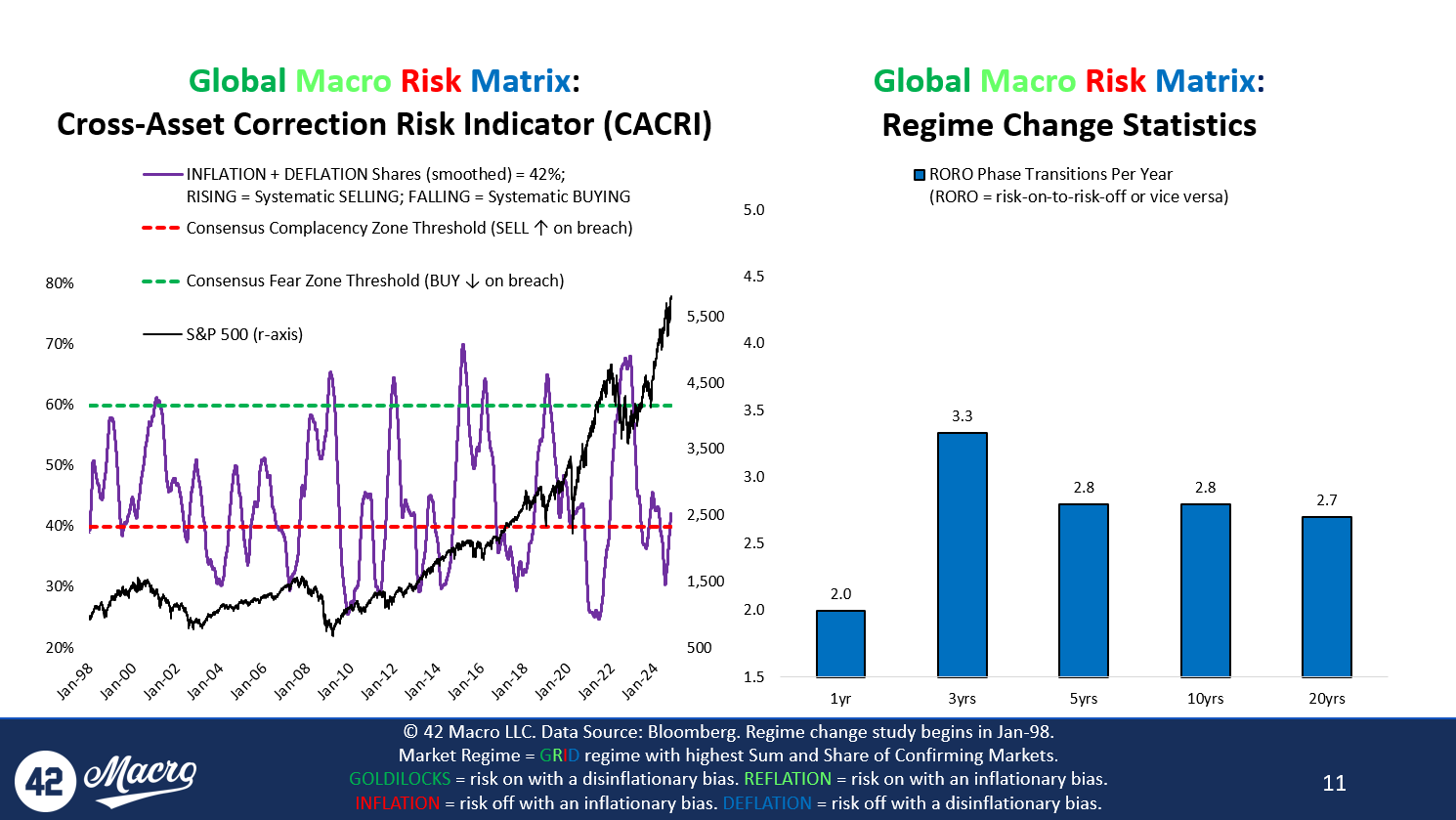

The release of macro data is often times a significant catalyst for financial markets. Differentiating the signal from the noise is imperative. Most of the time it’s not about the actual reported data, but what about that data was expected AND priced into market expectations. If the market has a meaningful response to new data, pay attention, there might be something new or different about it relative to what was “priced in”.

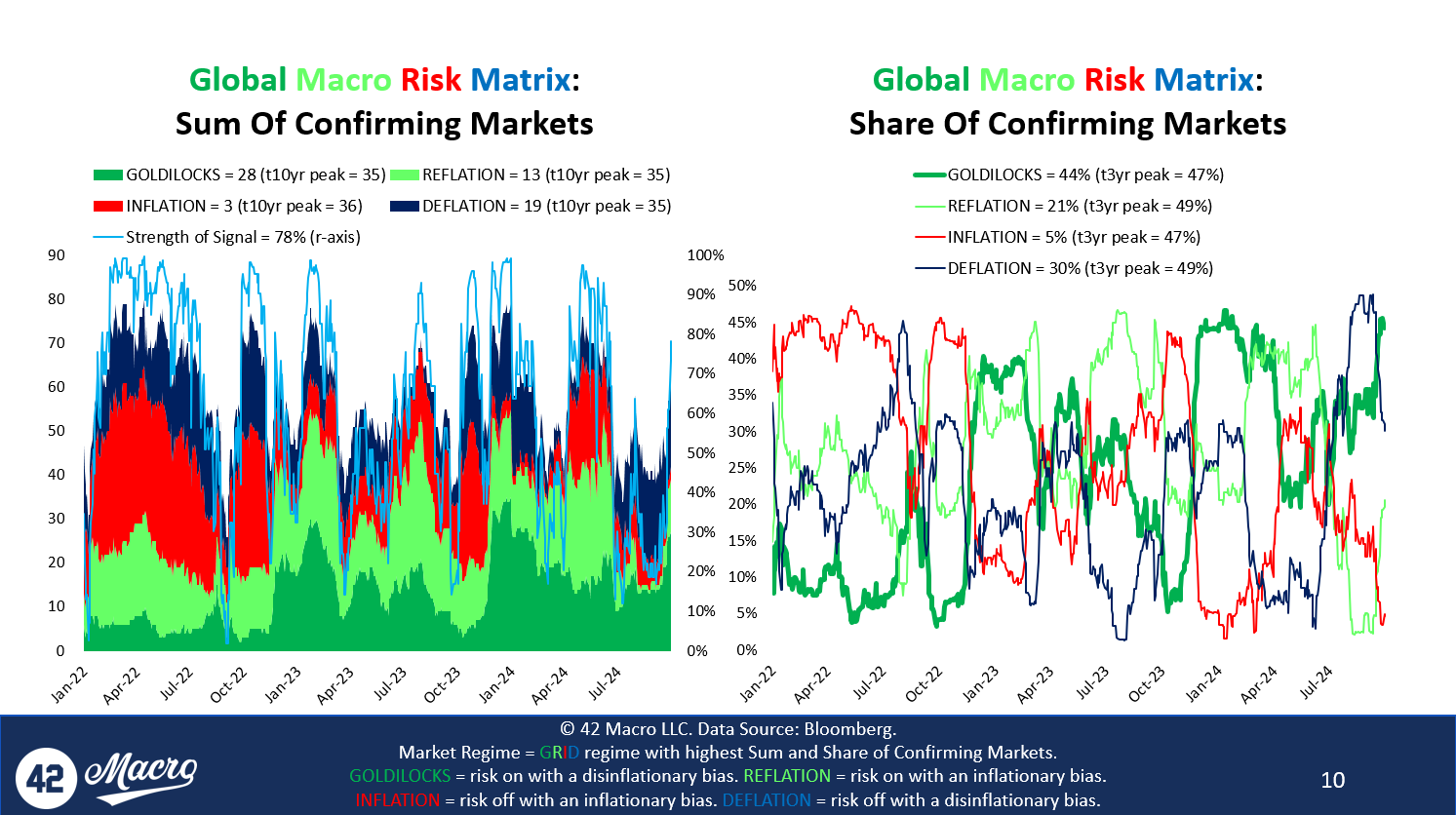

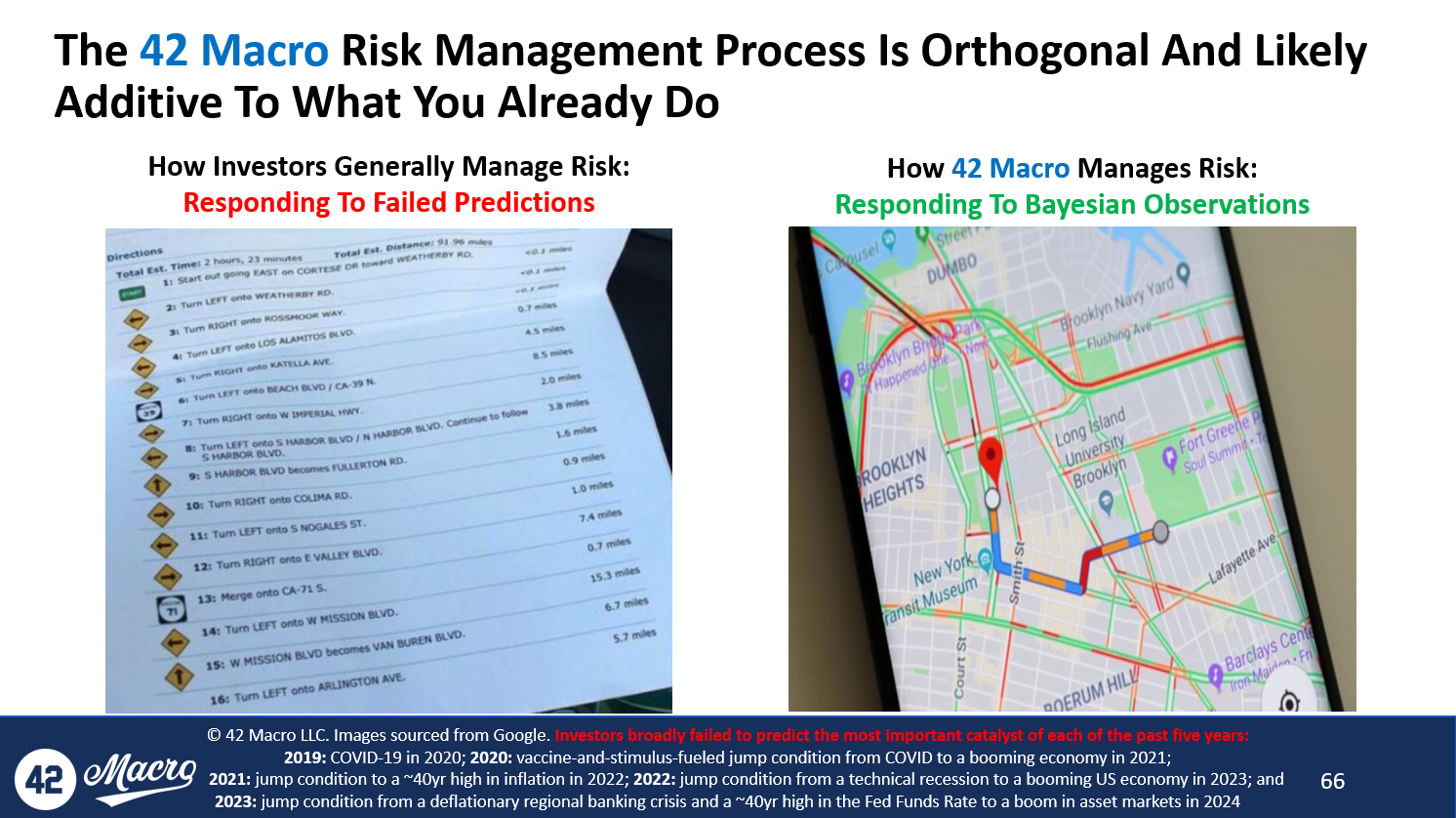

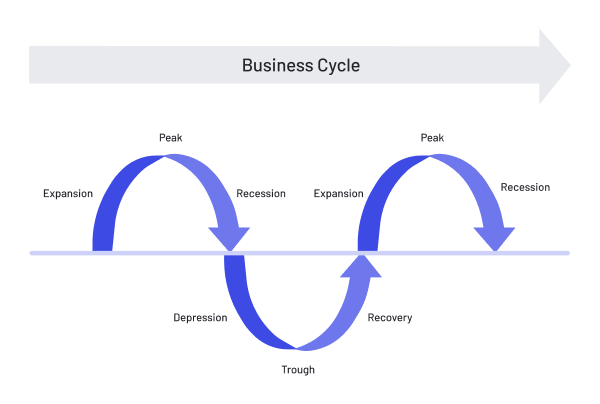

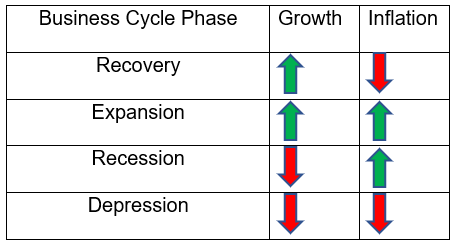

Whether you’re investing in the stock market on a daily, weekly, monthly or quarterly basis, it’s important to have some basic understanding of the business cycle and that macro data that is showing us where we are in that cycle. As an investor you cannot expect to pick every top and bottom of the market, but with the right macro data you can get an excellent read on the trending direction of economic growth and inflation. Knowing where you are in the business cycle and being able to forecast where you’re going is critical. Not having that information is the equivalent of driving blind.

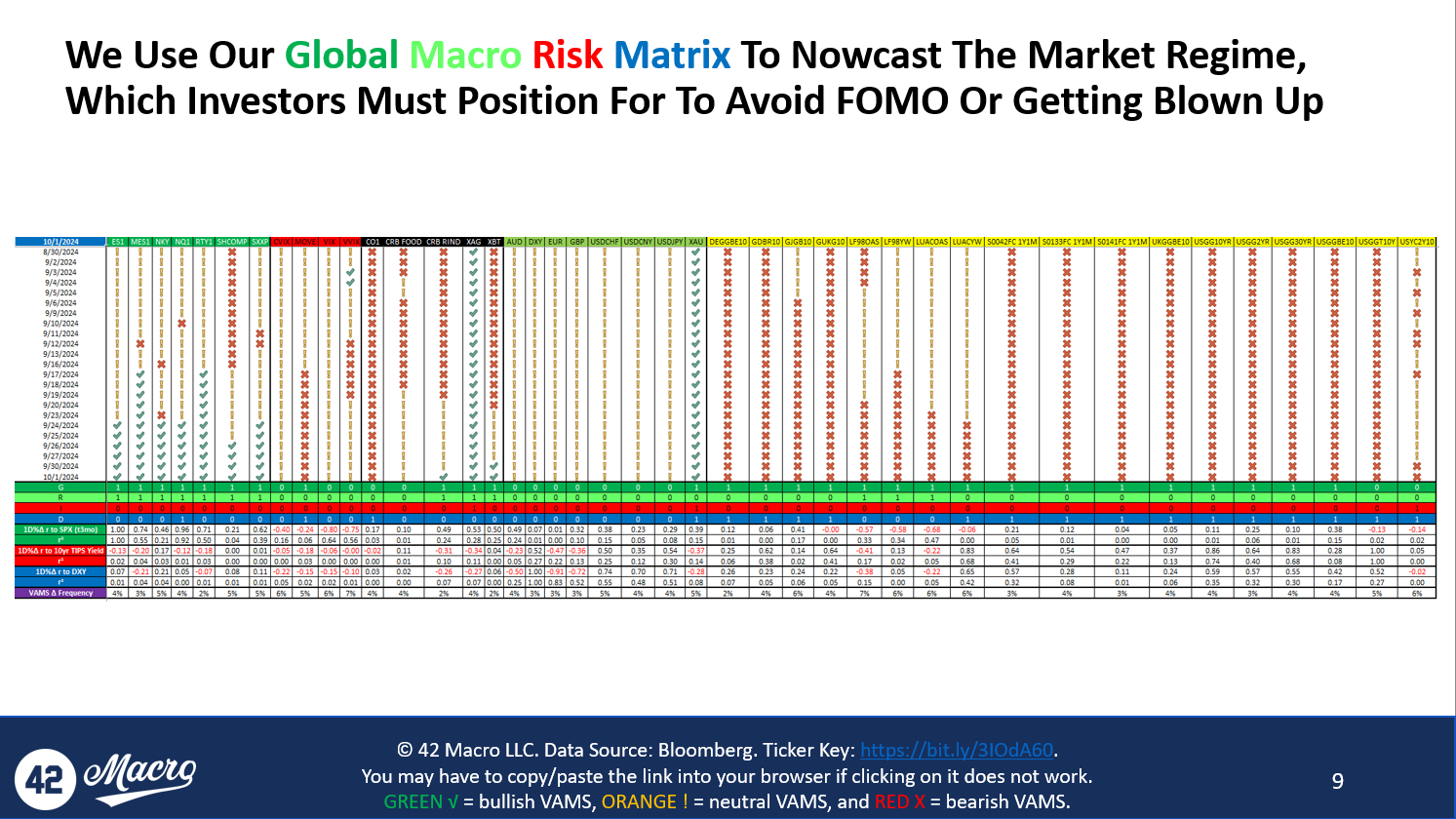

In this chapter, we’re going walk you through the high level macro economic data that matters most – the data that tracks economic growth and inflation AND is most highly correlated to the ups and downs in financial markets. At 42 Macro we are have spent our careers analyzing macro data and back testing the financial markets reactions to that data. When looking at data in general, we like to see a long

history of reporting.

This way we can look back to see how the market, over long periods of time and through numerous business cycles have responded to the data. How closely does the data correlate to the movements in the financial markets.

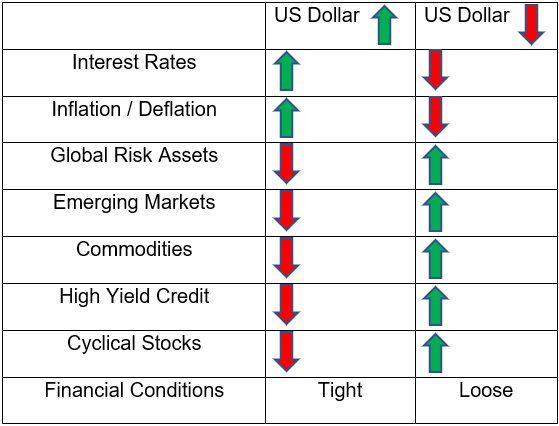

Given that markets are always forward looking, the data that typically matters the most is survey data (because it speaks to survey participant plans and expectations for the future) that measures economic growth as opposed to historical ‘hard’ data (which documents what happened in the past). That said, historic data is also important because it is often the data Central Banks and the Federal Reserve anchor on in making decisions related to interest rate policy and money creation. Interest rate policy is the key lever that is pulled to keep inflation at the desired single digit level. If inflation starts to rise above those levels, the Federal Reserve will raise interest rates in order to prevent the economy from overheating. When growth is slowing and unemployment is rising, the Federal Reserve will lower rates in order to stimulate economic growth

and job creation.

The data is what drives the monetary policy decisions and as you know, those decisions significantly impact financial markets. Often times, the type of economic environment we’re in (inflationary or deflationary) will direct your focus more towards the data most closely aligned with

economic environment.