Darius recently sat down with FFTT Founder and President Luke Gromen to discuss how marketable U.S. treasury market dynamics have shifted over recent years, the likelihood of a meaningful reduction in the federal budget deficit in this Fourth Turning, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. How Have Changes In Ownership Structure Contributed To Price And Yield Dynamics In The Treasury Market?

At 42 Macro, one of the ways we analyze the marketable U.S. Treasury market is by segmenting it into various investor cohorts:

- The Federal Reserve: The Fed’s share has been declining due to balance sheet runoff, peaking at 25% in late 2021 and now at only 15% of total marketable Treasury securities.

- Commercial Banks: Banks’ market share decreased from early 2022 until late 2023, when it began to stabilize. This stabilization was driven by programs like the Bank Term Funding Program (BTFP) and expectations that the Federal Reserve would dramatically lower interest rates. Currently, their share is around 15%, well south of the peak of 33% in 2003.

- Foreign Central Banks: The decline in global trade and the steady shift away from global dollar recycling led by the BRICS member nations caused foreign central banks’ share to steadily decline to 14% from a peak of 40% during the 2008 global financial crisis.

- Global Private Non-Bank Sector (Investors): This cohort has become the largest holder of marketable U.S. Treasury securities, with its share increasing from 36% in late 2021 to 55% today.

This shift in ownership has structurally altered the Treasury market. Unlike banks—such as the Fed, foreign central banks, and commercial banks which purchase Treasurys to satisfy policy or regulatory mandates (e.g., Dodd Frank, Basel III and IV)—global investors demand ex ante returns to compensate for taking risk in their portfolios.

As a result of this seismic shift, upward pressure on yields has intensified, signaling a more acute phase in the evolution of Treasury market dynamics and expectations.

2. How Likely Is Significant Reduction In The Federal Budget Deficit During This Fourth Turning?

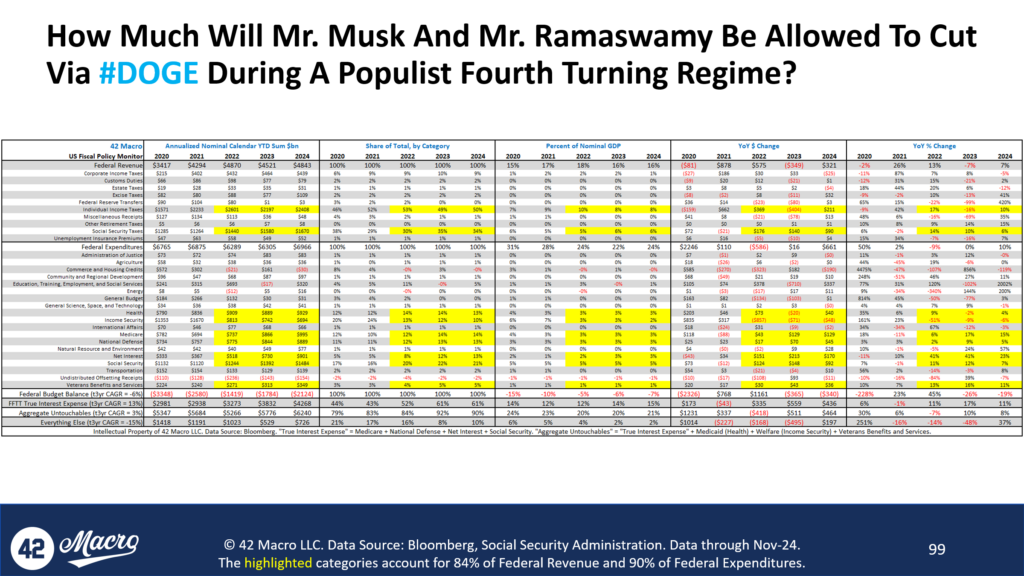

Our analysis of U.S. federal budget dynamics highlights significant challenges to achieving meaningful deficit reduction.

First, U.S. federal expenditures currently represent roughly a quarter of U.S. GDP—the highest share since at least 1970 excluding COVID and the GFC. Thus, significant cuts would likely catalyze a downturn in the economy—however beneficial a smaller government would be in the long run, which is something both Darius and Luke agree with. Per Luke, the last three recessions saw the U.S. federal budget deficit widen by 600bps, 800bps, and 1,200bps.

Secondly, our research indicates that approximately 90% of the budget is effectively untouchable. This “Aggregated Untouchables” category includes “True Interest Expense”—comprising Medicare, National Defense, Net Interest, and Social Security—along with Medicaid, Welfare, and Veterans’ Benefits. Collectively, these expenditures represent programs unlikely to face cuts under the current pro-populist political climate and are compounding at a rate of +3% per year (+13% per year in the “True Interest Expense” category). The remaining 10% of the budget, which largely includes discretionary spending, amounts to just over $700 billion and has already been shrinking at a compound rate of -15% per year over the past three years.

Lastly, demographic trends are exacerbating the fiscal burden. By 2025, 160,000 people will join the retirement-age population each month, compared to just 32,000 entering the working-age population.

Given these dynamics, meaningful deficit reduction appears improbable without tackling politically protected categories. This leads us to believe that meaningful austerity is an unlikely path forward in the context of this current Fourth Turning environment—especially without a significant devaluation of the US dollar preceding it.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +190%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.