Darius recently joined Adam Taggart to discuss the likelihood of significant deficit reduction during President Trump’s administration, a potential global refinancing air pocket, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

- How Likely Is A Significant Reduction Of The Federal Budget Deficit Amid DOGE And Tax Cuts?

Although we believe DOGE is likely to achieve meaningful fiscal expenditure reduction, our analysis of U.S. federal budget dynamics highlights significant challenges to achieving meaningful deficit reduction. Cutting spending ≠ cutting the deficit, once extending and expanding the Tax Cuts and Jobs Act (TCJA) are accounted for.

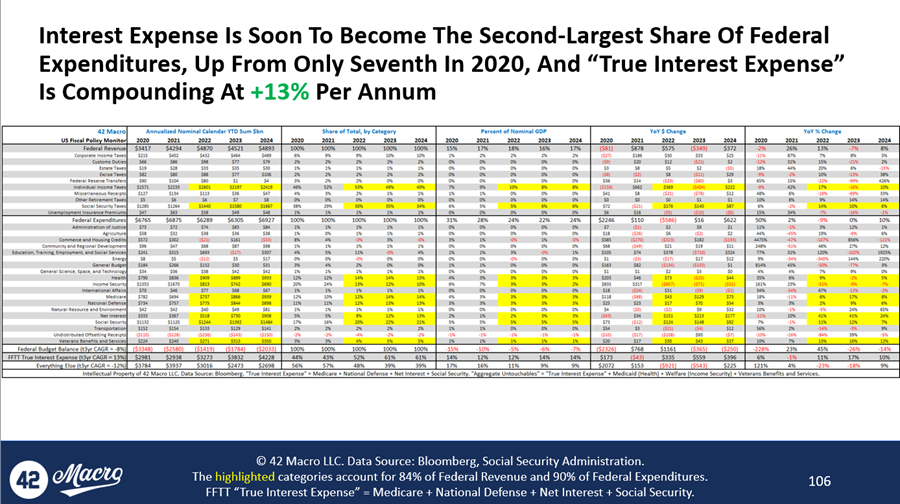

Our research indicates that approximately 61% of the federal budget is effectively untouchable. This includes FFTT’s “True Interest Expense” metric, which comprises Medicare, National Defense, Net Interest, and Social Security. Collectively, these expenditures represent programs that are unlikely to face cuts amid the current populist political climate and are compounding at a rate of +13% per year. The remaining 39% of the budget has already been shrinking at a compound rate of -12% per year over the past three years.

Given these dynamics, we believe meaningful deficit reduction appears improbable without tackling politically protected categories.

- Is A Global Refinancing Air Pocket On The Horizon?

At 42 Macro, we conducted a deep-dive empirical study on the global refinancing cycle and found it to be correlated with the global liquidity cycle. Currently, the lagged growth rate of global non-financial sector debt is accelerating sharply, and our models project this trend to continue through late 2025.

While conventional wisdom suggests this is likely to catalyze an increase in global liquidity, the risk remains that liquidity may fail to expand meaningfully, thus creating a global refinancing air pocket, similar to the divergences observed in 2008-09, 2011, 2015-16, 2018, and 2022, where the S&P 500 declined between 15% and 57%.

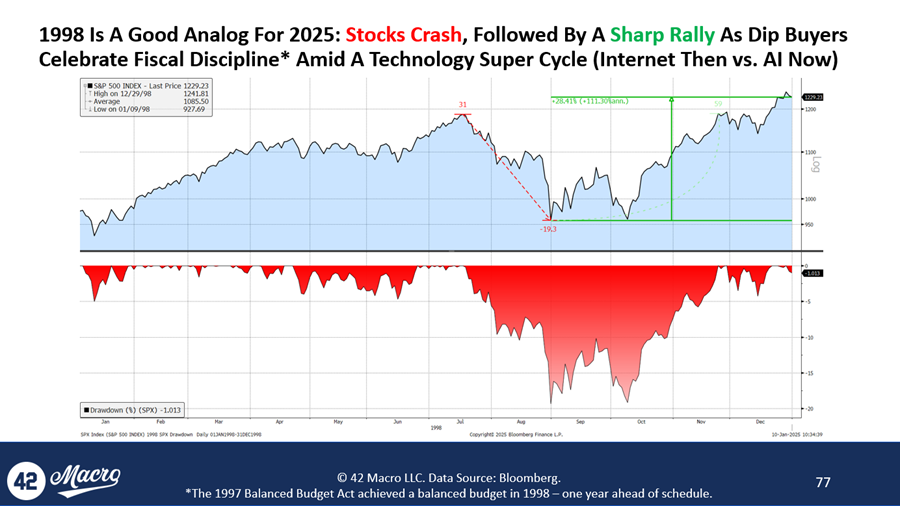

If global liquidity fails to follow the path of the year-over-year growth rate of world total non-financial sector debt, we believe it is likely to lead to severe disruptions—or even a meltdown—in global financial markets. However, we ultimately expect the dip will be bought because investors will finally find attractive valuations to bet on the AI supercycle amid tax cuts and deregulation. 1998 is a good analogy for how we are approaching financial market risk in 2025.

Since our bullish pivot in November 2023, the QQQs have surged 44% and Bitcoin is up +201%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.