Earlier this week, Darius joined Anthony Pompliano to discuss Global Liquidity, Inflation, the Housing Market, and more.

In case you missed it, here are five takeaways from the interview every investor needs to see:

1. Global Liquidity Has Been Declining Over The Past Few Months

Our proxy for global liquidity, estimated via central bank balance sheets, broad money supply, and FX reserves minus gold, has been waning over recent months.

Now that we have observed a negative inflection in global liquidity, it is important for investors to ascertain the durability of this nascent trend.

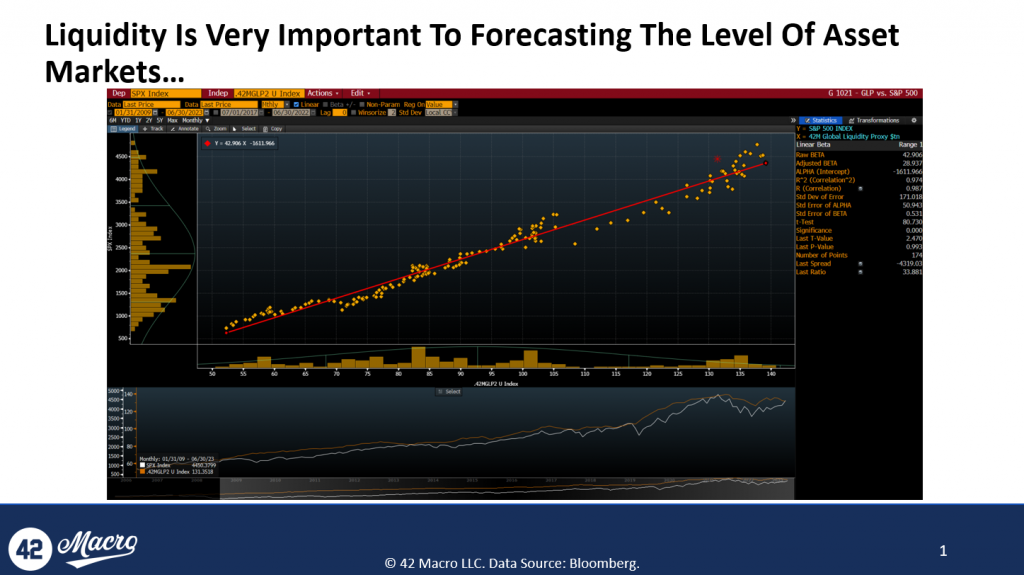

2. Liquidity And Asset Markets Are Correlated On A Levels Basis, But Not On A Rate of Change Basis

The correlation between global liquidity and the S&P500 is substantial on a level basis, explaining 97% of the index’s level since 2009.

However, when regressing global liquidity against the rate of change of the S&P500, there is only a 12% correlation between the two.

When analyzing Bitcoin, we found that liquidity explains 77% of its level but 0% of its rate of change.

So, although liquidity is essential to understanding the long-term trend in asset markets, we should not linearly extrapolate its effects on asset markets in the short to intermediate term.

3. Inflation Will Be The Driver That Causes Asset Markets to Decline

We believe the revival of inflation as an important topic could lead to a downturn in the markets.

Currently, we are seeing favorable inflation outcomes and growth exceeding expectations supporting asset markets.

This dynamic has been beneficial for asset markets in H1, and we believe it will continue through July and possibly into August.

However, we might see inflation data harden afterward, especially relative to consensus expectations.

As the market begins to acknowledge that inflation will be sticky and require more global policy tightening than has been priced in, we expect a market correction.

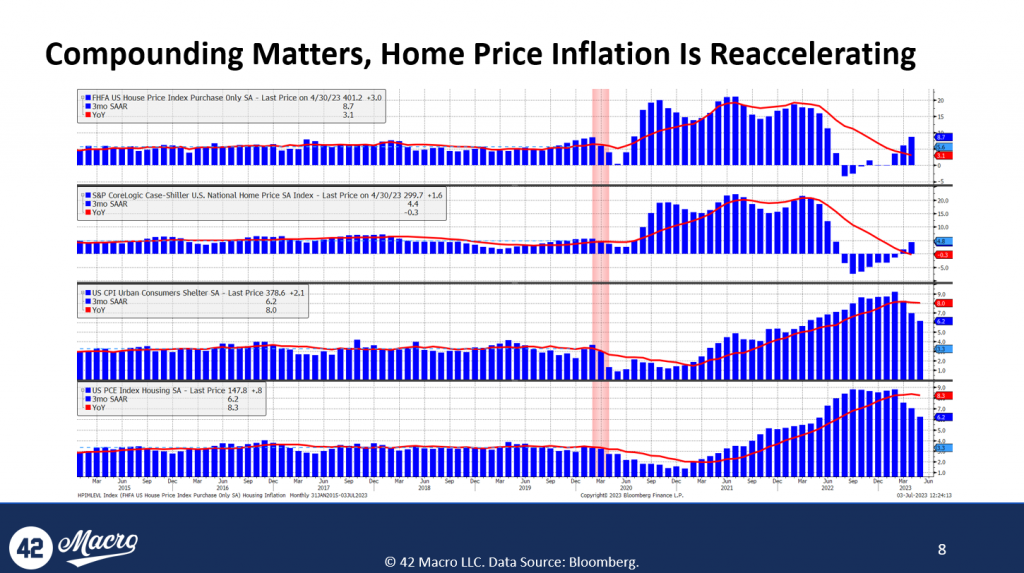

4. Home Prices Are Reaccelerating

According to the FHFA home prices index, home prices are increasing at a rate of 8.7% on a three-month annualized basis after bottoming in the first half of the year.

There is a rising probability we will see housing inflation bottoming out in the next two to three quarters, but at levels that contradict the Fed’s 2% inflation mandate.

The implications of this trend could be concerning, as the Fed might need to do significantly more to counteract the inflation impulse from the housing market.

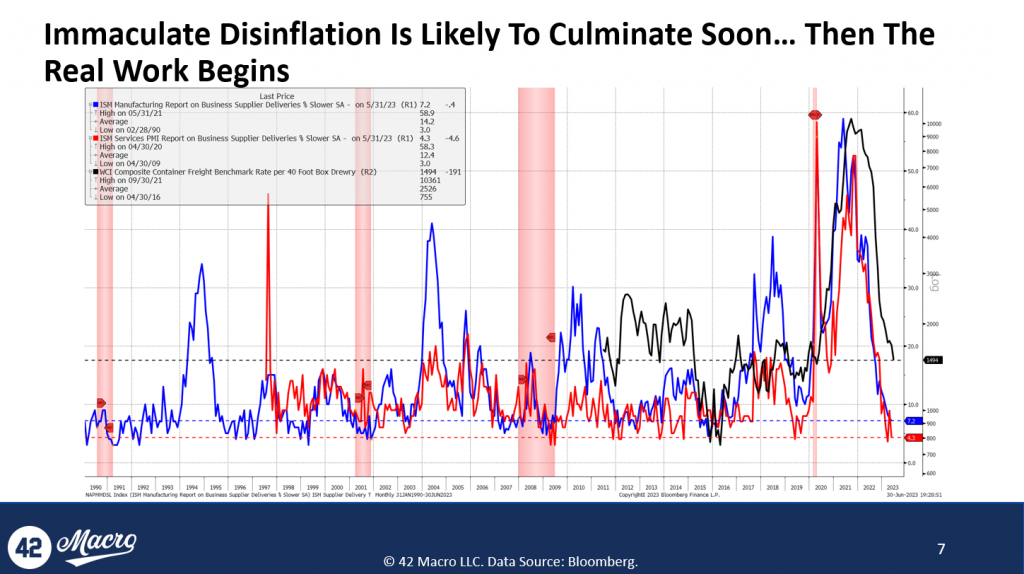

5. The Days of Immaculate Disinflation Are Over

Indices like ISM manufacturing, ISM services, and the supply delivery times index are back at levels consistent with 2% inflation, implying that the period of “immaculate disinflation” driven by pandemic-related factors is coming to an end.

We believe that the easy part of the inflation battle might be over soon.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights.