Last week’s +1.8pt MoM advance in the ISM Services PMI (54.5 = 6mo high) was adequately presaged by the New York Fed’s Services Survey a couple of weeks ago. The New Orders PMI hit a 6mo high as well alongside the highest reading in the Employment PMI since Nov-21.

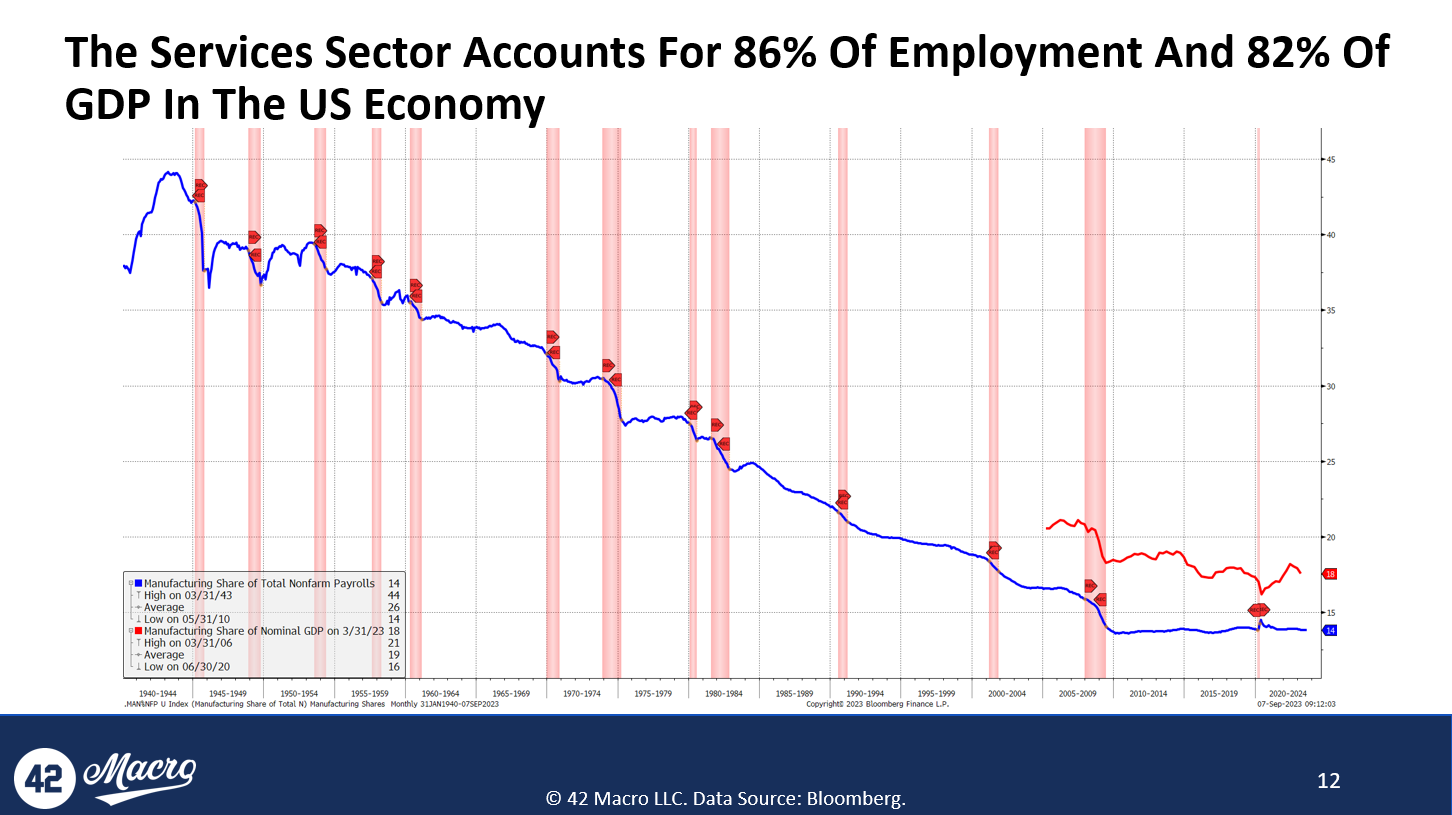

The probability of a near-term recession continues to dwindle because the services sector accounts for 86% of Total Nonfarm Payrolls.

Offsetting the positivity was the 4mo high in the Prices PMI, which is now trending higher again. If the inflation narrative devolves sooner than our qualitative research views anticipate, we could be in the early innings of a market crash.

China’s Crude Oil Imports accelerated to 30.9% YoY in August, fanning the flames of an ill-timed, hazardous breakout in energy prices.

All eyes on Wednesday’s August CPI report to confirm or disconfirm the prevailing “immaculate disinflation” theme, which itself is one-half of the “transitory GOLDILOCKS” theme we co-authored in mid-January (with the other being “resilient US economy”).