We joined Anthony Pompliano earlier this week to discuss the Debt Ceiling, Recession, Global Liquidity, and more.

Every investor will want to review the following six highlights from the interview:

1. We expect the Debt Limit Crisis to negatively impact global liquidity.

The US government will return to the international capital markets to borrow more money (after resolving the crisis).

When that happens, a material amount of liquidity will be removed from the system, driving asset prices down.

2. Understanding the Treasury General Account Balance

The Treasury General Account Balance, essentially the checking account of the US federal government, is a crucial component of global liquidity.

When this balance decreases, it signifies that the government is spending more, increasing liquidity in the economy.

The TGA has declined for the past few quarters, supporting global liquidity and risk assets.

We anticipate a significant increase in TGA in the coming months, which will drain liquidity from the private sector.

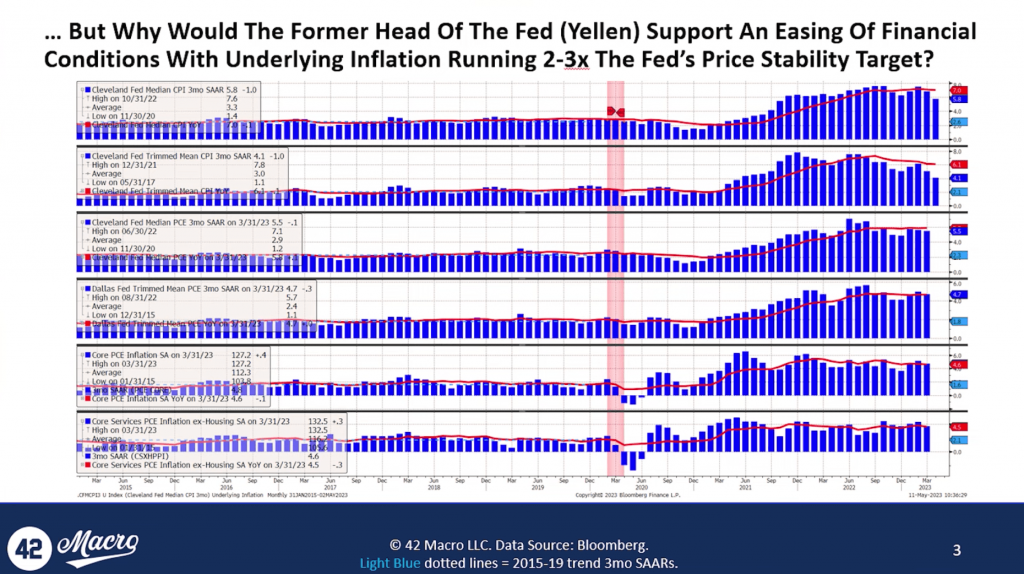

3. Inflation is running at 2-3 times the Federal Reserve’s price stability target.

Given current inflation rates, it doesn’t make sense for Secretary Yellen to support financial easing by flooding the market with T-bills.

Easing financial conditions would drive asset markets higher, only making inflation worse.

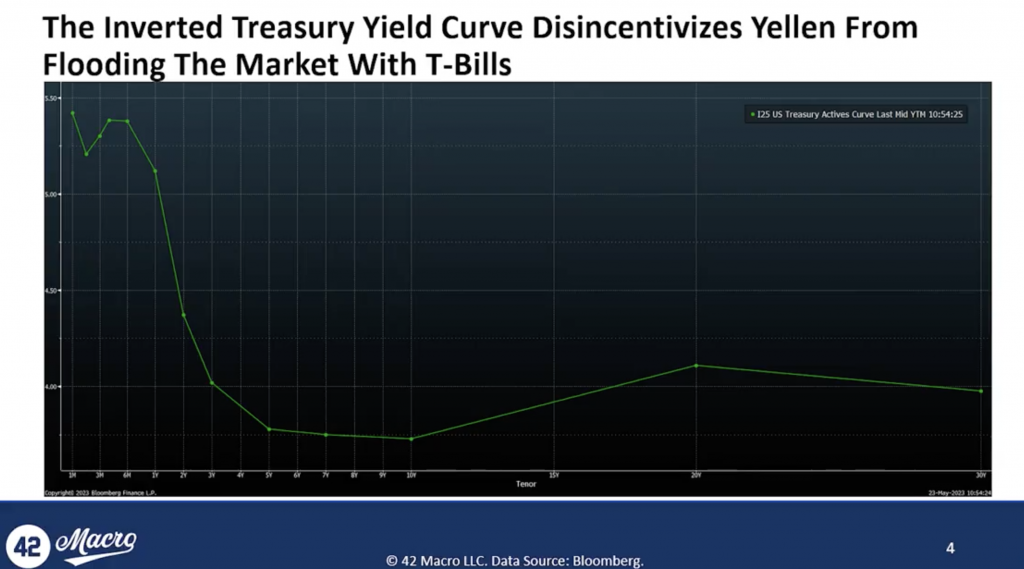

4. The Impact of the Inverted Yield Curve

An inverted yield curve occurs when short-term debt instruments (like T-bills) have a higher yield than long-term debt. It’s often seen as a predictor of an upcoming recession.

Because the Treasury needs to pay interest on issued debt, they are incentivized to lock in the lowest rates, which are currently notes maturing in the 3-10 year range.

This is another reason we believe Secretary Yellen is unlikely to flood the market with T-bills, supporting our view of lower asset prices in the quarters ahead.

5. Changes in Global Central Bank Policies

Global Central Banks also have massive implications for global liquidity and, therefore, asset markets.

We foresee another headwind for asset markets:

The two central banks responsible for the improvement in global liquidity the most over the past year, the People’s Bank of China (PBOC) and the Bank of Japan (BOJ), have been draining liquidity over the past quarter (on a trailing 3-month impulse basis).

The impulses take time to flow through financial markets, but we expect the actions of the PBOC and BOJ are likely to serve as a headwind for risk assets in short order.

6. Potential for a Rough Summer

We expect a shift in liquidity conditions from a very positive trailing six months to a more challenging period over the next two to four months.

The actions of the Fed, Treasury, and Foreign Central Banks over the next 1-2 quarters are not supportive of a positive liquidity environment.

Our advice to you is: if you are invested in risk assets, be careful.

That’s a wrap!

If you found this thread helpful:

1. Go to https://42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights

2. Have a great day!