Earlier this week, Darius joined Anthony Crudele to discuss the Recession, Equities, Investor Positioning, and more.

Miss the discussion? No problem. Here are the three most important insights that can help your portfolio:

1) Hard or Soft, the “Landing” in Inflation Will Mirror the Landing in Growth

If we have a recession, inflation will come down swiftly.

On the other hand, if we manage to avoid a recession and see a soft landing, then inflation will decline naturally over time. However, in a soft landing scenario we believe it will decrease to a terminal level higher than the Fed’s 2% target.

Both roads lead to cuts, but the severity of cuts will depend on the outcome: a hard landing will likely lead to 200-300 basis points of rate cuts, while a soft landing only leading to 50-100 basis points of cuts.

2) We Believe There Will Be A Blow-Off Top In Equities

We urge investors to expect a blow-off top in the US equity market, which is a phenomenon that happens ahead of every recession.

Our research surrounding market cycles, specifically around late business cycle turning points, reveals that in the year preceding the equity market’s peak, the S&P rises by approximately 16%, with zero non-double-digit values in a 12-cycle sample.

Typically, the S&P peaks just before the recession, approximately a month before the trough in the unemployment rate and breakout in jobless claims, squeezing bears right up until the last innings of the expansion.

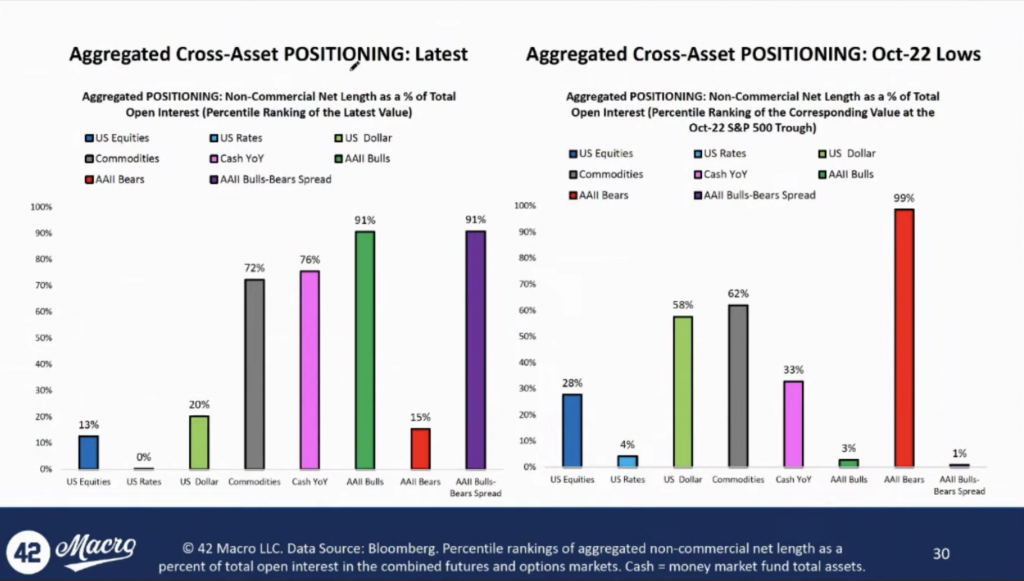

3) Bearish Investor Positioning Is Fueling This Rally

Our 42 Macro Aggregated Cross-Asset Positioning Models indicate that investors are still very bearish from a positioning standpoint.

The most recent data shows investors are more resolute in their bearish positions than at the October 22 lows.

Although those investors may be correct about the market’s destination in six to nine months, the challenge lies in the three to four months leading up to that period.

We believe there is risk of a continued market rally in the back half of the year, not driven by fundamentals but simply because the recession every bear is waiting on has not started yet.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!