The ~150,000 member United Auto Workers (UAW) union has declared “war” on Detroit’s big three auto makers GM $GM, Ford $F, and Stellantis $STLAM IM, threatening a strike by September 15 if the companies fail to acquiesce to demands that include a +46% wage increase and a decline in the work week to 32 hours. If a new collective bargaining agreement cannot be achieved by the deadline, the strike will be joined by Unifor — Canada’s largest labor union with ~315,000 total workers and ~18,000 auto workers.

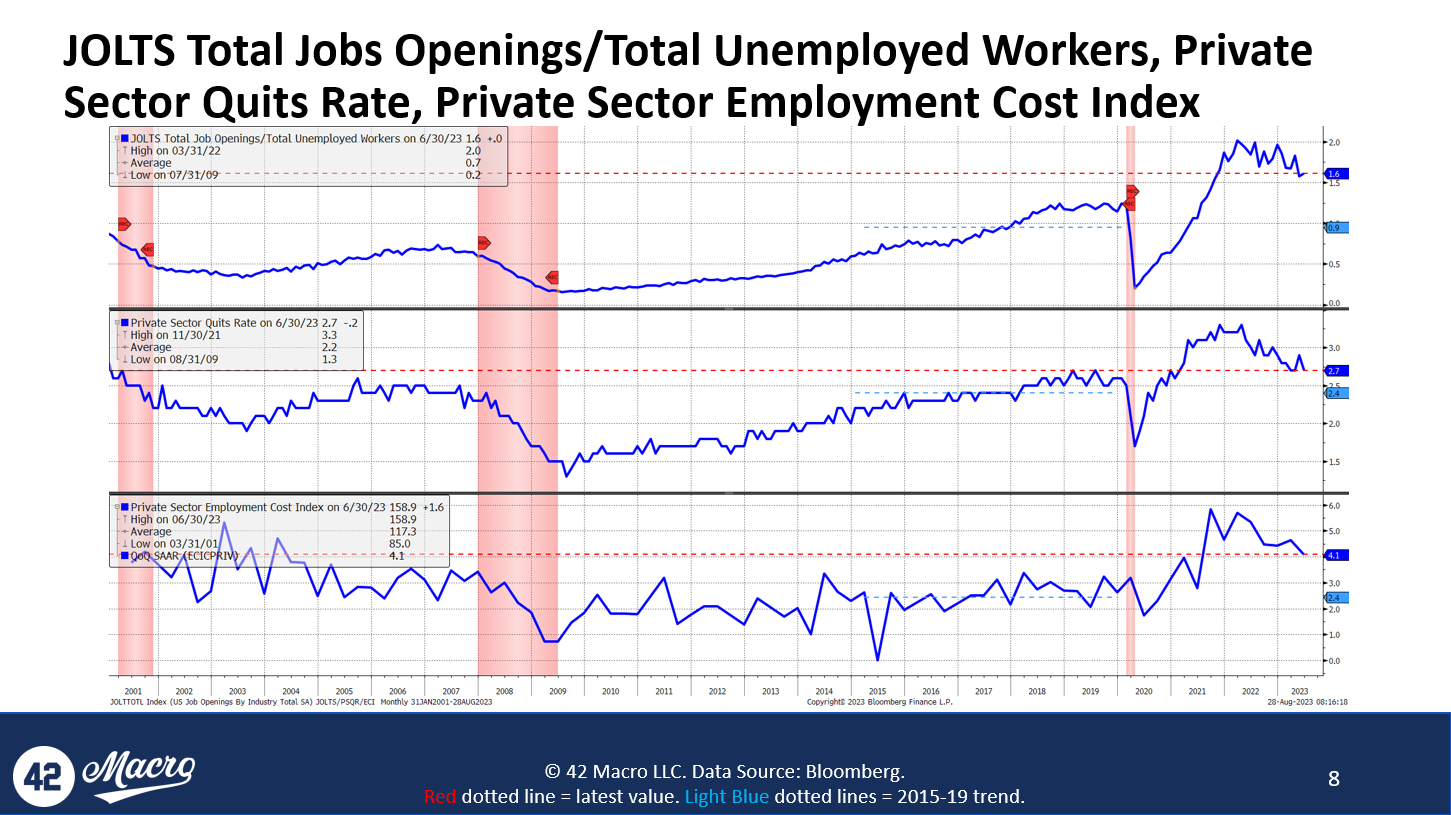

Stories like this are supportive of our view that the narrative around inflation is likely to shift from “immaculate disinflation” to “sticky inflation” within 3-6 months. We have been keen to call out the elevated probability of a soft landing in the US economy. While a soft landing is not our modal outcome, we believe it is a scenario worth educating you on because a soft landing in the economy is highly likely to result in a soft landing in inflation relative to the Fed’s 2% target — which Powell went out of his way to quadruple down on last Friday at Jackson Hole.

No firm on global Wall Street has had a more accurate view on the resiliency of the US economy than @42Macro has for the past year and, as a result, a better call on bonds. We still see more fixed income volatility in the months ahead because we believe the consensus narrative surrounding inflation is likely to deteriorate before the recession hits.