The economic situation in China continues to be an unmitigated disaster, with the July Retail Sales, Industrial Production, and Fixed Assets Investment all slowing and missing consensus estimates.

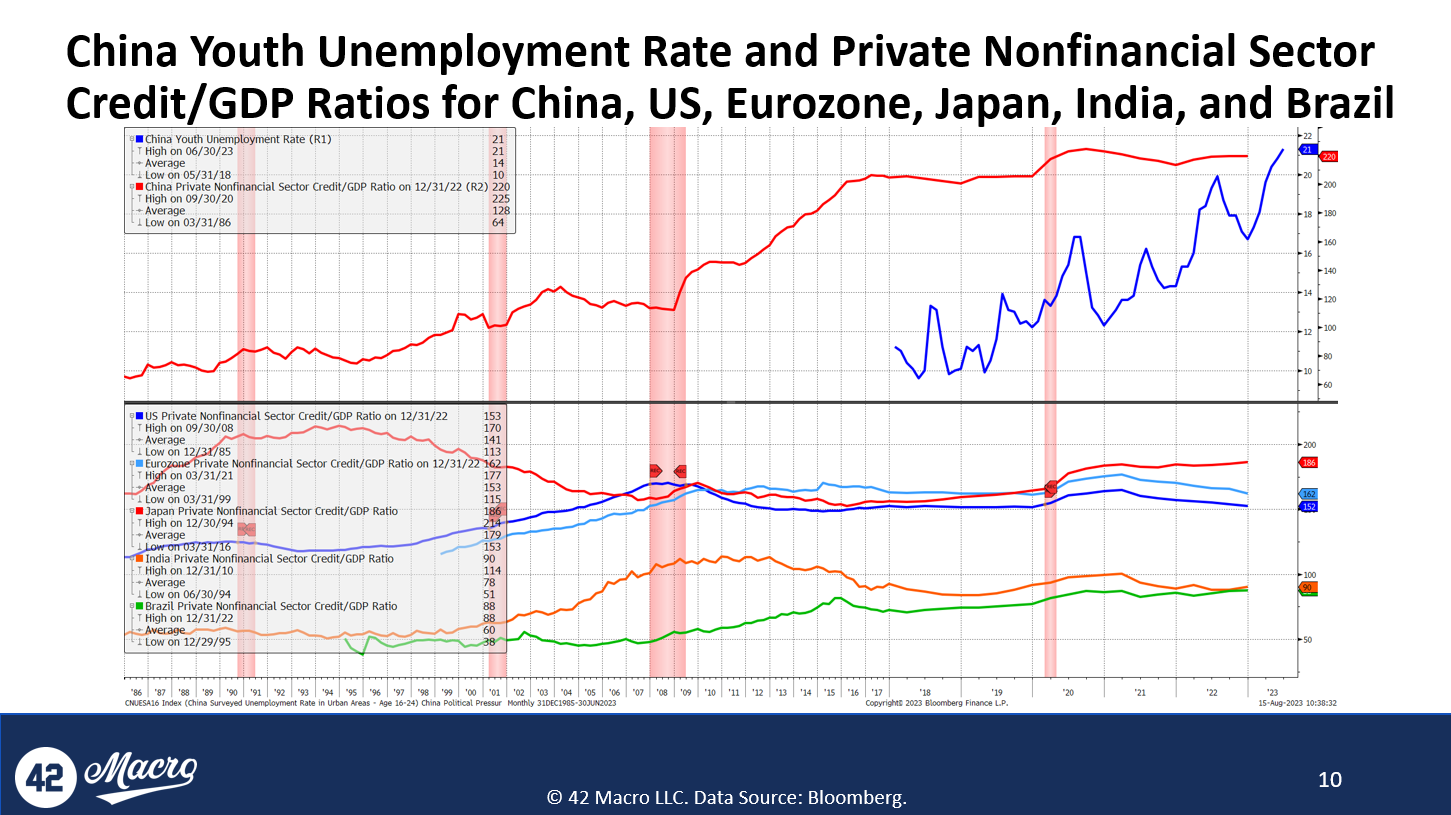

Animal spirits in China are being weighed down by beleaguered private sector balance sheets. With respect to liabilities, China remains one of the most indebted major economies in the world. With respect to assets, China’s property market — the #2 asset for Chinese citizens behind bank deposits — has yet to recover from the beating it took from the 1-2 punch of “Zero COVID” and Emperor Xi’s “Three Red Lines” macroprudential policy.

All told, the Chinese economy is doing exactly what we thought it would do in the absence of large-scale fiscal stimulus — i.e., return to the structural liquidity trap it was mired in prior to COVID.