Is Your “Safe” Portfolio Actually Built to Fail?

Darius Dale joined Anthony Pompliano on The Pomp Podcast to unpack three major shifts in today’s macro environment. He challenged the idea that bonds and cash are safe, highlighted the decline in foreign demand for U.S. debt, and outlined why the current regime still supports staying engaged in select risk assets. If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) Fiscal Recklessness Is Undermining U.S. Stability

Both parties are spending aggressively with no credible plan to rein in deficits. Even cutting all non-defense discretionary spending would only reduce the deficit from 7% to 5% of GDP—before the tax cuts reduce revenues (relative to baseline) further. With mounting debt and no political appetite for austerity, the long-term fiscal trajectory looks increasingly fragile.

Key Takeaway: Washington’s fiscal mismanagement is weakening U.S. credit quality and leaving fewer tools to manage future crises.

2) There Is A Geopolitically Driven Supply-Demand Imbalance In Treasuries

Foreign demand for Treasuries is fading. China, Europe, and Japan are pulling back due to strategic decoupling, re-militarization, and policy normalization, respectively. Meanwhile, assets traditionally considered “risky”—like Bitcoin, gold, and stocks—are outperforming.

Key Takeaway: As markets trudge deeper into this Fourth Turning regime, traditional “risk” assets are actually the safe havens. The real risk lies in holding bonds and cash.

3) Follow the Signals, Not the Headlines

Darius’s message is clear: stay engaged while the market regime supports it. With policymakers boxed into growing or printing their way out of structural imbalances, disciplined exposure to select risk assets is more important than ever. 42 Macro’s KISS Model Portfolio equips investors to sidestep behavioral traps and compound more effectively over time.

Key Takeaway: Avoid volatility drag and compound returns faster by remaining invested in traditional “risk” assets and only reducing exposure when the market regime tell you to.

Final Thought: The Fourth Turning Is Here

With bonds and the dollar failing to preserve capital, the definition of “safe” has changed. As the U.S. consumes an unsustainable share of global capital and shows little political will for fiscal repair, investors must rethink where real protection lies. The true risk isn’t volatility—it’s being stuck in assets with negative expected returns. As Darius notes, the Fourth Turning is more than a cycle—it’s the new investment reality.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

Paradigm C And The Resilience Premium

Darius Dale recently joined Anthony Pompliano on The Pomp Podcast to discuss the recent shift towards Paradigm C, the resilience of the U.S. economy, and the evolving roles of stocks, Gold, and Bitcoin within this new policy regime. If you missed the segment, here are three key takeaways that likely have huge implications for your portfolio:

1) Paradigm C Points to a Bull Market

Darius believes the bond market “broke” President Trump on April 9, prompting a shift away from Paradigm B’s economic pain toward Paradigm C—essentially a supercharged return to Wall Street-friendly policies. With trillions in tax cuts and supply-side incentives, this pivot supports the view that stocks may reach new all-time highs by the end of 2025.

Key Takeaway: A shift to Paradigm C increases the likelihood of a strong bull market and record highs by year-end 2025.

2) The Economy Is Stronger Than It Looks

Despite weak headline GDP, underlying data shows strength. Consumers—especially wealthier ones—still have cash to spend, and the services sector continues to drive economic resilience.

Key Takeaway: Don’t be fooled by soft GDP prints—the services sector is powering a resilient economy.

3) Policy Volatility Is the Real Risk

While current trends suggest a favorable outcome under Paradigm C, Darius warns that policymakers may misread market strength as validation, triggering a pivot back to Paradigm B’s aggressive negotiating tactics. Such a shift could destabilize the bond market and reverse recent gains in risk assets. The fragility of global capital account imbalances underscores the risk of heavy-handed tactics.

Key Takeaway: Markets may rally under Paradigm C—but incremental policy missteps could quickly reintroduce downside risk.

Final Thought: Stick To The Process

The market’s optimism hinges not just on policy outcomes, but on the clarity and consistency of those outcomes. As investors price in a shift toward Paradigm C—with its Wall Street-friendly monetary and fiscal largesse—any renewed flirtation with Paradigm B could reintroduce volatility and downside risk. Contextualizing policy signals within the context of our paradigm A-B-C framework and remaining prepared to dispassionately respond to policy pivots will be essential for navigating what comes next.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

The End of American Exceptionalism?

Darius Dale recently joined Víctor Hugo Rodríguez on Negocios Televisión to discuss why markets may not have bottomed yet—and what needs to change before risk assets become attractive again. If you missed the appearance, here are three key takeaways that likely have huge implications for your portfolio.

1) Markets Won’t Bottom Until Three Things Happen

Darius laid out a clear three-point checklist that must be met before investors can confidently reallocate into risk assets:

- The Fed must expand its balance sheet (i.e., QE or liquidity support).

- Consensus earnings and GDP estimates must be revised lower to reflect recession risks.

- Clarity is needed on fiscal policy—specifically, whether Trump’s tax cut package will actually be stimulative and whether the “DOGE” budget cuts will be softened.

Key Takeaway:

We’re still early in all three of these processes, meaning downside risk remains elevated over the next 2-3 quarters. Investors should expect more volatility until policymakers act decisively.

2) Foreign Demand for U.S. Assets Is Cracking

Darius warned that global capital allocators may be stepping back from U.S. Treasuries and equities. As the U.S. turns away from globalization and fiscal prudence, foreign investors are less willing to finance America’s growing deficits. With Congress potentially adding another $5-plus trillion in debt via tax cuts, this shift could put significant upward pressure on long-term yields.

Key Takeaway:

This marks the potential beginning of a structural regime shift in global capital flows—a bearish signal for bonds and a growing risk to U.S. financial stability.

3) The KISS Model Portfolio Is Positioned for Defense

Months ago, Darius moved his own allocation—and that of thousands of 42 Macro clients—into defensive posture. At the time of recording on Tuesday afternoon, the 42 Macro KISS Model Portfolio featured:

- 67.5% Cash

- 0% Stocks

- 30% Gold

- 2.5% Bitcoin

Key Takeaway:

KISS pivoted to 0% equities on March 5th, and will remain in defensive mode until it quantitatively derived volatility targeting and dynamic position sizing signals inflect. The strategy is designed to minimize drawdowns and preserve capital during cyclical bear markets—while also participating in bull markets.

Final Thought: Wait for the Signal, Not the Noise

Markets are still searching for footing in a rapidly shifting macro landscape. As Darius makes clear, this isn’t a moment for hero trades or blind optimism — it’s a moment for discipline. Until we see a dovish policy pivot, meaningful earnings downgrades, and/or clarity on fiscal direction, staying defensive isn’t just smart — it’s necessary. Risk-on will have its time, but we’re not there yet. Let the checklist, not emotions, guide you.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

Is the Bull Run Over?—Darius Dale on Macro Shocks & Market Tops

Darius Dale, 42 Macro Founder & CEO, recently joined InvestAnswers to break down the recent market volatility, the risks of macro shocks, and how investors should be thinking about the current market cycle. If you missed the podcast, here are three key takeaways that have huge implications for your portfolio:

1) Markets Are at a Tipping Point—Liquidity Holds the Key

While recent volatility has spooked investors, the bigger question is whether liquidity will continue to rise or start contracting. If liquidity expands, markets can push higher. If it stalls or reverses, risk assets could face severe pressure. Investors should watch the BOJ closely for the latest clues on liquidity amid the developing US growth scare. The sharp selloff in early-August is a preview of what may be in store for investors.

Key Takeaway:

Liquidity is the key driver—watch for shifts in fiscal policy, the FED’s [needed] countercyclical response, and global monetary policy to gauge where markets go next.

2) Tariffs, Policy Uncertainty, and Inflation Are the Big Unknowns

The Trump administration’s tariff plans and rapidly shifting policy stance could disrupt supply chains and push inflation higher before any pro-growth measures take effect. The Fed may be forced to delay an appropriate policy response due to sticky inflation, keeping rates higher for longer and creating liquidity pressures.

Key Takeaway:

Markets are grappling with uncertainty—investors must stay aware of how policy shifts could perpetuate a stagflationary shock.

3) AI & Macro Trends Will Reshape the Investment Landscape

Darius warns that AI-driven job displacement and structural fiscal challenges could accelerate The Fourth Turning. That outcome risks increasing economic and financial market volatility, while also supporting secular bull markets in assets like Bitcoin, Gold, and AI-driven equities.

Key Takeaway:

Positioning for the future means embracing AI, Gold, Bitcoin, and sound risk management as the macro landscape rapidly evolves.

Final Thought: Navigating a Shifting Macro Landscape

Liquidity will likely rise through mid-2025, but it may not rise fast enough to offset the rapidly accelerating global debt refinancing cycle. Key structural risks—fiscal imbalances, inflation pressures, and geopolitical shifts—remain. Investors must be proactive in managing risk and adapting to an increasingly unpredictable macro environment.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape , partner with 42 Macro’s data-driven insights and risk management overlays—KISS and Dr. Mo—processes to help you stay on the right side of market risk.

THE MACRO CLASS

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

Market Liquidity, 0DTE Options, and the New Volatility Paradigm

Darius recently sat down with Brent Kochuba of SpotGamma for a fascinating discussion on how options-driven leverage, zero-day options (0DTE), and shifting market structure are reshaping investment opportunities. If you missed it, here are the three most important takeaways that could significantly impact your portfolio:

1) Short-Term Leverage Is Driving Market Volatility—But It’s Not Changing the Trend

The explosion of 0DTE options and leveraged derivatives trading has created frequent, extreme price dislocations in individual stocks and the broader market. Brent explains how these short-term trading flows cause sharp intraday swings, leading investors to misinterpret market reactions to news events like CPI reports or earnings releases. However, while these distortions can be dramatic, they rarely change the medium-to-long-term market trend—meaning that many investors are getting shaken out of positions unnecessarily.

Key Takeaway:

Don’t overreact to short-term volatility. While markets may experience more frequent and violent moves due to the explosive growth of options activity, the underlying trend remains the dominant force. Investors who focus too much on short-term swings risk missing out on durable market trends.

2) Volatility Is Cheap—But That Presents Opportunities

Despite recent market swings, implied volatility remains historically low, signaling that investors are not properly hedging against risks. Brent highlights how right-tail risks (markets moving much higher) are currently underpriced, making call options a compelling opportunity. On the flip side, selective put spreads can offer inexpensive downside protection for investors looking to hedge without taking on too much drag.

Key Takeaway:

With volatility low, this is an ideal time to consider hedging strategies or capitalizing on underpriced upside exposure. Call options on key indices and AI-driven names may provide attractive asymmetric returns, while put spreads allow for cheap downside protection.

3) AI, Passive Flows, and ETF Growth Are Creating Liquidity Holes

Market liquidity is shrinking as passive flows, corporate buybacks, and structured products absorb more of the tradable float in major stocks. This means that even mega-cap names like NVIDIA can experience massive, seemingly irrational price moves (e.g., its recent $500 billion single-day market cap loss). These liquidity gaps are amplifying the impact of leveraged derivatives trades, creating both risks and opportunities for investors.

Key Takeaway:

Investors should be aware that liquidity holes are becoming more common, leading to sharp, unexpected market moves. Understanding how options-driven leverage interacts with ETF flows and passive investing is key to avoiding getting caught on the wrong side of a move—or capitalizing on mispricings when they occur.

Final Thought: The Time to Act Is Now

Markets are evolving rapidly, with AI, derivatives trading, and liquidity trends playing an increasingly dominant role. As these forces reshape market behavior, traditional risk management strategies are becoming less effective. Investors need adaptive tools—like our KISS Model Portfolio and Discretionary Risk Management Overlay (Dr. Mo)—to stay ahead of these changes and profit from the volatility rather than being caught off guard by it.

Since our bullish pivot in January 2023, the QQQs have surged 90% and Bitcoin is up +316%.

If you have missed part—or all—of this market, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

Thousands of investors around the world use 42 Macro to confidently navigate market shifts and optimize their portfolios. If you’re ready to incorporate macro into your investment process and stay ahead of these monumental changes, we invite you to watch our complimentary 3-part Macro Masterclass.

How Will Trumponomics 2.0 Impact Investor Portfolios?

Darius recently joined Charles Payne on Fox Business to discuss the potential impact of President Trump’s economic agenda on asset markets, the importance of observing the market rather than predicting it, and more.

If you missed the interview, here are the three most important takeaways fromthe conversation that have implications for your portfolio:

1) How Will President Trump’s Economic Policies Broadly Impact Markets in 2025?

When assessing the impact of President Trump’s economic agenda, both positive and negative effects on the economy and asset markets are likely.

Specifically, factors such as tariffs, securing the border, and a hawkish shift in Treasury net financing (i.e., less bills + more coupons) are likely to contribute negative supply shocks to the economy and asset markets. Conversely, tax cuts, deregulation, and accelerated energy production could generate positive supply shocks.

Investors should closely monitor the size, sequence, and scope of these policy changes, as they will play a crucial role in shaping asset markets throughout 2025.

2) What is The Likely Impact of Tariffs on Asset Markets?

Although many Wall Street investors cite the Smoot-Hawley example when discussing tariffs, we believe anchoring on that scenario is misguided. The real impact lies in the currency market. China is likely to respond to fresh tariffs by significantly devaluing the yuan, which carries profound implications for global asset markets. Historically, when China devalues the yuan, other major economies follow suit with sympathy devaluations to maintain competitiveness, resulting in a much stronger U.S. dollar.

If a similar pattern emerges in 2025, this would likely lead to a reduction in global liquidity, which is problematic for asset markets in the context of the global refinancing air pocket that may develop later this year.

3) Should Investors Focus On Observing The Market Rather Than Predicting It?

In short, yes. Our number one piece of advice for every investor is: Listen to what the market is telling you. Because asset markets trend far more frequently than they experience changes in trend, it is always best to align your portfolio with what the market is trying to price in, not against it. The trend is your friend.

Whether we are in an inflationary or deflationary environment, the most consistently successful strategy across all market conditions is trend following.

To successfully remain on the right side of market risk, investors must rely on signals from proven risk management systems (e.g., KISS and Dr. Mo) far more than their gut feel, emotions, or understanding of company or economy fundamentals.

Since our bullish pivot in January 2023, the QQQs have surged 81% and Bitcoin is up +328%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just macro insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Best of luck out there,

— Team 42

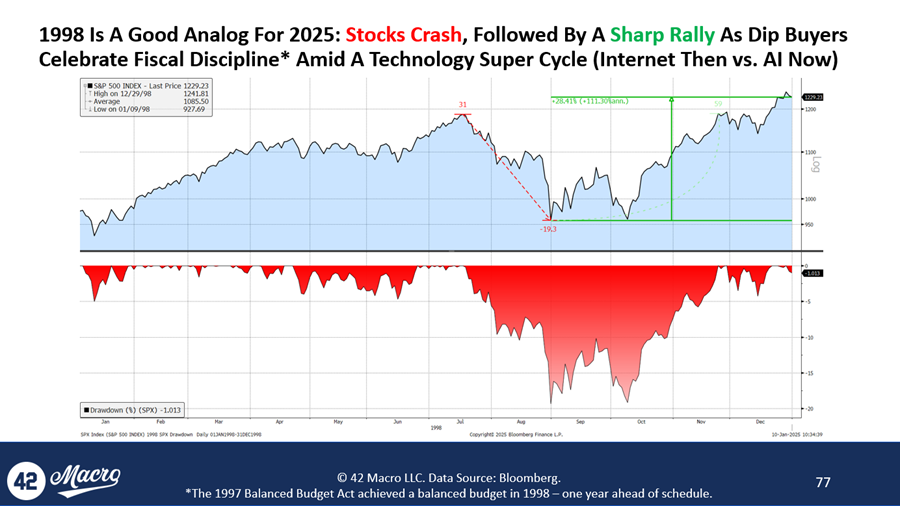

Will Risk Assets Crash In 2025 Like They Did In 1998?

Darius recently joined Adam Taggart to discuss the likelihood of significant deficit reduction during President Trump’s administration, a potential global refinancing air pocket, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

- How Likely Is A Significant Reduction Of The Federal Budget Deficit Amid DOGE And Tax Cuts?

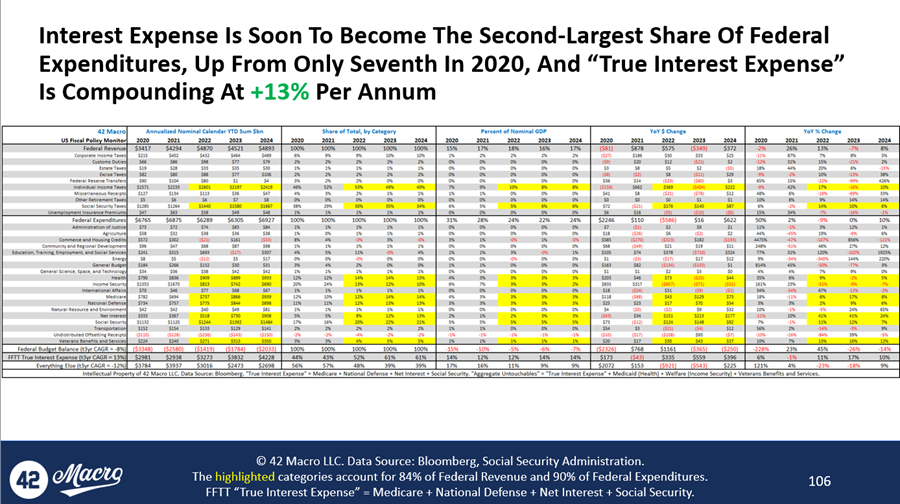

Although we believe DOGE is likely to achieve meaningful fiscal expenditure reduction, our analysis of U.S. federal budget dynamics highlights significant challenges to achieving meaningful deficit reduction. Cutting spending ≠ cutting the deficit, once extending and expanding the Tax Cuts and Jobs Act (TCJA) are accounted for.

Our research indicates that approximately 61% of the federal budget is effectively untouchable. This includes FFTT’s “True Interest Expense” metric, which comprises Medicare, National Defense, Net Interest, and Social Security. Collectively, these expenditures represent programs that are unlikely to face cuts amid the current populist political climate and are compounding at a rate of +13% per year. The remaining 39% of the budget has already been shrinking at a compound rate of -12% per year over the past three years.

Given these dynamics, we believe meaningful deficit reduction appears improbable without tackling politically protected categories.

- Is A Global Refinancing Air Pocket On The Horizon?

At 42 Macro, we conducted a deep-dive empirical study on the global refinancing cycle and found it to be correlated with the global liquidity cycle. Currently, the lagged growth rate of global non-financial sector debt is accelerating sharply, and our models project this trend to continue through late 2025.

While conventional wisdom suggests this is likely to catalyze an increase in global liquidity, the risk remains that liquidity may fail to expand meaningfully, thus creating a global refinancing air pocket, similar to the divergences observed in 2008-09, 2011, 2015-16, 2018, and 2022, where the S&P 500 declined between 15% and 57%.

If global liquidity fails to follow the path of the year-over-year growth rate of world total non-financial sector debt, we believe it is likely to lead to severe disruptions—or even a meltdown—in global financial markets. However, we ultimately expect the dip will be bought because investors will finally find attractive valuations to bet on the AI supercycle amid tax cuts and deregulation. 1998 is a good analogy for how we are approaching financial market risk in 2025.

Since our bullish pivot in November 2023, the QQQs have surged 44% and Bitcoin is up +201%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Conditions Are In Place For Market Crash In 2025

Darius recently joined David Lin to discuss the impact of tariffs, the outlook for inflation, the role of gold in our KISS Model Portfolio, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. How Are Tariffs Likely To Impact Asset Markets In 2025?

We believe China is likely to respond to tariffs by significantly devaluing the yuan, which carries profound implications for global asset markets. Historically, when China devalues the yuan, other major economies follow suit with sympathy devaluations to maintain competitiveness. During the 2018-2019 trade war, this dynamic led to broad-based declines in the euro, Japanese yen, British pound, and Swiss franc—on top of the yuan’s depreciation—resulting in a materially stronger U.S. dollar.

If a similar pattern emerges in 2025, we could see a sharp appreciation of the U.S. dollar in the second half of the year, potentially reinforced by a less hawkish Federal Reserve. This would likely lead to higher interest rates, rising bond market volatility, elevated currency market volatility, and a stronger U.S. dollar – all of which are headwinds for global liquidity.

Given the historic scale of global refinancing needs in 2025, we believe any liquidity contraction is likely to trigger a severe market correction – and potentially even a full-scale crash.

2. What Is The Outlook For Inflation?

According to our GRID Model projections for Headline CPI and the econometric study of all the postwar economic cycles in and around recession we conducted, we believe US inflation is unlikely to return durably to trend in the absence of a recession, which implies the highest probability outcome is inflation firming over the medium term against easing base effects.

Leading indicators of inflation also support our hawkish NTM inflation outlook. Core PPI, a reliable leading indicator for inflation in this business cycle, began breaking down approximately 18 months before Core CPI and Core PCE. Core PPI bottomed in December 2023 and has been trending higher since.

Moreover, Core CPI and Core PCE deflator appear to be stabilizing at an above-trend level. These metrics may accelerate in 2025 before resuming the longer-term downtrend, and the key risk is that consensus expects inflation to keep falling, and a rebound in inflation—however modest—could force markets to price out additional Fed rate cuts for 2025 and 2026.

3. Why Did We Replace Core Fixed-Income Exposure with Gold in Our KISS Model Portfolio?

We incorporate gold into the portfolio to enhance diversification by reducing overall beta and introducing non-correlated asset classes, which helps mitigate drawdowns and volatility while also providing exposure to Fourth Turning monetary policy dynamics. Gold serves as a low-beta asset, with a trailing six-month beta of approximately 0.3 to the S&P 500.

Moreover, the addition of gold to KISS reflects our understanding that if our Investing During A Fourth Turning Regime analysis proves true over the long term and the Fed is forced to accelerate financial repression and monetary debasement, it is highly unlikely that bonds will outperform other assets on a real, risk-adjusted basis.

We expect monetary debasement and financial repression to be tools that the Fed employs to address the challenges of excessive sovereign debt and a robust economy that leaves little incentive for buyers of government bonds, and we believe gold will prove to be a far better hedge against accelerated monetary debasement and financial repression than bonds.

Since our bullish pivot in November 2023, the QQQs have surged 44% and Bitcoin is up +201%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Here’s Why 2025 Will Be A Tricky Year For Investors

Darius recently joined Cheryl Casone on Fox Business to discuss the current risk-on Market Regime, the medium-term drivers of asset markets, the impact of upcoming fiscal and regulatory policy changes, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

- We are currently in a risk-on Market Regime, and we anticipate that risk-on condition may generally persist for the next ~three months due in large part to a likely $700-800bn decline in the Treasury General Account (TGA). In risk-on Market Regimes, investors are typically rewarded for taking on high-beta, cyclical exposures, such as consumer discretionary, technology, financials, and industrials.

- As we move further into 2025, the key issue for asset markets is likely to be the significant changes coming from fiscal and regulatory policies. Some of these initiatives should be positive for asset markets, including tax cuts, much more M&A, and DOGE, while others, such as tariffs, a too-strong USD, and stagflation lowering the strike price of the “Fed put,” may have negative implications. For investors, the challenge is to understand the size, sequence, and scope of these policy changes. Ultimately, navigating the sequence of policy changes effectively will determine whether you make or lose money as an investor over the medium term.

- Earlier this month, Fed Chairman Jerome Powell’s press conference marked the end of the Fed’s asymmetrically dovish reaction function, which they had effectively maintained from November 2023 through December 18, 2024. This reaction function supported the buoyant asset market performance throughout the year that we have persistently called for. However, the Fed’s approach to monetary policy moving forward will likely be more balanced, with a nuanced view of labor market and inflation risks. This shift places the responsibility back to us as investors to accurately forecast where the labor market and inflation are headed, as these will ultimately determine policy decisions.

Since our bullish pivot in November 2023, the QQQs have surged 43% and Bitcoin is up +169%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Why Crypto Is An Important Asset Class For Millennials

Darius recently joined Charles Payne on Fox Business to discuss the impact of last week’s FOMC decision and Chair Powell’s press conference, the outlook for liquidity, how to invest successfully during this Fourth Turning, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

- While the Fed’s reaction function remains dovish, we believe it is likely no longer asymmetric. With the Fed now adopting a more balanced assessment of risks, the responsibility shifts back to us as investors to accurately forecast where the labor market and inflation are headed, as these will ultimately determine policy decisions.

- The outlook for US liquidity remains positive. As long as the Democrats do not extend or eliminate the debt ceiling during Biden’s administration – and it appears they will not – the Treasury General Account balance is likely to be spent down to zero within the first four to five months of 2025. This development would be bullish for asset markets.

- The current Fourth Turning is defined by factors such as excessive fiscal policy, monetary debasement, and financial repression. This macroeconomic backdrop is structurally bullish for stocks, credit, cryptocurrencies, and commodities. It is structurally bearish for Treasury bonds and the U.S. dollar. We believe the crypto asset class holds significant importance for Millennials because they recognize that the current system is not working in their favor, and investing in crypto is a “calculated gamble” on an alternative future in which the gap between the haves and have-nots is much narrower.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +167%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.