What Must Be Done To Prevent DOGE From Failing?

Darius recently sat down with FFTT Founder and President Luke Gromen to discuss how marketable U.S. treasury market dynamics have shifted over recent years, the likelihood of a meaningful reduction in the federal budget deficit in this Fourth Turning, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. How Have Changes In Ownership Structure Contributed To Price And Yield Dynamics In The Treasury Market?

At 42 Macro, one of the ways we analyze the marketable U.S. Treasury market is by segmenting it into various investor cohorts:

- The Federal Reserve: The Fed’s share has been declining due to balance sheet runoff, peaking at 25% in late 2021 and now at only 15% of total marketable Treasury securities.

- Commercial Banks: Banks’ market share decreased from early 2022 until late 2023, when it began to stabilize. This stabilization was driven by programs like the Bank Term Funding Program (BTFP) and expectations that the Federal Reserve would dramatically lower interest rates. Currently, their share is around 15%, well south of the peak of 33% in 2003.

- Foreign Central Banks: The decline in global trade and the steady shift away from global dollar recycling led by the BRICS member nations caused foreign central banks’ share to steadily decline to 14% from a peak of 40% during the 2008 global financial crisis.

- Global Private Non-Bank Sector (Investors): This cohort has become the largest holder of marketable U.S. Treasury securities, with its share increasing from 36% in late 2021 to 55% today.

This shift in ownership has structurally altered the Treasury market. Unlike banks—such as the Fed, foreign central banks, and commercial banks which purchase Treasurys to satisfy policy or regulatory mandates (e.g., Dodd Frank, Basel III and IV)—global investors demand ex ante returns to compensate for taking risk in their portfolios.

As a result of this seismic shift, upward pressure on yields has intensified, signaling a more acute phase in the evolution of Treasury market dynamics and expectations.

2. How Likely Is Significant Reduction In The Federal Budget Deficit During This Fourth Turning?

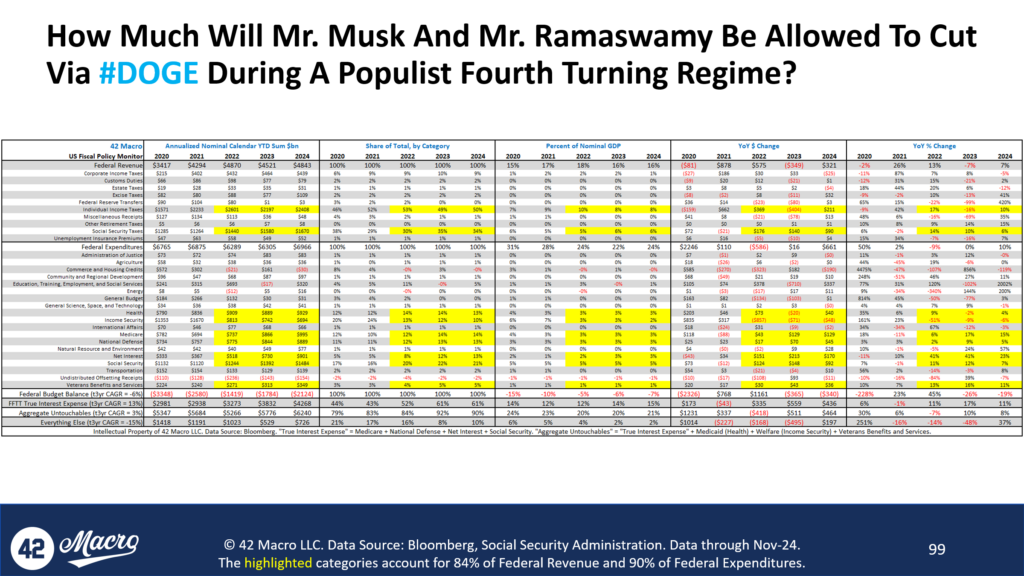

Our analysis of U.S. federal budget dynamics highlights significant challenges to achieving meaningful deficit reduction.

First, U.S. federal expenditures currently represent roughly a quarter of U.S. GDP—the highest share since at least 1970 excluding COVID and the GFC. Thus, significant cuts would likely catalyze a downturn in the economy—however beneficial a smaller government would be in the long run, which is something both Darius and Luke agree with. Per Luke, the last three recessions saw the U.S. federal budget deficit widen by 600bps, 800bps, and 1,200bps.

Secondly, our research indicates that approximately 90% of the budget is effectively untouchable. This “Aggregated Untouchables” category includes “True Interest Expense”—comprising Medicare, National Defense, Net Interest, and Social Security—along with Medicaid, Welfare, and Veterans’ Benefits. Collectively, these expenditures represent programs unlikely to face cuts under the current pro-populist political climate and are compounding at a rate of +3% per year (+13% per year in the “True Interest Expense” category). The remaining 10% of the budget, which largely includes discretionary spending, amounts to just over $700 billion and has already been shrinking at a compound rate of -15% per year over the past three years.

Lastly, demographic trends are exacerbating the fiscal burden. By 2025, 160,000 people will join the retirement-age population each month, compared to just 32,000 entering the working-age population.

Given these dynamics, meaningful deficit reduction appears improbable without tackling politically protected categories. This leads us to believe that meaningful austerity is an unlikely path forward in the context of this current Fourth Turning environment—especially without a significant devaluation of the US dollar preceding it.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +190%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Why Tariffs Are Much Worse For Investors Than You Likely Realize

Darius recently sat down with Bleakley Financial Group CIO Peter Boockvar to discuss the impact of the Trump administration’s proposed tariffs, insights from the 42 Macro Positioning Model, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. What Are The Second And Third Order Effects Of Tariffs And How Might They Cause Problems For Asset Markets?

According to data from the Committee for a Responsible Federal Budget, the Trump administration’s proposed tariffs are expected to generate nearly $3 trillion in revenue to help offset the ~$4+ trillion cost of permanently extending the Tax Cuts and Jobs Act (TCJA).

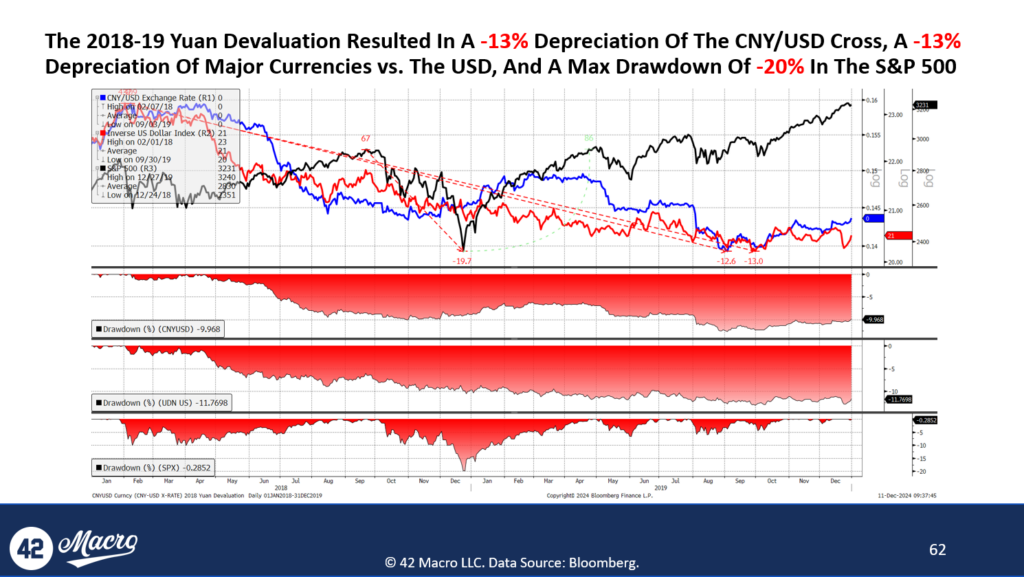

We believe the market is underestimating both the likelihood and scale of these tariffs given that the Congressional budget reconciliation process – specifically the Byrd Rule – will require pay fors to offset the lost revenue from tax cuts. An equally important but often overlooked factor is the potential for retaliation, particularly from China.

Historical examples, such as the Trump-era trade war, illustrate how heightened tariffs can lead to significant devaluations of the Chinese yuan. If this pattern repeats, it is likely to trigger competitive devaluations among other major currencies, resulting in an excessively strong U.S. dollar. In our view, such dollar strength is likely to suppress global capital formation and weigh heavily on U.S. corporate earnings, ultimately creating a significant headwind for asset markets.

2. What Insights Does The 42 Macro Positioning Model Provide About The Current State of Asset Markets?

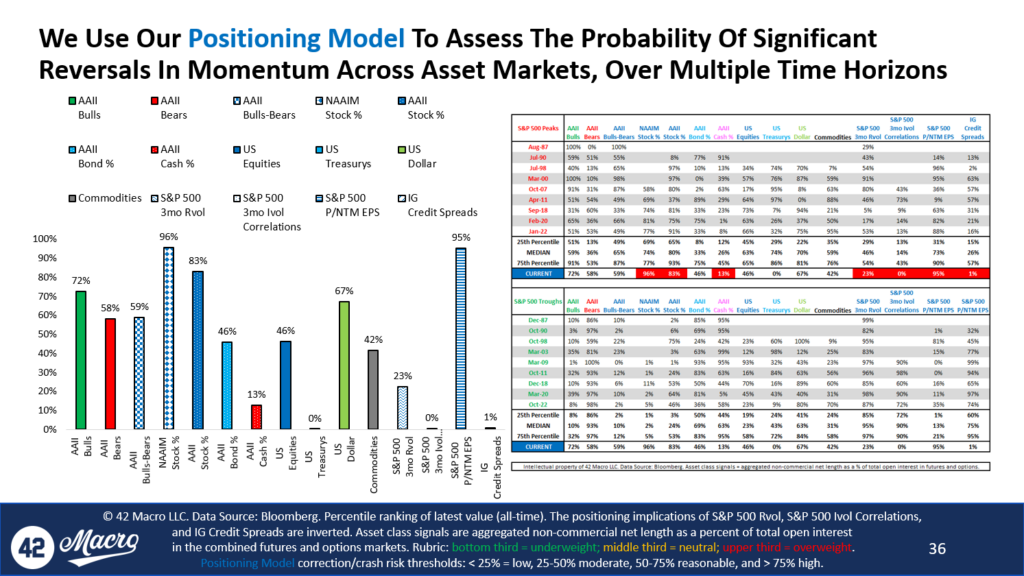

Our 42 Macro Positioning Model analyzes a 15 long-term time series, comparing their current levels to the median values observed at major bull market peaks and troughs. Currently, the model indicates several red flags for positioning and sentiment:

- AAII stock allocation exceeds the median value observed at major bull market peaks in the seven market cycles since Jan-98.

- AAII cash allocation is also below the median value observed at major bull market beaks.

- S&P 500 realized volatility—an inverse proxy for systematic fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 implied volatility correlations—an inverse proxy for market-neutral hedge fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 price/NTM EPS ratio sits in the 95th percentile of all historical data, dating back to the late 1980s, and is well above the median value observed at major bull market peaks.

- Investment-grade credit spreads are in the first percentile of all historical data, also dating back to the late 1980s, and are well below the median value observed at major bull market peaks.

From a positioning perspective, although these metrics do not necessarily serve as immediate catalysts for reversing the bullish momentum of risk assets, they represent significant potential energy once bearish catalysts emerge. When momentum does reverse, we believe positioning is asymmetric enough to unwind in an aggressive-enough manner to cause a stock market crash.

Since our bullish pivot in November 2023, the QQQs have surged 48% and Bitcoin is up +203%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

What Are The Hidden Dangers Looming Over Asset Markets?

Darius recently sat down with Anthony Pompliano to discuss the risks of a stronger US dollar, a potential global refinancing air pocket, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. How Can A Stronger US Dollar Cause Problems For Asset Markets?

Our research indicates one significant implication of a strong US dollar is that it pressures foreign investors to repatriate dollar-denominated assets to service the 70% of global debt and 60% of cross-border lending that rely on the US dollar.

The events of 2022 provide a clear example of the potential consequences in such an environment. During a major US dollar rally from January to September of that year, the dollar appreciated by 18%, leading to a reduction in liquidity and severe declines across asset classes, as Gold fell 10%, US equities dropped 25%, US Treasury bonds declined 31%, and Bitcoin plummeted approximately 58%.

Moreover, tariff policies introduced by the Trump Administration, along with potential changes in the Treasury’s net financing policy, may accelerate dollar strength. Coupled with ongoing US economic exceptionalism—driven by tax cuts and deregulation—these factors could push the dollar even higher, increasing the pressure on markets and global financial stability.

If the Federal Reserve’s policy options are constrained by a resilient economy or persistent inflation, it may struggle to prevent the dollar from trending higher, creating significant challenges for asset markets.

2. Is A Global Refinancing Air Pocket On The Horizon?

At 42 Macro, we conducted a deep-dive empirical study on the global refinancing cycle and found it is, in fact, a key leading indicator of global liquidity.

By tracking the year-over-year growth rate of world total non-financial sector debt, lagged by four and a half years to align with typical refinancing timelines, we observe a strong correlation with fluctuations in global liquidity growth. Currently, the lagged growth rate of global non-financial sector debt is accelerating sharply, and our models project this trend to continue through late 2025.

While conventional wisdom suggests this is likely to catalyze an increase in global liquidity, the risk remains that liquidity may fail to expand meaningfully, thus creating a global refinancing air pocket, similar to the divergences observed in 2008-2009, 2011, 2015-2016, 2018-2019, and 2022. If global liquidity fails to follow the path of the year-over-year growth rate of world total non-financial sector debt, we believe it is likely to lead to severe disruptions—or even a meltdown—in global financial markets, negatively impacting asset markets along the way.

Since our bullish pivot in November 2023, the QQQs have surged 44% and Bitcoin is up +184%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Is The Fed On The Precipice Of Another Major Policy Mistake?

Darius recently hosted Unlimited Funds CEO Bob Elliot on this month’s 42 Macro Pro to Pro, where they unpacked the Fed’s asymmetrically dovish reaction function, the impact of the work-from-home phenomenon, their systematic approaches to investing, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Is Driving the Fed’s Expansionary Monetary Policy?

We authored our “Resilient U.S. Economy” theme in September 2022, and since then, we have identified a new contributing pillar: the continuation of expansionary monetary policy.

We believe this policy direction is puzzling, driven largely by the Fed’s belief that no further cooling in the labor market is needed to achieve 2% inflation—a stance we view as highly likely to be inaccurate. Nevertheless, it remains the Fed’s current perspective.

Bob Elliot offered an insightful take on this issue, suggesting that the Fed’s position likely stems from a fundamental disconnect between how academics interpret markets and models versus how practitioners do. This divergence may explain their controversial outlook on the labor market’s role in achieving their desired inflation target.

2. How Is The Work-From-Home Phenomenon Affecting Labor Market Dynamics?

At 42 Macro, we monitor various workforce dynamics metrics, including Nonfarm Productivity Growth and the Private Sector Quits Rate. Our analysis shows that Productivity Growth is currently above trend, while the Private-Sector Quits Rate has declined significantly from its elevated levels over the past couple of years.

We believe this shift toward longer employee tenures is likely a key driver behind the current above-trend rate of productivity growth, as longer retention generally leads to greater employee efficiency. This increased productivity is helping to offset some of the inflationary pressures stemming from higher wages and income growth, and we believe it is likely to persist.

Additionally, the rise of remote work plays a significant role in this dynamic. With the flexibility to live and work from virtually anywhere, employees are more likely to stay with their current employers, further contributing to lower turnover and increased productivity.

3. Why Did We Replace Core Fixed-Income Exposure with Gold in Our KISS Portfolio?

One of the recent adjustments we made in our systematic KISS Model Portfolio was to replace our core fixed-income exposure with gold. This decision reflects our understanding that if our Investing During A Fourth Turning Regime analysis proves true over the long term, it is highly unlikely that bonds will outperform other assets on a real, risk-adjusted basis.

While we recognize that no one—including us—is ever 100% correct on their fundamental views, even partial accuracy in our predictions suggests a strong likelihood that assets like gold, Bitcoin, stocks, and real estate will prove to be far better hedges against accelerated monetary debasement and financial repression than bonds. Indeed, we expect monetary debasement and financial repression to be tools that the Fed employs to address the challenges of excessive sovereign debt and a robust economy that leaves little incentive for buyers of government bonds.

Given this dynamic, we pivoted entirely out of core fixed-income exposure and allocated that portion of our systematic KISS Model Portfolio to gold in October. Our 60/30/10 trend-following strategy now features maximum allocations of 60% stocks, 30% gold, and 10% Bitcoin.

Since our bullish pivot in November 2023, the QQQs have surged 37%. Momentum $MTUM is up +48% and Bitcoin is up +169%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it’s time to explore how our KISS Model Portfolio or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just macro insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Buying The Dip In A Risk On Market

Darius sat down with Schwab Network’s Nicole Petallides last week to discuss the current risk-on Market Regime and the outlook for asset markets.

If you missed the interview, here is the most important takeaway from the conversation that has significant implications for your portfolio:

We Are In A Risk-On Market Regime And Believe Investors Should Consider Buying This Dip For Three Reasons:

- U.S. growth is likely to exceed consensus expectations over the medium term, alongside an improving global economy.

- The Federal Reserve maintains an asymmetrically dovish reaction function, which we believe will continue to support asset markets over the medium term.

- U.S. and global liquidity are likely to accelerate markedly over the medium term.

Despite our being in a risk-on Market Regime, our positioning model recently indicated a high risk of a correction in risk assets, and we believe the current decline in stocks is likely the beginning of that correction.

We do not expect this correction to be severe, likely no more than 5-8% in $SPX price terms. The earliest we currently anticipate a sustained risk-off market regime commencing is Q2 of next year.

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and exhaustion from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just macro insights to help you grow your portfolio—our way of saying thanks for being part of the 42 Macro universe.

The Biggest Threat To The US Economy Today

Darius recently joined our friend Anthony Pompliano, where they discussed the impact of the recent port strike, the outlook for inflation, the national debt, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Impact Will The Recent Port Strike Have On The Economy?

Many of the goods entering the country pass through the ports along the Gulf Coast, East Coast, and the Port of Long Beach. We believe the recent shutdowns at these ports are likely to cause a temporary stagflationary effect.

To track the potential impact on inflation, we monitor the ISM Manufacturing and Services PMIs, which include a subindex for slower supplier delivery times. Our research shows these delivery times surged during the pandemic and after the early 2021 Biden stimulus, but have since retreated, coinciding with a decline in core inflation.

However, with the port shutdowns – now scheduled to begin on January 15th – we expect delivery times to rise again, further contributing to the stickiness in inflation we are currently observing.

2. Is 3% Inflation The New 2%?

We first published our secular inflation model at the beginning of 2022, which predicts a higher underlying trend in core PCE inflation over the next decade.

From 2010 to 2019, the 10-year run rate of core PCE inflation was 1.6%. However, our model projects a range of 2.7% to 3.1% for 2020 to 2029.

We have maintained the view that the Federal Reserve is prioritizing financial and economic stability over strict adherence to its 2% inflation target. Inflation has effectively become the Fed’s third mandate, and we believe the Fed will ultimately tolerate a higher trend inflation rate over the next decade, likely around 3%, even if they do not officially adjust their target.

3. Do Both Political Parties Contribute To The Deficit?

Our deep dive into historical economic and policy dynamics reveals that both Republicans and Democrats have contributed to the national debt.

Since the post-war era, the growth rate of the national debt under both administrations has been roughly similar:

- After one year, median cumulative debt growth is 7% under Democrat Presidents and 6% under Republican Presidents.

- After two years, it is 10% for Democrats and 12% for Republicans.

- By the third year, both are around 22%.

- By the fourth year, Republicans outpace Democrats with 39% debt growth compared to 26%.

Whether through increased fiscal spending or tax cuts that widen the deficit, our research indicates that both parties are responsible for the unchecked growth of public debt in the United States.

In short, the data run counter to emotional narratives bandied about by the media (e.g., Fox News) and increases the probability the US experiences a fiscal crisis in this Fourth Turning Regime because it lowers the probability of fiscal austerity being implemented.

That’s a wrap!

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and stress from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to join them, we are here to support you.

When you sign up, you’ll get immediate access to our premium research and signals—and if we’re not the right fit, you can cancel anytime without penalty.

The Fed Is Easing Into A Major Regime Shift

Darius recently sat down with our friend Felix Jauvin from Blockworks, where they discussed the Fed, the bond market, a positive inflection in the fiscal impulse, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Is The Fed Cutting Rates to Ease or Normalize?

When the Fed cuts rates, it is important to distinguish between policy normalization and easing. Outright easing refers to the Fed lowering the policy rate below neutral to stimulate the real economy.

Normalization, however, aims to bring the policy rate to a neutral level without additional stimulus. We believe the Fed is cutting rates to normalize policy rather than stimulate the economy.

Taking a step back, the Fed is lowering the policy rate during a business cycle expansion, with growth already likely to exceed expectations according to our GRID Model projections. Altogether, this creates a generally supportive environment for asset markets.

2. Is the Bond Market Pricing In A Recession?

When examining the neutral policy rate in U.S. dollar money markets, we find that they are only pricing in about half of a recession.

Historically, on a median basis, during postwar U.S. recessions, the Fed has lowered the policy rate by around 400 basis points. In recessions caused by overly restrictive monetary policy, the Fed has lowered the policy rate by a median of 475 basis points.

With roughly 250 basis points of rate cuts currently priced in, this reflects only 50-55% of a typical recession. We disagree that the bond market is fully pricing in a recession. Instead, we believe the market is pricing in a bimodal distribution: one scenario of a soft landing (which we currently are in the camp of) and the other of a potential recession.

3. How Has The Fiscal Impulse Changed In Recent Months?

At 42 Macro, we track US Treasury Federal Budget Net Receipts, Net Outlays, and the Budget Balance on a fiscal year-to-date, year-over-year percentage change basis.

When observing the data, we find the fiscal impulse has been modestly negative since early 2024. Through July, the budget deficit was down 6% on a fiscal year-to-date, year-over-year percentage change basis. However, with the data through August, the budget deficit has risen by 24%. This marks a significant inflection from a negative fiscal impulse to a positive one.

This dynamic will likely contribute to our GRID Model projections for Nominal GDP to surprise to the upside in the US economy over the medium term. That dynamic favors overweighting risk assets like stocks, credit, crypto, and commodities and underweighting defensive assets like bonds and the US dollar.

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and exhaustion from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to join them, we are here to support you.

When you sign up, you’ll get immediate access to our premium research and signals—and if we’re not the right fit, you can cancel anytime without penalty.

Why The Fed Needs To Front Load Rate Cuts

Darius recently joined our friend Charles Payne on Fox Business, where they discussed the outlook for the US economy, the impact of rate cuts, the significance of the Dollar, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Is The Medium Term Outlook On The Economy?

While the slowing economy might seem concerning after a significant market rally, we believe growth is likely to surprise to the upside over the medium term.

Generally speaking, the preponderance of evidence points to an economy that is moderating and a labor market that is cooling but not collapsing.

When observing the leading indicators of the broader business cycle, we believe they do not suggest investors should expect a recession over the medium term, which is positive for asset markets.

2. How Would A 50 Basis Points Cut Affect The Global Economy?

The U.S. Net International Investment Deficit doubled in the five years through 2023, increasing from $10 trillion in Foreign-Owned U.S. Assets to $20 trillion. This means a large amount of unrealized capital gains may flow out of the U.S. if the Fed is not careful managing the pace of the dollar’s decline.

A 50 basis point cut next week would likely send a signal to international capital allocators that something might be wrong with the U.S. economy, causing them to book gains and return home with their capital.

In our view, we would not suggest starting with a 50 basis point cut. However, if data from the labor market and inflation support it, the Fed should accelerate the pace of easing between now and the end of March. Beyond that, their window to continue easing may close for a while due to accelerating inflation.

3. How Will The DXY Impact Asset Markets Over The Next 12 Months?

The dollar is typically the most dominant factor in driving the global economy and global liquidity.

We believe the dollar is poised to decline significantly over the next 12 months, which should provide a positive boost to global growth.

However, investors should remain cautious and continue favoring defensive sectors and factors within the equity and fixed income markets because this could also trigger the unwinding of popular trades, including the Yen carry trade.

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and exhaustion from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to join them, we are here to support you.

When you sign up, you’ll get immediate access to our premium research and signals—and if we’re not the right fit, you can cancel anytime without penalty.

2025 Warning: Slowing Growth, Rising Inflation, and Productivity Could Squeeze Markets

Darius recently joined our friend Jeremy Szafron on Kitco News, where they discussed the recent decline in housing starts, the U.S. economy, inflation, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Does The Recent Housing Market Data Indicate About The Broader Economy?

Recent housing starts and building permit data, along with last week’s NAHB homebuyer market sentiment report, suggest an accelerated decline in the housing market, with housing starts and building permit data at levels not seen since summer 2020. This is concerning because the housing cycle has historically been a persistent leading indicator of the broader business cycle.

As a result, we anticipate growth will slow in the coming months. However, we do not advise investors to position for a developing recession in the U.S. economy.

Specifically, the latest retail sales and industrial production data, and other persistent leading indicators of the business cycle, currently indicate a recession is unlikely to materialize over a medium-term time horizon (3-12 months). Instead, we are currently observing a meandering off the top of the growth curve, which we believe is likely to persist over the next year or so.

2. How Is The U.S. Economy Transitioning From Its Growth Cycle Upturn?

The U.S. economy has been in a growth cycle upturn since the summer of 2022 when we authored our ‘Resilient U.S. Economy’ theme. We are now observing an economy that is merely getting less resilient.

Current data suggests a softening labor market, potentially at a faster rate than in recent quarters. However, our comprehensive analysis of leading indicators—including jobless claims, temporary employment, cyclical employment, layoffs, discharge rates, productivity, and corporate profit growth—does not indicate an impending severe downturn that would pose significant market risk.

While growth is likely to slow over the medium term, we do not anticipate the U.S. economy will decelerate as rapidly as the consensus currently expects. As a result, we believe the rate cuts presently priced into the 2025 forward rate curve in the U.S. are unlikely to materialize. A reconciliation is likely to occur near the year, but for now, we maintain a relatively optimistic outlook for asset markets – especially through year-end.

3. What Economic Challenges Might Emerge In 2025?

Our research suggests the inflation cycle will hit its low in the coming months before rising throughout 2025. This scenario implies growth potentially slowing to a below-trend pace in early 2025, with inflation bottoming at a level inconsistent with the Fed’s 2% target before reaccelerating.

Concurrently, we might observe a moderation or significant slowdown in productivity growth. The combination of slowing growth, rising inflation, and reduced productivity could lead to a margin squeeze and a significant slowdown in earnings. From a timing perspective, we view the first half of next year as the period with the most market risk.

Investors will likely need to reset their expectations for 2025 earnings lower during this time. However, we do not believe the markets need to debate this excessively at present because, historically, markets typically focus only on the next one to three months.

That’s a wrap!

By now, you’ve likely realized that piecing together an investment strategy from finance podcasts, YouTube videos, and macro “gurus” on 𝕏 is not delivering the results you know you deserve.

This kind of approach only leads to confusion from conflicting advice, frustration from mediocre returns, and exhaustion from the emotional rollercoaster of your portfolio swings.

If you don’t change your process, how can you expect to get better results?

Over 2,000 investors around the world confidently make smarter investment decisions using our clear, actionable, and accurate signals—and as a result, they make more money.

If you are ready to join them, we are here to support you.

When you sign up, you’ll get immediate access to our premium research and signals—and if we’re not the right fit, you can cancel anytime, without penalty.

Markets Turning From ‘Goldilocks’ Towards Deflation

Darius joined our friend Adam Taggart this week to discuss the risk of recession, inflation, the risk of a US fiscal crisis, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. How High Is The Risk of Recession In The Next 3 to 12 Months?

While we agree with the consensus that the economy is late cycle, with a low unemployment rate of 4.3% and an inverted yield curve since October 2022, we do not currently see a high risk of recession in the next 3 to 12 months.

Our assessment is based on our econometric study of all the postwar economic cycles in and around recession. That process consisted of normalizing the policy, profits, liquidity, growth, stocks, employment, credit, and inflation cycles, and comparing current trends to historical patterns leading into and through a recession. Despite observing significantly tight policy, we have not experienced the typical breakdown in the corporate profit cycle, liquidity cycle, growth cycle, or stock market cycle that usually occurs a few quarters ahead of a recession.

The current constellation of these leading indicators suggests limited recession risk in the medium term. However, we will continue monitoring and flagging critical inflections in these indicators for our clients, as the US economy remains in a late-cycle condition.

2. What Is Driving The Risk of A US Fiscal Crisis?

We believe the risk of a US fiscal crisis is much closer than most investors realize.

Our assessment stems from a significant shift in the labor versus capital dynamic around 2000 – Employee Compensation as a share of Domestic Corporate Businesses Value Added dropped below trend and has remained there, primarily influenced by factors like China’s entry into the WTO, globalization, and domestic deregulation. This shift has concentrated corporate profits among the elite, creating an inequitable situation and fueling the rise of populism on both sides of the political spectrum.

Many do not realize that both political parties are contributing to a high probability of a fiscal crisis by the end of this decade. Democrats are implementing policies that inflate the incomes of the lower half of the income distribution, while Republicans are doing the same for the upper half. These forms of socialism require piling on debt, which in turn is pushing us toward a potential fiscal crisis.

3. What Is The Outlook For Inflation?

Per the same deep-dive empirical study highlighted above, we have found that inflation is the most lagging indicator of the business cycle.

Heading into a downturn, policy generally tightens first, followed by a breakdown in corporate profits and liquidity. Growth and stocks break down about one to two quarters later, followed by employment and credit. Inflation usually breaks down below trend 12 to 15 months after a recession starts.

As a result, we believe it is very unlikely that inflation returns durably to trend without a recession in the US economy. We do not, however, believe price stability is the Fed’s priority in a Fourth Turning regime. Maintaining order in global sovereign debt markets amid structurally elevated public debts and deficits is far more important.

That’s a wrap! If you found this blog post helpful, explore our research for exclusive, hedge-fund-caliber investment insights you can act on today.