What’s Driving Global Liquidity?

Darius sat down with Maggie Lake last week on Real Vision’s Daily Briefing to discuss all things Global Liquidity.

If you missed the interview, here are three takeaways from the conversation that have significant implications for your portfolio:

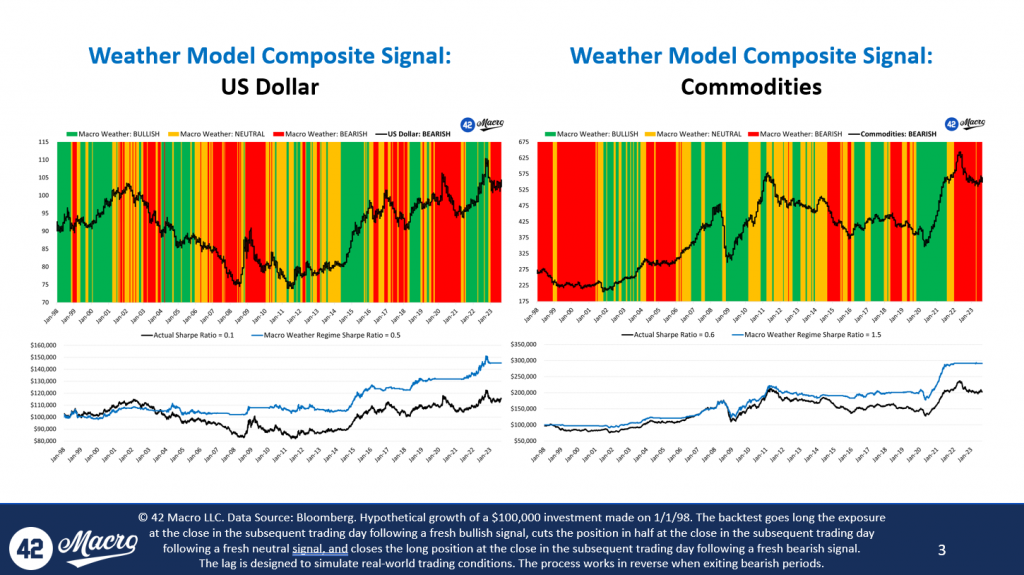

1. The Recent Surge In The Dollar Has Negatively Impacted Global Liquidity

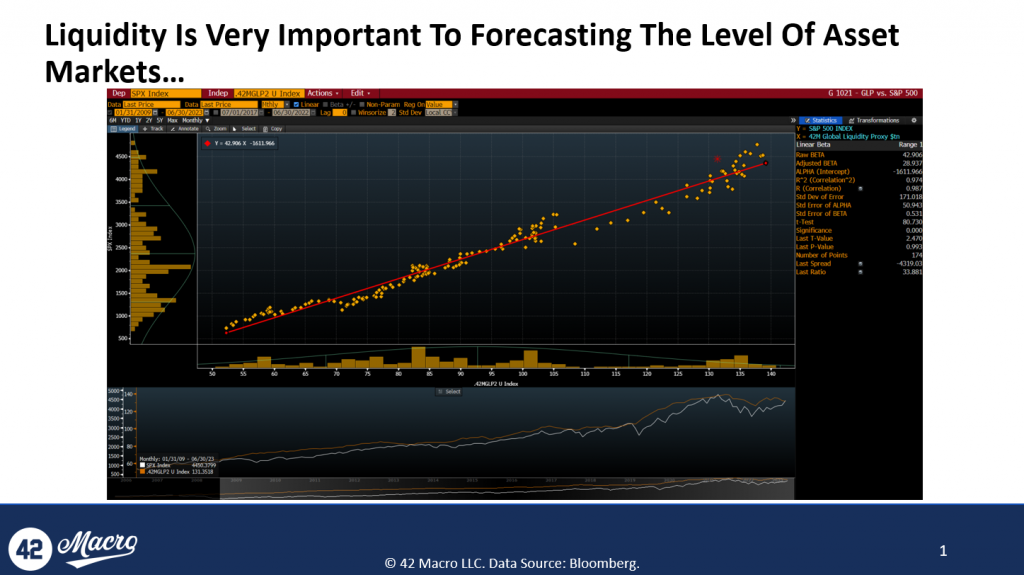

Our 42 Macro Global Liquidity proxy, a sum of global central bank balance sheets, global broad money supply, and global FX reserves minus gold, is a key driver of risk assets like equities and bitcoin.

Since mid-July, the US Dollar has rallied aggressively. This rally weighed on global liquidity because the Dollar and FX volatility are negatively correlated to global liquidity.

If we see a breakout in currency volatility, which is in the process of occurring according to our Volatility-Adjusted Momentum Signal, the negative global liquidity impulse could continue to decline, negatively impacting risk assets.

2. Currency And Interest Rate Volatility Have Hampered Private Sector Liquidity

Most retail investors think of liquidity solely in terms of whether or not central banks are supplying liquidity to the global financial system.

Private sector agents like commercial banks and non-bank lenders – primarily from net international investment surplus economies like Europe and Japan – also supply liquidity, referred to as “private sector liquidity.”

Recent currency and interest rate volatility have made it difficult for these private sector agents to supply liquidity to the system, impeding the overall global liquidity supply.

3. The Dollar Could Reach Its Highs From Last October If It Slows Its Trajectory

If the dollar continues its aggressive trend over the next few months, the Fed may have to step in and intervene because it will likely coincide with something “breaking” in the Treasury market.

But, if the dollar slows its trajectory and grinds its way higher, we believe it may reach its highs of $113 from October of last year in DXY terms.

That’s a wrap!

If you found this blog post helpful:

- Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

- RT this thread and follow @DariusDale42 and @42Macro.

- Have a great day!

US-Global Growth Divergence

Last week, Composite PMIs came in below expectations across continental Europe and in China. Stagflation is the fear in Europe, while deflation is the fear in China. Neither public sector appears ready to supply the liquidity required to ignite animal spirits within their respective economies and financial markets. Regarding the Composite PMI data specifically, only four (Japan, Russia, Brazil, and US) of the 13 economies that have reported thus far posted MoM accelerations in August. Only Japan, China, India, Russia, Brazil, and the US reported figures greater than 50, indicating expansion. Europe was a noteworthy laggard with Spain, Italy, France, Germany, Eurozone, and UK all slowing sequentially to sub-50 readings, indicating contraction.

It is now fashionable to make the short-USA/long-RoW (rest of world) call, citing valuation differentials, but we disagree with that view. Valuation is not a catalyst for market developments, Rather, valuation merely acts as an accelerant when flows reverse. FWIW, we do not believe valuations matter all the time; in fact, most of the time valuation is irrelevant because the overwhelming majority of investors cannot take risk in accordance the time horizons (3, 5, 10 years) that valuation metrics are most instructive on. Retail investors generally operate on short to medium-term time horizons because of FEAR and FOMO; institutional investors generally operate on short to medium-term time horizons because of career risk.

The US Economy Remains As Resilient As Ever

Last week’s +1.8pt MoM advance in the ISM Services PMI (54.5 = 6mo high) was adequately presaged by the New York Fed’s Services Survey a couple of weeks ago. The New Orders PMI hit a 6mo high as well alongside the highest reading in the Employment PMI since Nov-21.

The probability of a near-term recession continues to dwindle because the services sector accounts for 86% of Total Nonfarm Payrolls.

Offsetting the positivity was the 4mo high in the Prices PMI, which is now trending higher again. If the inflation narrative devolves sooner than our qualitative research views anticipate, we could be in the early innings of a market crash.

China’s Crude Oil Imports accelerated to 30.9% YoY in August, fanning the flames of an ill-timed, hazardous breakout in energy prices.

All eyes on Wednesday’s August CPI report to confirm or disconfirm the prevailing “immaculate disinflation” theme, which itself is one-half of the “transitory GOLDILOCKS” theme we co-authored in mid-January (with the other being “resilient US economy”).

Odds Are You Suck at Predicting, So Stop

Odds Are You Suck at Predicting, So Stop

Now that we have your attention, let’s spend the next 90 seconds together helping you become a better investor:

- In August 2019, what did you expect to occur in the economy and financial markets in 2020? You would be lying if you said risk assets would suffer their deepest crash since 2008 amid a global pandemic, only to recover sharply because of record fiscal and monetary stimulus.

- In August of 2020, what did you expect to occur in the economy and financial markets in 2021? You would be lying if you said the US economy and risk assets would BOOM due to the combination of vaccine proliferation and record fiscal and monetary stimulus.

- In August of 2021, what did you expect to occur in the economy and financial markets in 2022? You would be lying if you said the Fed would tighten monetary policy at the fastest pace in 40 years amid a 40-year high in inflation.

- In August of 2022, what did you expect to occur in the economy and financial markets in 2023? You would be lying if you said both the US economy and the stock market would prove to be far more resilient than the bond market.

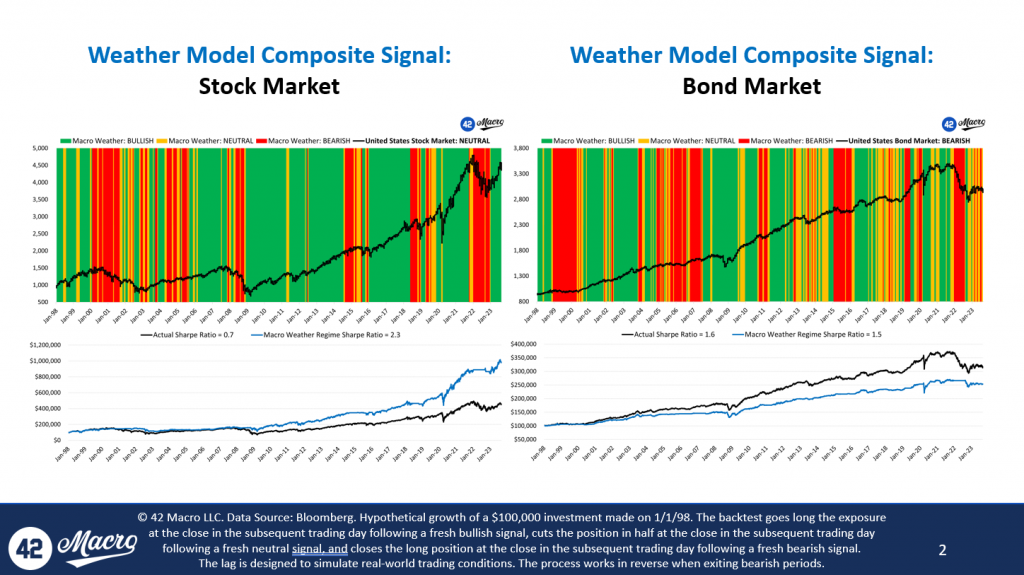

Stop trying to predict everything and join the systematic investing revolution benefitting thousands of 42 Macro clients worldwide. We do as much fundamental research as any firm on global Wall Street regarding what is likely to happen in financial markets, but we do not let those views influence our investment decisions.

The only information that impacts our portfolio recommendations is A) what is actually happening in the economy (not to be confused with what we expect to happen); and B) how what is actually happening has historically influenced asset market performance. The alternative to our systematic, trend-following approach is blowing up your or your clients’ account(s) thinking you can top and bottom tick asset markets with any consistency.

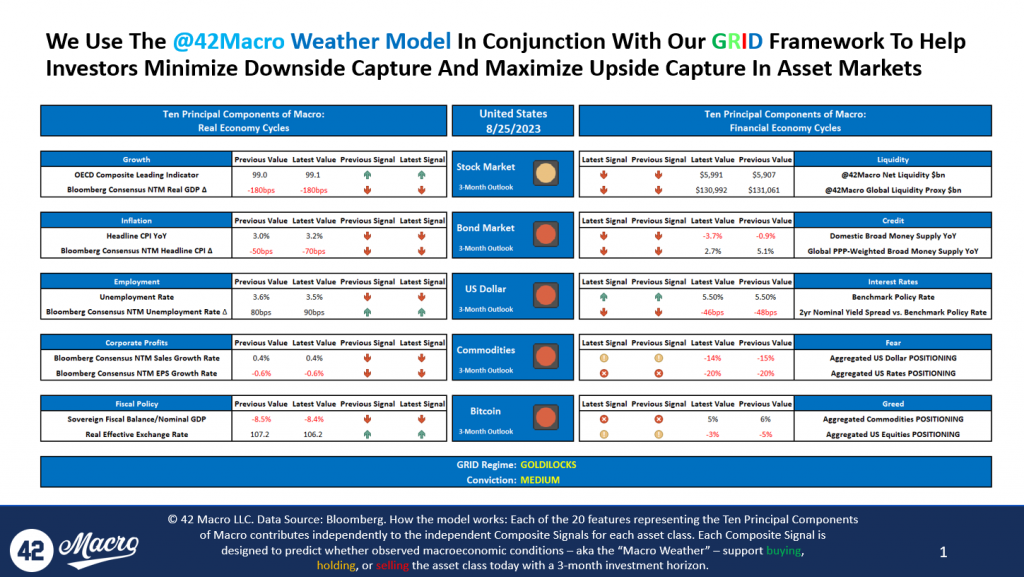

Our Macro Weather Model is the cutting-edge quantitative tool that 42 Macro clients rely upon to nowcast A and backtest B, in real-time, on a rolling basis:

CLICK HERE to download our full Macro Weather Model slide deck for today, August 25th, 2023.

CLICK HERE to see our Macro Weather Model in action across our various research products.

For those of you that now understand the value of adding a Bayesian research and risk management overlay to your investment process, we look forward to helping you improve both your investment performance and investing acumen.For the rest of you, best of luck with your 2024 predictions! We genuinely hope they aren’t as off target as your Aug-19, Aug-20, Aug-21, and Aug-22 predictions likely were about 2020, 2021, 2022, and 2023. Have a great day!

What Is The Outlook on Inflation?

Earlier this week, Darius joined Anthony Pompliano to discuss Global Liquidity, Inflation, the Housing Market, and more.

In case you missed it, here are five takeaways from the interview every investor needs to see:

1. Global Liquidity Has Been Declining Over The Past Few Months

Our proxy for global liquidity, estimated via central bank balance sheets, broad money supply, and FX reserves minus gold, has been waning over recent months.

Now that we have observed a negative inflection in global liquidity, it is important for investors to ascertain the durability of this nascent trend.

2. Liquidity And Asset Markets Are Correlated On A Levels Basis, But Not On A Rate of Change Basis

The correlation between global liquidity and the S&P500 is substantial on a level basis, explaining 97% of the index’s level since 2009.

However, when regressing global liquidity against the rate of change of the S&P500, there is only a 12% correlation between the two.

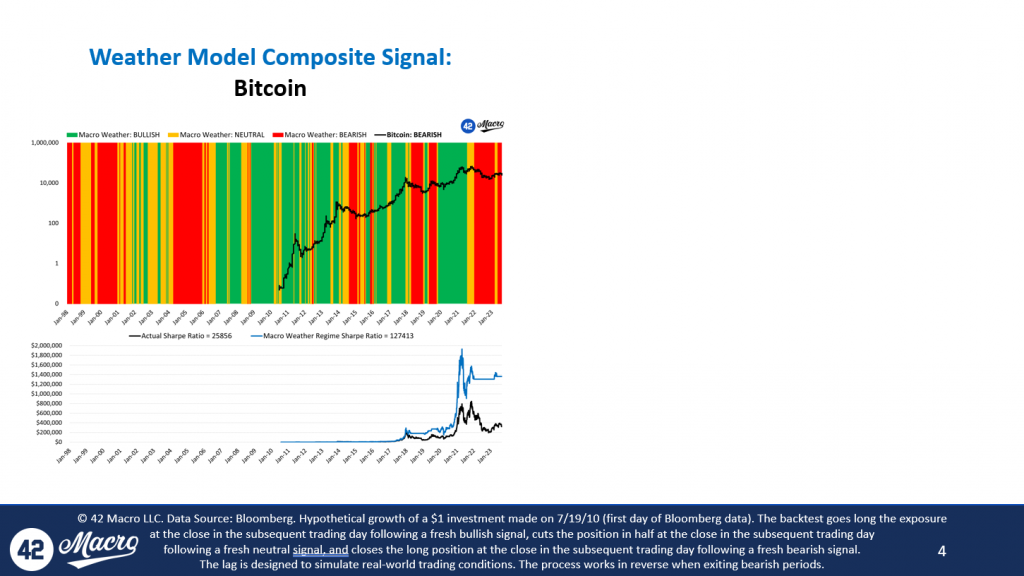

When analyzing Bitcoin, we found that liquidity explains 77% of its level but 0% of its rate of change.

So, although liquidity is essential to understanding the long-term trend in asset markets, we should not linearly extrapolate its effects on asset markets in the short to intermediate term.

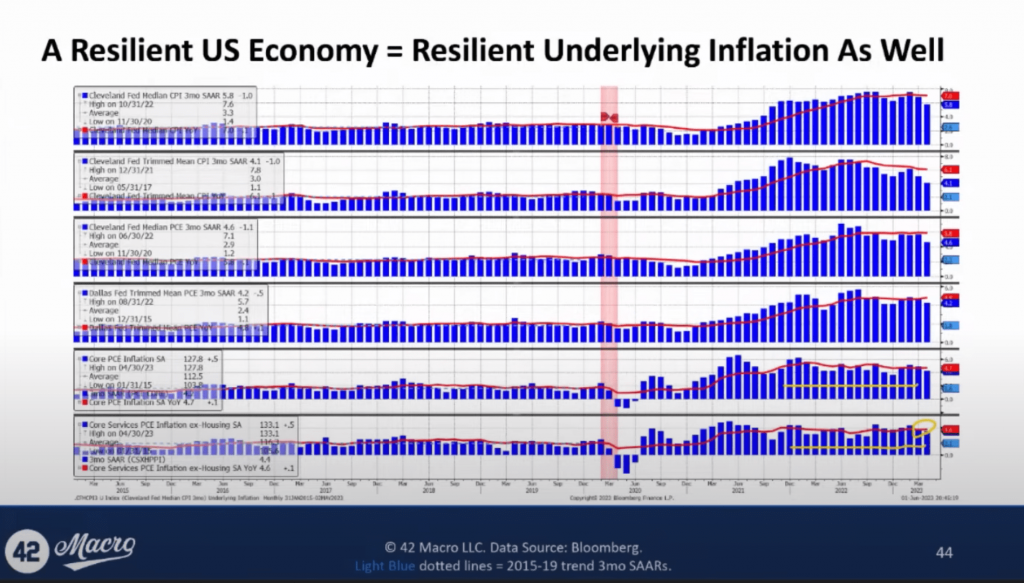

3. Inflation Will Be The Driver That Causes Asset Markets to Decline

We believe the revival of inflation as an important topic could lead to a downturn in the markets.

Currently, we are seeing favorable inflation outcomes and growth exceeding expectations supporting asset markets.

This dynamic has been beneficial for asset markets in H1, and we believe it will continue through July and possibly into August.

However, we might see inflation data harden afterward, especially relative to consensus expectations.

As the market begins to acknowledge that inflation will be sticky and require more global policy tightening than has been priced in, we expect a market correction.

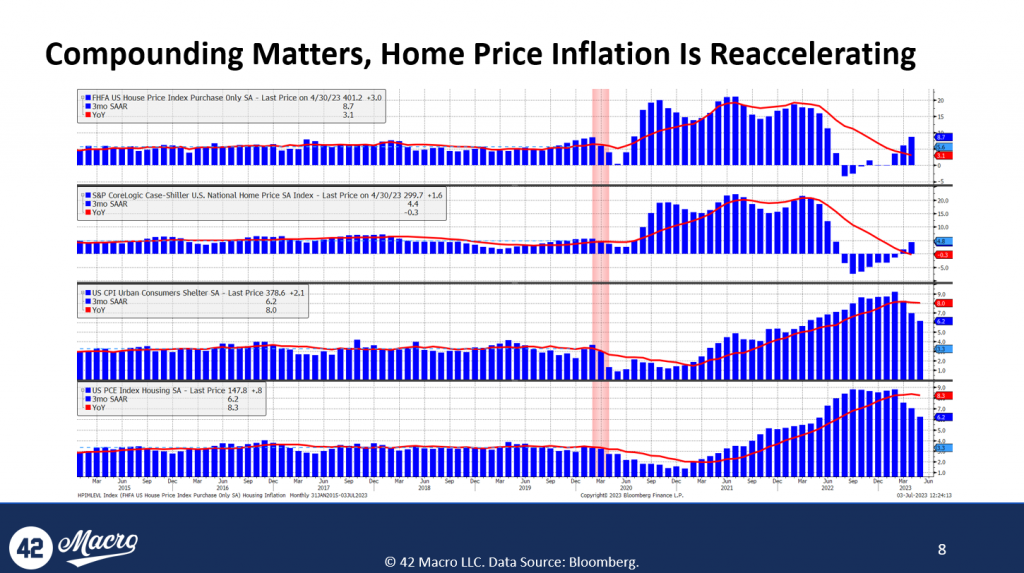

4. Home Prices Are Reaccelerating

According to the FHFA home prices index, home prices are increasing at a rate of 8.7% on a three-month annualized basis after bottoming in the first half of the year.

There is a rising probability we will see housing inflation bottoming out in the next two to three quarters, but at levels that contradict the Fed’s 2% inflation mandate.

The implications of this trend could be concerning, as the Fed might need to do significantly more to counteract the inflation impulse from the housing market.

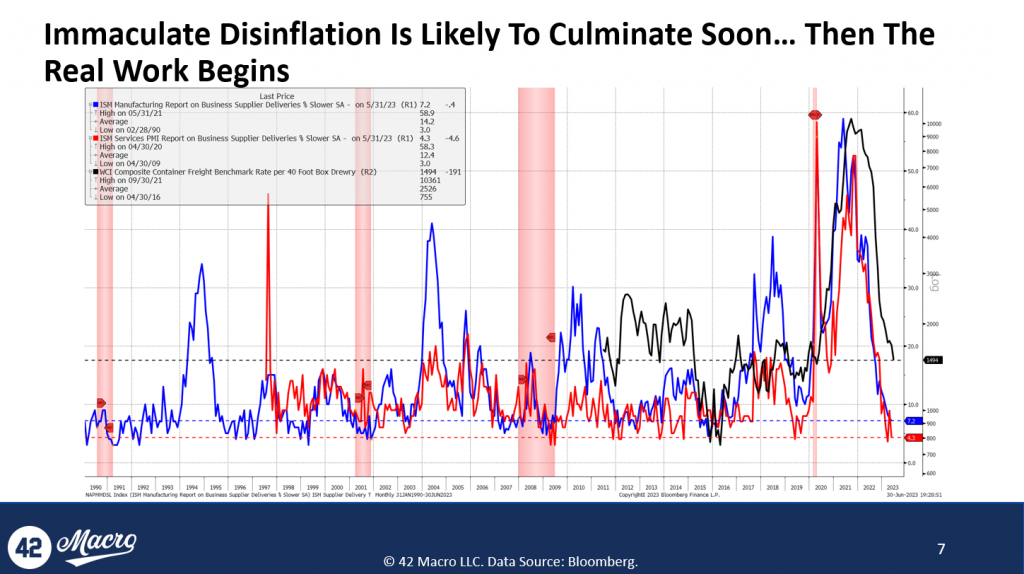

5. The Days of Immaculate Disinflation Are Over

Indices like ISM manufacturing, ISM services, and the supply delivery times index are back at levels consistent with 2% inflation, implying that the period of “immaculate disinflation” driven by pandemic-related factors is coming to an end.

We believe that the easy part of the inflation battle might be over soon.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights.

Macro Indicators and Tactics for Uncertain Times

1) The US Economy Remains on a Path to a Recession

At the beginning of the year, most investors expected a first-half recession followed by a recovery in the second half.

Since last summer, our view has consistently been that the U.S. economy had more endurance than what was perceived by most investors.

This belief led us to forecast a later start to the recession, in late-2023, contrary to the general market consensus.

Our view was, and still is, that a recession would likely kick off in Q4 of this year or Q1 of next year.

2) Inflation Will Not Reach 2% Without a Recession

U.S. inflation, a lagging business cycle indicator, usually breaks down during and through a recession.

Our data suggests that it’s improbable we will see evidence of sustainable 2% inflation before a recession hits: our models currently forecast inflation stabilizing at around 3-5%, not the Fed’s 2% target.

This could lead to two potential outcomes: either the Fed acknowledges more action is needed, or the bond market panics over the lack of progress.

Either way, we believe it will result in the Fed applying more pressure, pushing the economy into recession.

3) Europe’s Economic Contraction Will Likely Worsen

The European economy has recently confirmed its recession, primarily due to the effects of monetary tightening.

Despite the assumptions that fiscal stimulus would resolve the situation, Europe’s economy is in decline, with retail sales tracking down 2% to 4% across Europe.

Given the current data, we predict the recession in Europe is likely to worsen over the medium term.

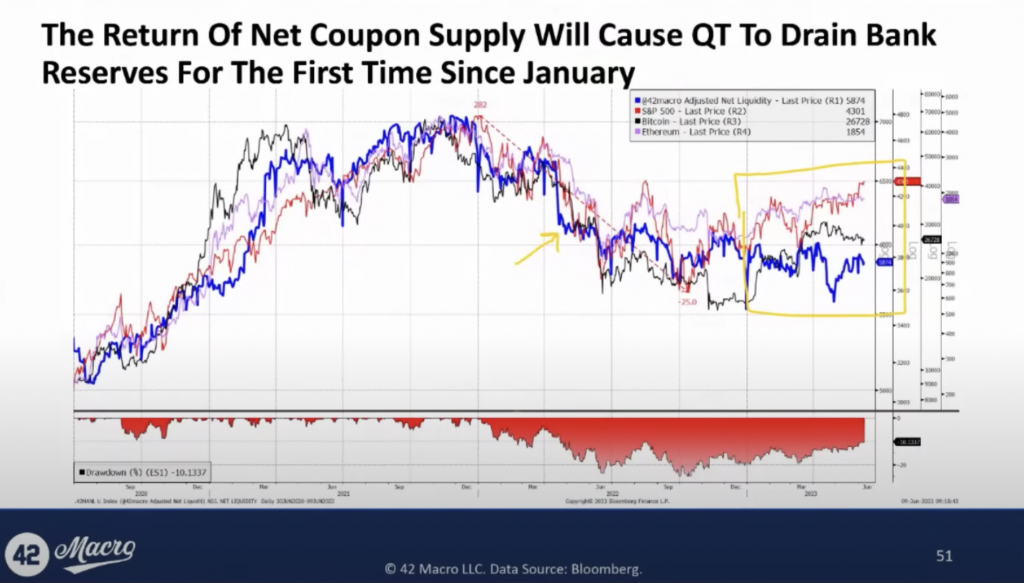

4) Upcoming Quantitative Tightening Will Negatively Impact Asset Markets

The return of net coupon supply will instigate QT, causing it to deplete bank reserves for the first time since January.

Our Adjusted Net Liquidity model, which subtracts the Treasury General Account (TGA) balance and Reverse Repo Facility (RRP) balance, as well as emergency lending from the Fed’s balance sheet, shows a breakdown in the correlation between US public sector liquidity and asset markets at the beginning of the year when QT ceased draining bank reserves.

Up until now, QT has truly been going on in the background.

We believe this correlation will resume in the coming months and negatively affect risk assets.

5) The Stock Market Is Likely To Peak During Q4 (or Early In Q1 At The Latest)

Our study of past recessions shows that the stock market, on a median basis, typically peaks a month before the trough in the unemployment rate.

Historically, the stock market usually rises sharply in the year leading up to the end of a business cycle, with a median return of around +16%.

Equity markets are generally strong preceding a recession.

We maintain the view that the stock market will likely peak in Q4 (or early in Q1 at the latest) and many of today’s too-early bears will fail to profit from the pending Phase 2 Credit Cycle downturn.

At that point, we will be positioning for the next anticipated down leg in the market.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Global Liquidity Decoded

1. China and Japan are Important to the Global Liquidity Cycle:

China and Japan are key contributors to the global liquidity cycle.

Regarding their contributions to the global central bank balance sheet, global narrow money supply, and global FX reserves minus gold – the three metrics that we feature in the @42Macro Global Liquidity Proxy – China makes up ~20%, while Japan makes up ~15%. Understanding their liquidity cycles is vital in forecasting inflections in global liquidity.

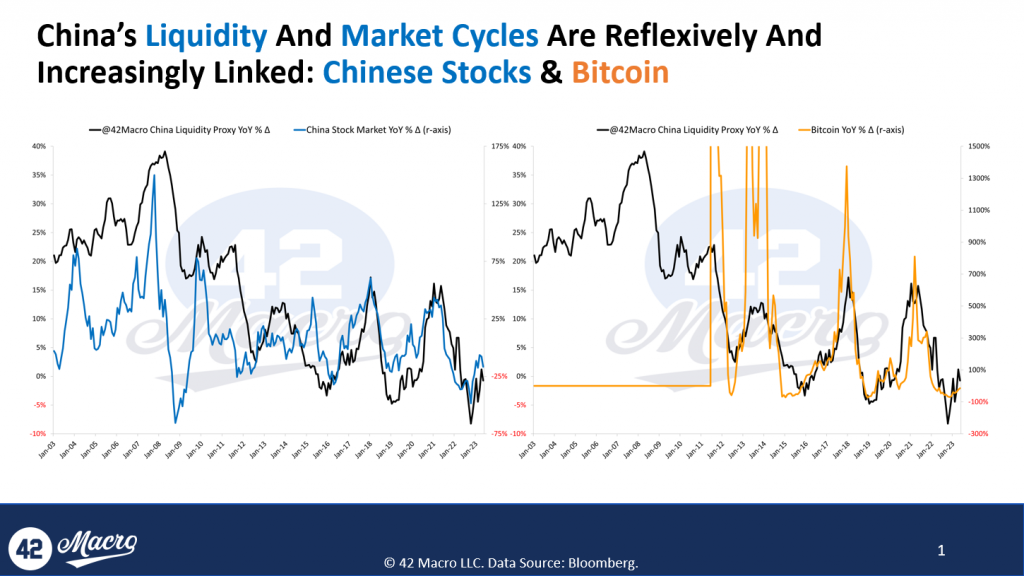

2. The Chinese Liquidity Cycle Has a Big Impact on Asset Markets:

There’s a direct link between China’s liquidity and the global markets, including Bitcoin. Any significant shift in China’s liquidity, positive or negative, can considerably affect asset markets.

Our research shows that the Chinese economy shifted from adding approximately $1.5 trillion of liquidity in Q1 of this year to removing liquidity in the past few months. The pullback in Chinese liquidity coincides with #Bitcoin failing to continue its rally. We believe we will see another injection of liquidity into the Chinese economy; we just don’t believe it will happen in the short term.

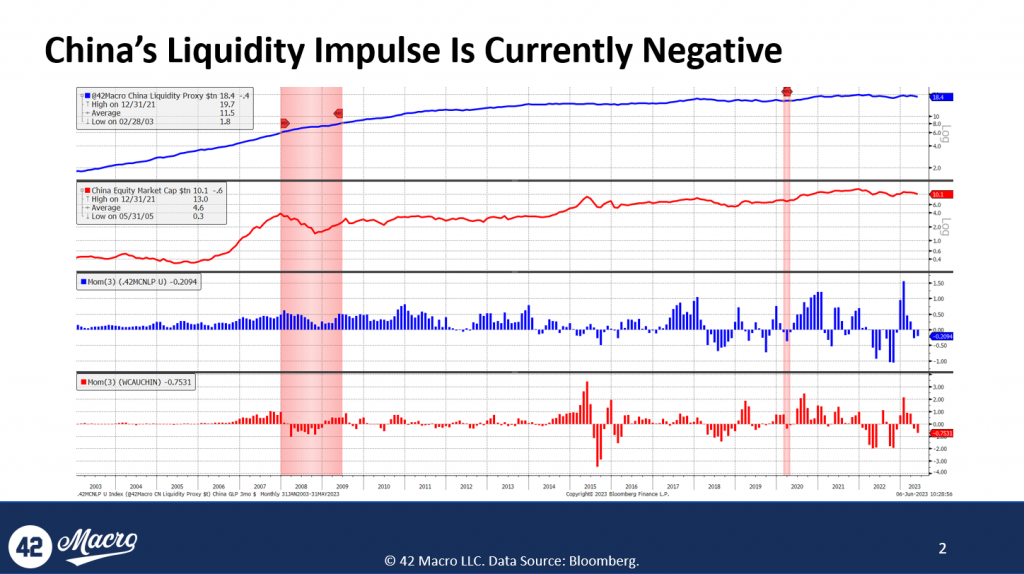

3. Waning Public Sector Liquidity Provision in China:

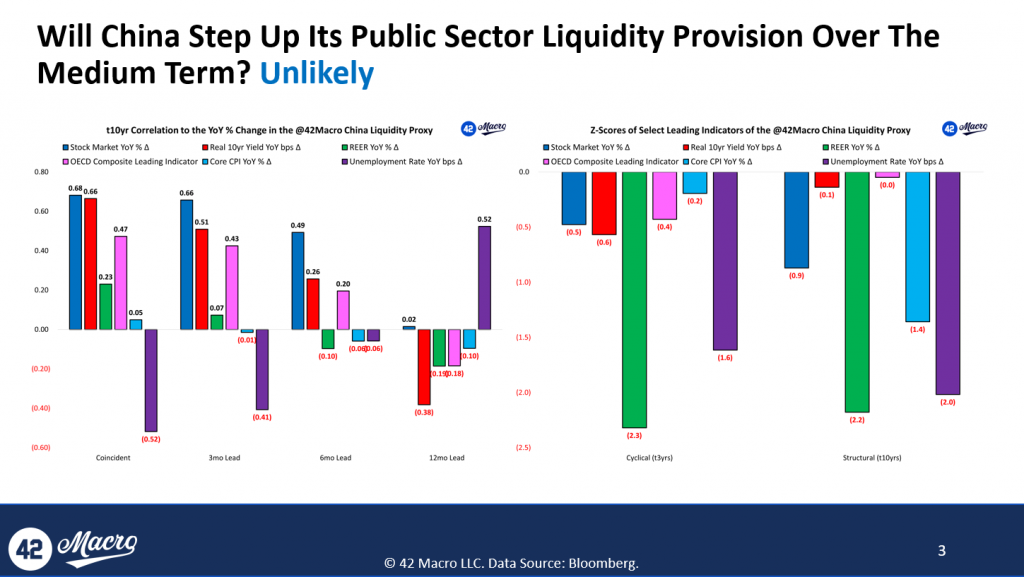

The Chinese stock market is viewed as a reliable leading indicator of the country’s liquidity cycle because locals often have intelligence regarding future actions of the People’s Bank of China (PBOC).

We believe the recent decline in the Chinese stock market likely signals a decrease in China’s contributions to global liquidity over the medium term (because the market doesn’t anticipate a wave of liquidity from the PBOC).

4. Japan’s Liquidity Cycle Influences Bitcoin Too:

Like China, Japan’s liquidity cycle strongly correlates with Bitcoin and other risk assets.

Our research shows that in October of last year, the Japanese economy was removing $1.5 trillion from global liquidity on a three-month impulse basis.

In Q1 of this year, they shifted to add $2 trillion.

Because inflation is still very high in Japan, we do not foresee a liquidity injection from the BOJ in the near term.

5. It’s Not Just Enough to Monitor Global Liquidity; You Must Forecast It As Well:

The timeline for changes in liquidity inputs to manifest in outputs (values or liquidity changes) varies by the economy.

When an economy is at the bottom of its growth cycle (e.g., unemployment rising on a YoY basis, etc.), lead times are usually shorter because central banks will react with a sense of urgency to support their economies.

Conversely, factors like stock market performance and real interest rates in China may not trigger a similar sense of urgency by the PBOC and/or Chinese commercial banks.

Overall, the objective is to understand these dynamics to forecast the global liquidity impulse, which is currently negative. We believe this negative impulse is the reason Bitcoin hasn’t fully recovered its YTD high.

That’s a wrap!

If you found this thread helpful:

- Go to https://42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!

Rough Summer Ahead?

We joined Anthony Pompliano earlier this week to discuss the Debt Ceiling, Recession, Global Liquidity, and more.

Every investor will want to review the following six highlights from the interview:

1. We expect the Debt Limit Crisis to negatively impact global liquidity.

The US government will return to the international capital markets to borrow more money (after resolving the crisis).

When that happens, a material amount of liquidity will be removed from the system, driving asset prices down.

2. Understanding the Treasury General Account Balance

The Treasury General Account Balance, essentially the checking account of the US federal government, is a crucial component of global liquidity.

When this balance decreases, it signifies that the government is spending more, increasing liquidity in the economy.

The TGA has declined for the past few quarters, supporting global liquidity and risk assets.

We anticipate a significant increase in TGA in the coming months, which will drain liquidity from the private sector.

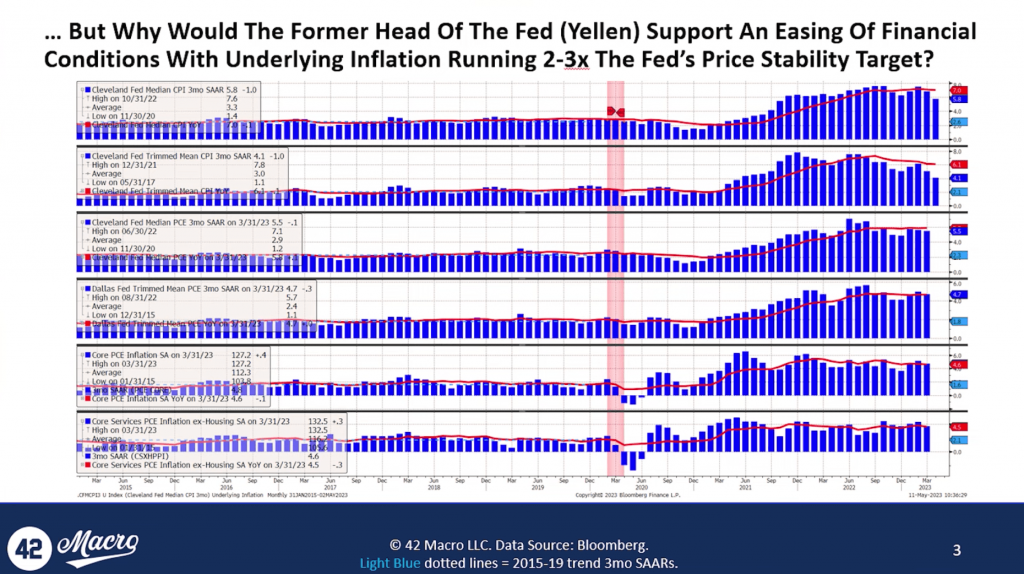

3. Inflation is running at 2-3 times the Federal Reserve’s price stability target.

Given current inflation rates, it doesn’t make sense for Secretary Yellen to support financial easing by flooding the market with T-bills.

Easing financial conditions would drive asset markets higher, only making inflation worse.

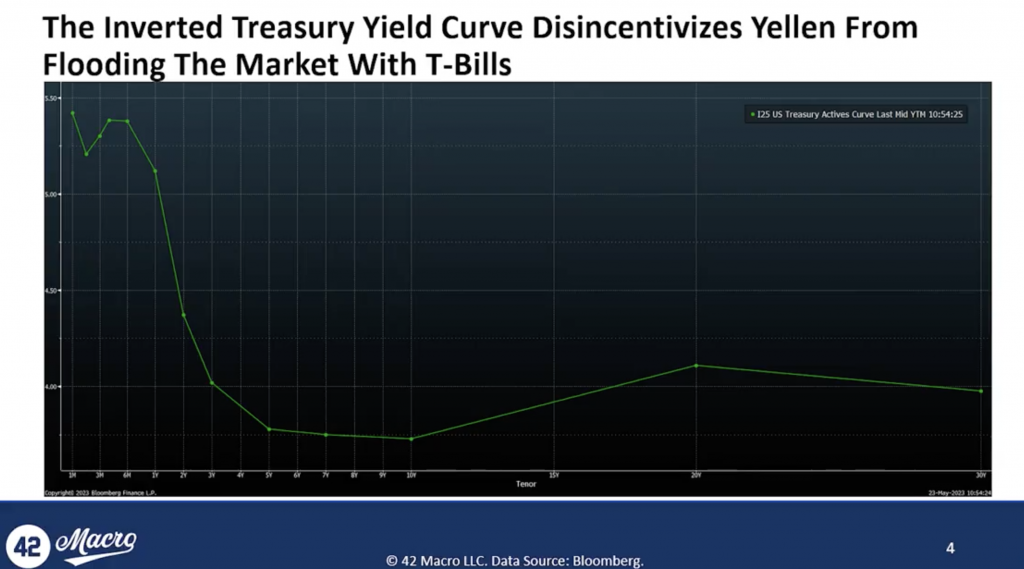

4. The Impact of the Inverted Yield Curve

An inverted yield curve occurs when short-term debt instruments (like T-bills) have a higher yield than long-term debt. It’s often seen as a predictor of an upcoming recession.

Because the Treasury needs to pay interest on issued debt, they are incentivized to lock in the lowest rates, which are currently notes maturing in the 3-10 year range.

This is another reason we believe Secretary Yellen is unlikely to flood the market with T-bills, supporting our view of lower asset prices in the quarters ahead.

5. Changes in Global Central Bank Policies

Global Central Banks also have massive implications for global liquidity and, therefore, asset markets.

We foresee another headwind for asset markets:

The two central banks responsible for the improvement in global liquidity the most over the past year, the People’s Bank of China (PBOC) and the Bank of Japan (BOJ), have been draining liquidity over the past quarter (on a trailing 3-month impulse basis).

The impulses take time to flow through financial markets, but we expect the actions of the PBOC and BOJ are likely to serve as a headwind for risk assets in short order.

6. Potential for a Rough Summer

We expect a shift in liquidity conditions from a very positive trailing six months to a more challenging period over the next two to four months.

The actions of the Fed, Treasury, and Foreign Central Banks over the next 1-2 quarters are not supportive of a positive liquidity environment.

Our advice to you is: if you are invested in risk assets, be careful.

That’s a wrap!

If you found this thread helpful:

1. Go to https://42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights

2. Have a great day!