A return of inflation pressure destroys the “transitory GOLDILOCKS” narrative and potentially derails the actual GOLDILOCKS US economy that has supported risk assets for the past few quarters, paving the way for a cross-asset crash. Our qualitative research views expect that process to occur within 3-6 months. Our best guess based on the momentum in key inflation time series and the labor market is sometime around yearend or early in the new year.

Emphasis on “guess”. We deliberately never speak in certainties about the future; the only investors that do are those chasing clout on podcasts and social media platforms. Beware conviction from folks that lack the DEEP, DAILY Bayesian inference process required to understand the full distribution of probable economic and financial market outcomes.

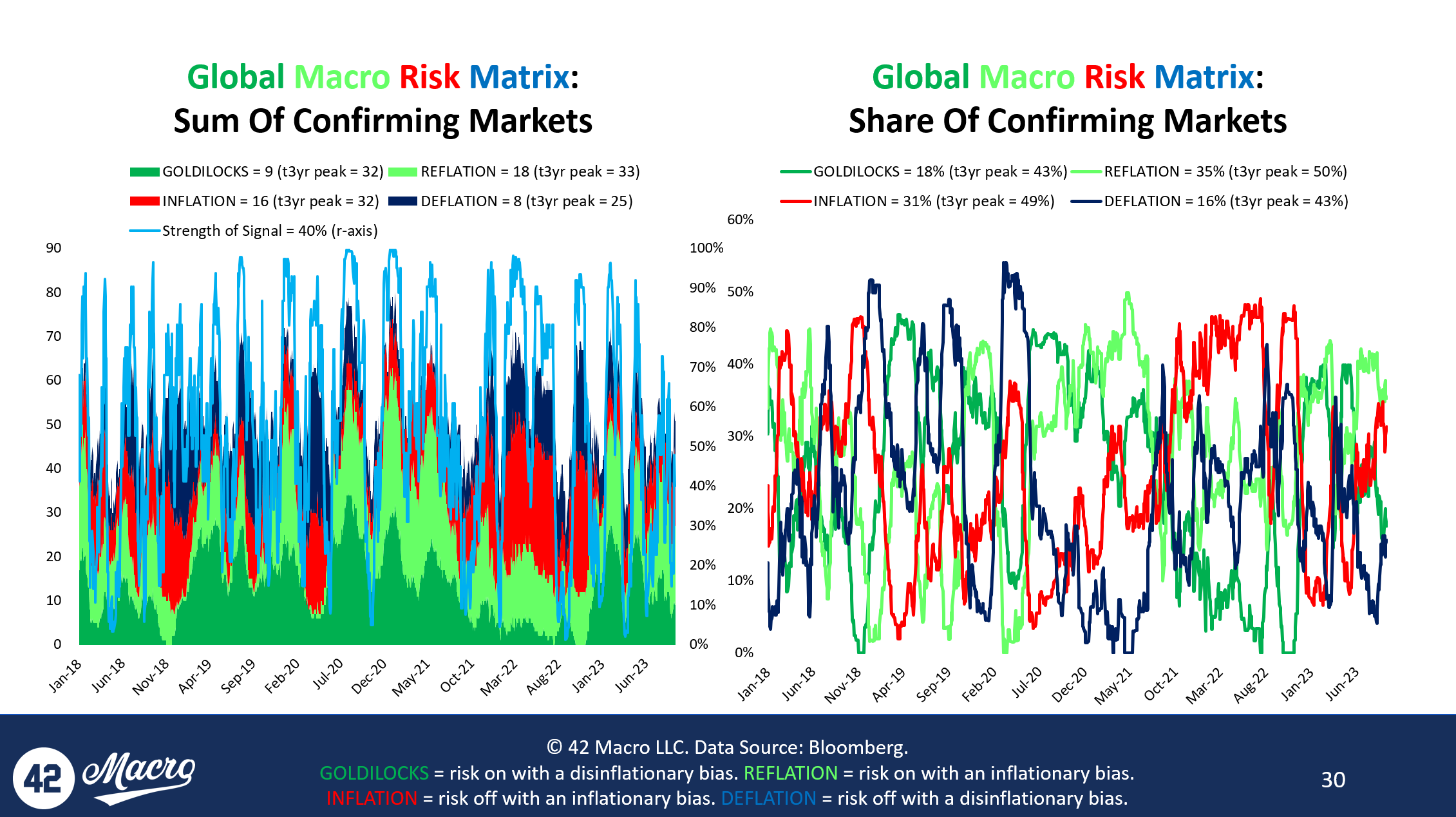

If we are wrong on the timing of the handoff from “immaculate disinflation” to “sticky inflation” and it happens much sooner than our 3-6 months [from now] projection, our Global Macro Risk Matrix will transition from risk-on REFLATION to risk-off INFLATION early in that process. Such a shift would be your queue to shift from a buy-the-dip mentality to a sell-the-rip mentality in asset markets. It would also be your queue to pivot defensively from a factor tilt perspective. Until then, we remain constructive on risk in accordance with the “transitory GOLDILOCKS” that we co-authored with our friend Bob Elliott in January.