What Matters More, AI Disruption or Bank Deregulation?

Welcome to The Weekly!

Recent divergence in global equity markets reflects mounting scrutiny of corporate AI capex trajectories, as market participants parse both escalating investment commitments and the deflationary risk AI poses to non-technology industry profits.

From this starting point, bank deregulation appears to be a greater upside risk than AI disruption is a downside risk, as (1) regulators broadly align on a deregulatory trajectory tied to the recalibration of the US Basel III Endgame framework, and (2) Paradigm C—the growth phase of the cut → grow → print sequence required to address the geopolitically driven supply-demand imbalance in the Treasury bond market continues to be the dominant driver of the economy and asset markets.

Elsewhere, the Q4 GDP and December PCE data supports our Resilient US Economy, U-Shaped Economy, and Sticky Inflation themes, broadly aligning with the latest FOMC projections of a ~2% real growth and 2.5–3.0% inflation US economy.

In Case You Missed It

This Is What Kevin Warsh Will Say About the Labor Market to Fix the Fed’s Broken Reaction Function

Enjoy this excerpt from our February 14, 2026 | Around the Horn webcast breaking down the declining dynamism of the US labor market as indicated across dozens of key high- and low-frequency economic statistics.

Our research continues to view the Fed’s reluctance to return the policy rate to a neutral setting as perpetuating a likely jobless recovery. Additionally, we project a structural uptrend in productivity growth, which will likely cause an even greater bifurcation between the outlooks for GDP and corporate profitability and the outlooks for employment, consumer confidence, and incumbent politicians.

Chart of the Week

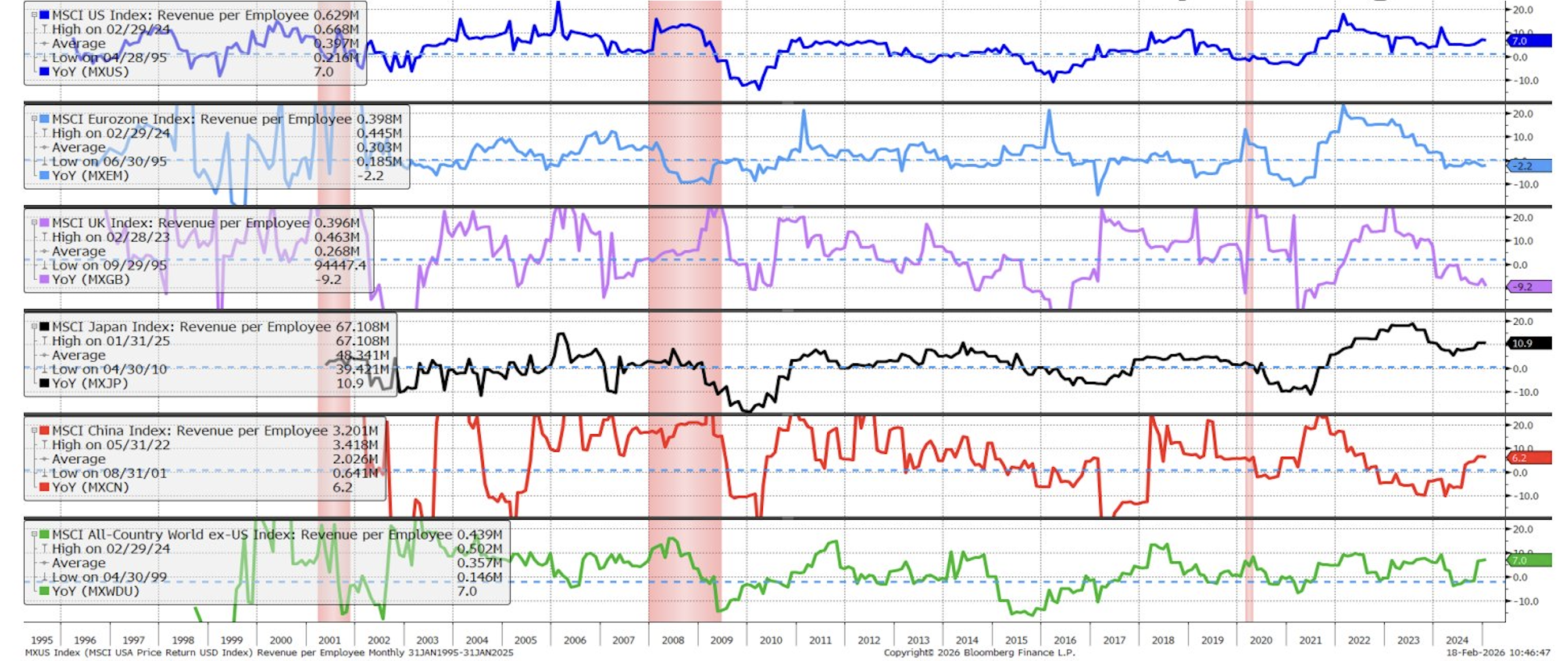

The Diffusion of AI Throughout The Global Economy Favors International Stocks Over US Stocks As Productivity Converges

As AI adoption spreads across the global economy, productivity gains are broadening beyond the U.S. While U.S. firms have led in recent years, the convergence of global productivity trends suggests international equities may be positioned to benefit as AI-driven efficiency gains become more evenly distributed across developed and emerging markets.

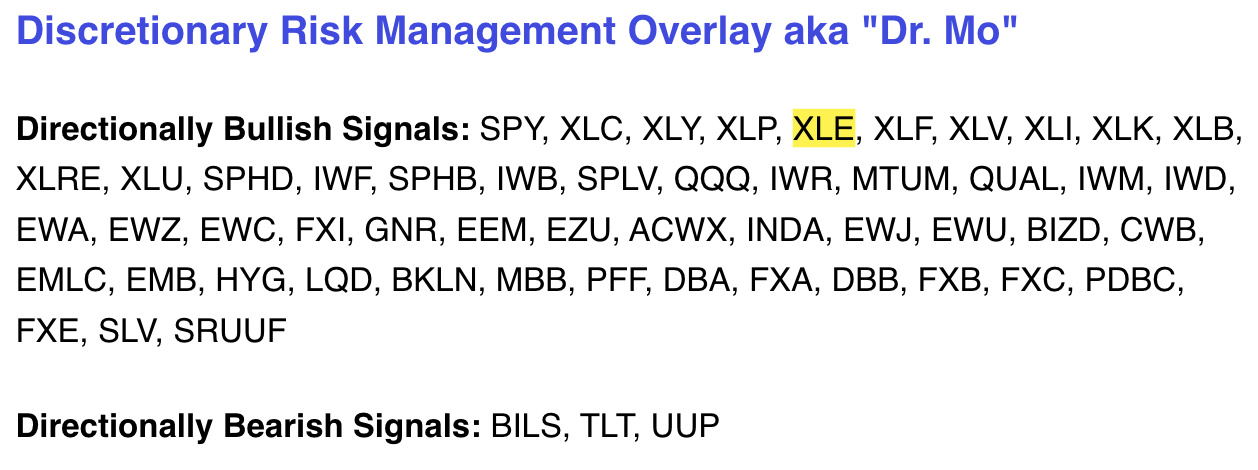

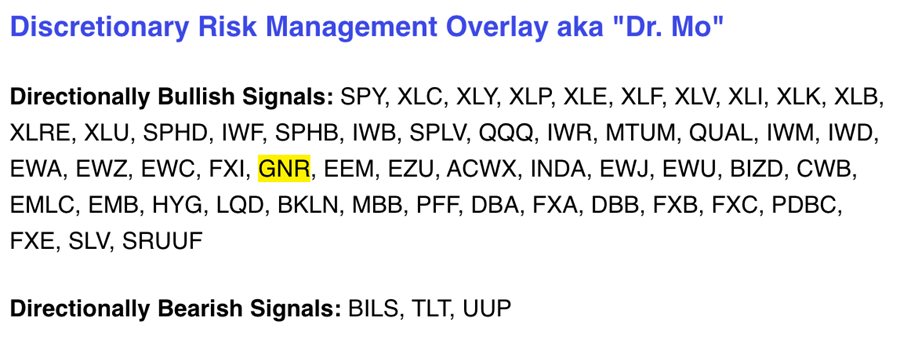

Successful Signals From Dr. Mo

On November 29th, 2025, our Discretionary Risk Management Overlay signaled a bullish breakout in Energy $XLE. Since the pivot, $XLE has appreciated 21%.

Community Spotlight

This week, we’re excited to share feedback from a member of our global investor community. Specifically, the data-driven discipline that 42 Macro provides to our community.

It’s always rewarding to see KISS and Dr. Mo deliver meaningful outcomes for investors around the world. We truly appreciate your feedback.

Parting Shot | Factor Risk

Market risk is one thing. Factor risk is another.

Staying on the right side of the cycle is difficult. Staying on the right side of growth vs. value, U.S. vs. international, quality vs. beta, across multiple rotations, is exponentially harder.

Factor rotations occur more frequently than market cycles. The probability of stacking consistent wins declines dramatically.

Most investors don’t need factor alpha. They need disciplined exposure to beta and systematic risk management.

Explore 42 Macro’s KISS and Dr. Mo and discover the frameworks and signals that underpin our systematic approach to managing risk.

EXPLORE 42 MACRO RESEARCHWill Inflation Cause Asset Markets to Devolve From Violent Chop Into a Violent Drawdown?

It’s the Valentine’s Day & President’s Weekend’s Edition of the The Weekly!

In answer to the question:

No, this bearish scenario is unlikely according to our cyclical and structural research views related to the inflation cycle. The just released softer-than-feared inflation print spurred incremental conviction around prospective Fed easing, driving rates lower and leaving equities marginally changed as investors closed out a volatile trading week with a sigh of relief.

The recent correction instead likely signals an acceleration in AI diffusion. As we have detailed, a wider adoption of AI technology represents a durable positive shock to productivity, which represents a positive shock to corporate profitability and negative shock to trend inflation.

Related, the Resilient US Economy is recovering from its U-shaped slowdown, but the upturn is being propelled by fiscal expansion and government employment while private-sector hiring stagnates—setting up a jobless, AI-accelerated recovery with historic implications for inflation and corporate profits.

Make no mistake, understanding how these dynamics differ from past cycles is critical for navigating what comes next.

As always, members of 42 Macro’s global investor community will have deeper insights into our views and how our institutional-grade risk management overlays, KISS and Dr. Mo, help investors maximize gains in bull markets and minimize losses in bear markets.

In Case You Missed It

If Your Stomach Is Dropping From Market Ups And Downs, Here’s Why

Enjoy Forbes‘ recent piece (read here) examining the surge in cross-asset volatility as stocks, metals, and crypto all sold off in tandem.

As Darius highlights in the article, there is a key structural shift underway: a growing inverse relationship between dollar and currency volatility, driven by the growing geopolitical supply-demand imbalance in the Treasury market.

Chart of the Week

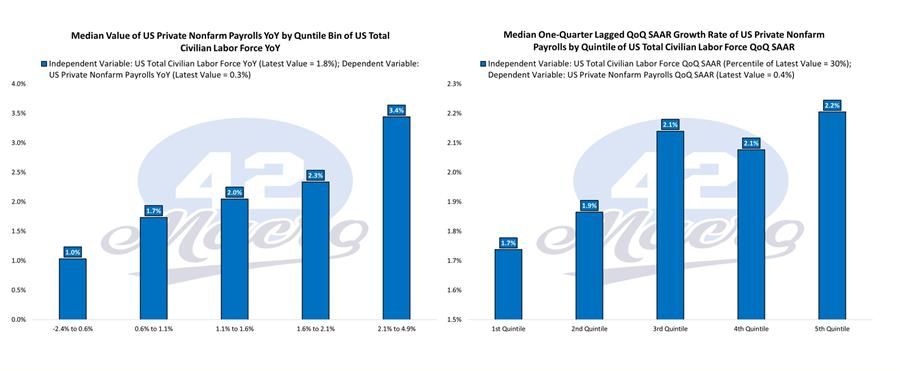

The Dramatic Underperformance Of Employment Growth Relative To The Growth Of Labor Supply Supports Our Jobless Recovery Thesis

Employment growth is dramatically underperforming relative to labor supply growth, supporting 42 Macro’s Jobless Recovery thesis. AI diffusion and capital deepening are boosting output and productivity without a commensurate rise in hiring.

Successful Signals From Dr. Mo

On November 29th, 2025, our Discretionary Risk Management Overlay signaled a bullish breakout in Global Commodity Producers $GNR. Since the pivot, $GNR has appreciated 21%.

Community Spotlight

This week, we’re glad to share a Valentine from a member of our global investor community. Specifically, the unmatched value that 42 Macro provides.

It’s always fulfilling to see KISS and Dr. Mo create positive outcomes for investors around the world. Thank you.

Parting Shot | The Cantillon Effect

Money is never neutral. It enters the system somewhere, and the first recipients benefit most.

The Cantillon Effect explains why new liquidity often lifts asset prices and government-supported sectors before it shows up in wages or broad consumer prices. The sequence matters.

In cycles shaped by fiscal expansion and shifting liquidity flows, identifying where capital is moving can be as, or even more important than reacting to headline data.

Explore 42 Macro’s KISS and Dr. Mo and discover the frameworks and signals that underpin our systematic approach to managing risk.

EXPLORE 42 MACRO RESEARCHCan the Fed Stay Independent Amid Treasury Bond Market Imbalance?

On Yahoo! Finance, Darius joined Josh Lipton to explain why rising volatility, Fed independence concerns, and geopolitical stress are reshaping market structure. With a historic degree of crowded bullish positioning, near-term chop remains likely. However, 42 Macro maintains a constructive medium-term backdrop as the economy continues to experience a structural uptrend in productivity growth.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) Productivity Is Driving Disinflation

Darius emphasized that inflation should be analyzed through trend impulses, not noisy month-to-month prints. When viewed through three- and six-month annualized rates, core CPI, core goods, core services, and shelter CPI all show negative impulses. He argued that a cyclical upturn in productivity is already underway and likely evolving into a structural shift—moving the U.S. from a 2% trend productivity economy toward a 3% regime.

Key Takeaway: Disinflation is being driven by productivity gains alongside cooling wages and housing, not economic weakness.

2) There Is a Growing Geopolitical Supply-Demand Imbalance in the Treasury Bond Market

While headlines focus on President Trump’s pressure campaign against Fed Chair Powell, Darius argues this framing misses the bigger picture of why this is all happening. The core issue is a growing geopolitically driven supply–demand imbalance in the Treasury Bond Market. With foreign participation shrinking and private investors absorbing more supply, the Fed is increasingly the only institution capable of stabilizing the market, making some erosion of independence structurally inevitable over time.

Key Takeaway: The Treasury market’s scale and imbalance will ultimately force deeper Fed involvement to fill the void.

3) A Constructive Medium-To-Long-Term Outlook

Darius acknowledged that historically crowded bullish positioning makes markets vulnerable to corrections and choppier price action. However, he stressed that volatility does not negate the broader opportunity set. A productivity-led expansion supports a constructive medium-to-long-term outlook for risk assets, even if near-term drawdowns occur.

Key Takeaway: Volatility is rising, but productivity-driven growth keeps the medium-term outlook constructive.

Final Thought: Long Signal/Short Noise

Investors who fixate on noisy economic releases or political theater risk missing the forest for the trees. The defining feature of this cycle is not policy drama; it’s a structural shift in productivity and a Treasury market that has outgrown traditional buyers. Volatility will rise, but history suggests productivity-led expansions ultimately reward disciplined investors who stay systematic and avoid reacting emotionally to headline noise.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

How Should Investors Respond to the Sea Change in US Monetary Policy?

Darius joined our friends Romaine Bostick and Katie Greifeld on Bloomberg: The Close to break down what he called one of the most historic Fed decisions of our lifetimes. In a single press conference, the Fed signaled renewed balance-sheet expansion and a revised reaction function that is increasingly geared toward supporting asset markets in lieu of combatting above-target inflation.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) The Fed Has Entered a New Monetary Policy Regime

The FOMC effectively acknowledged that the financial system now requires ongoing balance sheet expansion to counter the stress in the repo market from bloated public sector borrowing — an outcome we have been explicitly forecasting for years. Branded as “reserve management,” the Fed’s T-bill purchases are effectively QE and reflect a clear erosion of central bank independence that is likely to grow over time.

Key Takeaway: The Fed’s revised reaction function fits 42 Macro’s long-held expectation that rising deficits would force a more growth-oriented, liquidity-providing US central bank.

2) Five of Six Key Macro Cycles Are/Will Be Tailwinds for Risk Assets

With monetary policy easing, growth improving, inflation falling, fiscal policy easing, and liquidity in an uptrend, five of six macro cycles are tailwinds. While historically crowded bullish positioning — the sixth key macro cycle — suggests the next few months may be volatile, the likelihood of explosive upside in risk assets for a fourth consecutive year in 2026 is reasonably high. Take our word for it; we’ve helped thousands of investors in 80+ countries around the world maximize upside capture in the prior three years.

Key Takeaway: With five of six key macro cycles supportive, the medium-term backdrop remains decisively bullish.

3) The AI Trade Is Now a Macro Force

We may be in the early innings of a potential AI-driven bubble, and valuations matter less when five of six key macro cycles are supportive. That said, industrial revolutions tend to end in secular bear markets, so investors must be ready to protect their life savings from a repeat of the Dot Com Bust or Global Financial Crisis.

Key Takeaway: Market timing is for novice investors who haven’t yet figured out that market timing is a fool’s errand. Moreover, remaining fully invested at all times is for investors who intend to lose half (or more) of their life savings in the coming secular bear market. Trend-following systems like KISS and Dr. Mo will be best positioned to sell near the top.

Final Thought: Navigating the New Fed Liquidity Regime

Structural liquidity support, AI-driven profitability, and above-consensus growth confirm 42 Macro’s view: investors should prepare for a volatile but rewarding stretch as Paradigm C merges with the advent of Paradigm D. Click here to learn more about our Paradigm framework:

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

The Battle for Structural Reform at the Fed Begins

Darius Dale joined our friend Maria Bartiromo on Fox Business Network to break down the Fed’s evolving reaction function, 42 Macro’s 100th-percentile outlook for growth and corporate profits, and the rising role of AI in reshaping cost structures across Corporate America. Despite near-term volatility around last week’s FOMC meeting, Darius reiterated that the U.S. economy is heading into a period of extremely robust economic growth supported by structural reform at the Federal Reserve and powerful secular productivity forces.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) A “Hawkish Cut” Today, but a More Dovish Fed Tomorrow

Darius noted that while Powell may downplay expectations for further easing to preserve credibility, the real story is the coming leadership shift at the Fed. The next Chair is widely expected to prioritize growth and embrace a structurally dovish reaction function that is aligned with the administration’s agenda.

Key Takeaway: Structural reform at the Fed sets the stage for more easing, more liquidity, and continued support for risk assets.

2) Corporate America Is Accelerating Toward AI Adoption

JP Morgan’s surge in tech and AI spending is a microcosm of a broader competitive dynamic. Firms will be forced to adopt AI rapidly to control costs, driving productivity higher even as labor markets lag behind.

Key Takeaway: AI-driven cost compression will fuel profit growth and likely extend the Paradigm C bull market.

3) The Bull Market Lives On — But It’s Becoming White-Knuckle

The next 3–6 months may be volatile, but the medium-term setup is unequivocally bullish. Growth is likely to come in 50% higher than current consensus estimates throughout 2026–27, which implies corporate earnings may demonstrably surprise to the upside as well.

Key Takeaway: The journey may be bumpy, but the destination is likely higher. Having the data-driven courage to remain invested and not reacting not to every headline is the winning strategy.

Final Thought: Eyes on the Prize

Paradigm C remains one of the most constructive macro backdrops in decades. As liquidity improves and AI-powered profitability accelerates, 42 Macro’s systematic overlays—KISS and Dr. Mo—will help ensure our clients’ portfolios stay aligned with the prevailing macro regime, while safeguarding against the risk that our fundamental research views are proven wrong.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

How Should Investors Respond To Recent Market Volatility?

Darius Dale recently joined Cheryl Casone on Fox Business to discuss the state of earnings, energy markets, and Fed policy heading into the year-end. Despite short-term volatility, we continue to view our six-month-old Paradigm C theme as supportive of one of the most constructive investment backdrops in years.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) Corporate Earnings Continue to Defy Bears

Darius noted that despite Tesla’s miss, this is “the best earnings season we’ve seen since Q2 of 2021,” with roughly 85% of S&P 500 companies beating earnings and sales growth accelerating. He emphasized that these results confirm the ongoing resilience of the U.S. economy and the durability of the current Paradigm C bull market.

Key Takeaway: Broad-based earnings strength continues to validate 42 Macro’s Paradigm C framework and supports staying risk-on for investors managing risk over medium-to-long-term time horizons.

2) Small-Cap Rotation on the Horizon

With small-cap earnings turning positive and projected to grow sharply into 2026, Darius sees a coming rotation as underperforming managers chase returns beyond the “Mag 7” as we head into 2026. Fiscal and monetary easing, coupled with deregulation and increased M&A, will likely fuel a new leg of broad-market leadership.

Key Takeaway: Fiscal easing, deregulation, and rotation pressure could make small caps one of 2026’s best-performing factors.

3) Fed Policy Still Playing Catch-Up

Darius warned that the Fed’s delayed response to a weakening labor market and loss of timely data access underscores a recurring pattern of reactionary policy errors. He argued that continued labor softening increases the odds of accelerated easing, and that investors should stay positioned for liquidity-led growth.

Key Takeaway: Our research still indicates structural regime change at the Fed remains as likely, and 42 Macro’s KISS and Dr. Mo frameworks are built to capitalize on it.

Final Thought: Staying on the Right Side of Paradigm C

“Paradigm C remains one of the best investing environments I have seen in my career, which includes helping investors maximize upside capture during the explosive bull markets of 2009-10, 2013-14, 2016-17, 2020-21, and 2023-24,” Darius adds. With earnings strength, policy easing, and broadening market leadership, 42 Macro’s KISS and Dr. Mo systematic frameworks help investors block out the noise and maximize upside capture in the current bull market.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

Can the Traditional 60/40 Portfolio Survive Fiscal Dominance?

Darius Dale recently joined our friends Tom Keene and Isabelle Lee of Bloomberg to discuss why the traditional 60/40 portfolio is not optimized for the current structural macro regime featuring fiscal dominance. Investors who integrate Gold, alternative assets, and systematic frameworks, like 42 Macro’s KISS Model Portfolio, will be best positioned to compound returns and avoid volatility drag over the long term.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) The Traditional 60/40 Portfolio is Outdated

“The traditional 60/40 model is broken.” Darius explained that while equities remain supported by fiscal and policy levers driving a “transitory boom” in the economy, the Treasury bond market has become a melting ice cube. Structural supply-demand imbalances in Treasuries, driven by geopolitics, deficits, and fading foreign demand, mean institutions are turning toward gold and alternatives as new core asset allocations.

Key Takeaway: Bonds no longer provide the diversification they once did. Just as we predicted over a year ago, institutional investors are shifting toward gold and other alternatives as portfolio stabilizers in a world defined by fiscal dominance.

2) The “Debasement Trade” Hasn’t Even Started Yet

“In our opinion, the debasement trade hasn’t really even started yet,” Darius explained. “This is an institutional portfolio asset reallocation. Term premia are about 100 basis points mispriced, inflation is about 50 basis points mispriced, and the positive stock-bond correlation is likely to persist as inflation remains elevated. Those three dynamics are working against investors who still hold too many Treasuries.”

Key Takeaway: The shift away from Treasuries toward gold and alternative assets is still in its early stages. The real debasement trade will likely begin when the Fed is forced by internal political and external geopolitical dynamics to absorb excess Treasury supply.

3) Avoid Getting Trapped In Cash

When asked about common mistakes that investors make, Darius highlighted the behavioral trap of fleeing to cash and never reinvesting. “You need a system that gets your cash allocation to go up and down, not just up.” 42 Macro’s KISS and Dr. Mo frameworks were designed to systematically scale exposure based on regime signals, not emotion.

Key Takeaway: Emotional market timing decisions destroy long-term performance. Systematic overlays like KISS and Dr. Mo help investors manage exposure through both risk-on and risk-off regimes without getting trapped in cash.

Final Thought: Stay the Course, Systematically

Darius closed by reaffirming the importance of discipline: “If you’re going to retire, you want to do it on time and comfortably — and you’re not going to day trade your way there.” Paradigm C rewards systematic investors who stay invested, manage liquidity, and adapt to structural regime change rather than rejecting it.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

Will Tariff Volatility Derail Paradigm C?

Darius Dale recently joined our friend Julie Hyman of Yahoo Finance to explain why investors should continue to fade volatility associated with “tariffs” — exactly what our global investor community has been doing since April. This administration understands it must outgrow the debt trajectory and is pulling fiscal, regulatory, and monetary policy levers to drive a durable and robust recovery starting next year—the core tenet of our Paradigm C theme.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) Tariffs Are the Trees, Paradigm C Is the Forest

Darius explained that focusing myopically on tariffs misses the broader macro picture. The administration’s combined fiscal, regulatory, trade, and monetary policy mix—including a likely structural regime change at the Federal Reserve—will likely create a robust and durable recovery starting early next year.

Key Takeaway: Investors should continue to fade trade policy uncertainty and focus on the full gamut of policies impacting growth.

2) Monetary Policy as Part of the Fiscal Machine

Darius noted that while monetary policy “does not usually go under the [presidential] administration bucket,” it increasingly functions as part of the the fiscal dominance regime. He expects the next Fed chair to guide markets to a much lower neutral policy rate, providing the monetary support needed to reduce the negative distributional consequences of fiscal dominance. As he states, “Financial repression and monetary debasement are necessary preconditions for this regime to function [properly].”

Key Takeaway: Likely structural regime change at the Fed will reinforce fiscal dominance and extend the current expansion.

3) Policy Focus is Shifting

The policy focus in Washington is shifting from aggregate statistics like GDP and corporate profits to distributional realities affecting households and small businesses. He pointed out that only about 20% of job growth over the past three years has come from the private sector and that future fiscal easing and deregulation will target these imbalances.

Key Takeaway: Policy is evolving to support small businesses and households, further reinforcing the likely improvement in growth due to Paradigm C.

Final Thought: What Does This Mean for Markets?

The administration’s core goal is to outgrow the debt trajectory, and most major policy levers are being aligned toward that end. If policymakers avoid “kicking over the legs of the stool,” the cumulative impact of these fiscal, monetary, and regulatory shifts is likely to remain broadly positive for markets.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

How Should Investors Navigate the U.S. Government Shutdown?

Last week, Darius Dale joined Andrew Bell on BNN Bloomberg to discuss 42 Macro’s 100th-percentile-bullish Paradigm C theme and the US government shutdown. He explained why a U.S. government shutdown would likely be a non-event for markets, how the U-shaped U.S. economy remains on track for a likely robust recovery in 2026, and why a weaker dollar could unleash a powerful tailwind for risk assets.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) Government Shutdown Fears are Misplaced

History has shown that shutdown fears are misplaced. Darius points out that the longest shutdown in U.S. history (spanning from December 2018 – January 2019) saw the S&P 500 rally 10% during the closure and another 10% in the three months that followed.

Key Takeaway: Political theatrics continue to be unable to derail 42 Macro’s 100th-percentile-bullish (relative to Global Wall Street) Paradigm C thesis. The past and present government shutdowns have continuously proven to be noise, not signal.

2) The U-Shaped U.S. Economy Will Likely Reaccelerate

During the segment, Darius reiterated that 42 Macro’s U-Shaped Economy thesis remains intact. While the U.S economy may reach a nadir in the second half of 2025, we continue to anticipate a robust recovery in 2026 as growth-friendly fiscal, monetary, and regulatory policies align with our view.

Key Takeaway: Markets are smart and wise enough to look through the worst part of the U-Shaped economy. We continue to believe that risk assets are likely to be much higher in price over a medium-term time horizon.

3) A Weaker U.S. Dollar is Bullish for Risk Assets

42 Macro models continue to signal that the U.S. Dollar is likely to stay weakened on a 12-24 month time horizon as other major central banks are either done easing (ECB, BOE, SNB, PBOC) or normalizing monetary policy in a hawkish direction (BOJ). Additionally, such periods of globally synchronized economic recovery have tended to perpetuate significant declines in the dollar – an outcome that will likely result in a much higher stock of global liquidity that is incredibly bullish for asset prices.

Key Takeaway: Instead of scaring away foreign investors, we continue to believe a weaker USD will continue to reflate global liquidity and support the bullish environment for asset prices.

Final Thought: Investors That Systematically Block Out Bear Porn Will Continue To Win

Fiscal expansion, moderate inflation tolerance, and monetary adaptation continue to shape a regime that favors growth and risk assets. Investors who stay systematic and positioned for this policy-driven expansion are best equipped to capture the upside as Paradigm C unfolds.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42

What Does the U-Shaped Economy Mean for Investors?

Darius Dale recently joined our friend George Gammon on Rebel Capitalist Interviews to discuss the cyclical and structural forces shaping markets into 2026 and beyond. He explained why the current slowdown is merely a transitory period of weakness that sets the stage for a robust and durable recovery, how fiscal dominance is redefining the Fed’s role, and why deregulation remains an under-appreciated upside risk for the economy and asset markets.

If you missed the discussion, here are three key takeaways that likely have huge implications for your portfolio:

1) The U-Shaped U.S. Economy Is Not An L-Shaped Economy

Darius noted the U-shaped economy slowing down into late 2025, with growth bottoming in Q4, before reaccelerating in 2026. Tariffs, policy uncertainty, and anniversary effects of earlier fiscal stimulus are now “throwing sand in the gears” of the economy. However, he stressed that fiscal easing through the “One Big [Ugly] Bill” – which features tax cuts and increased defense and border spending – monetary easing, and substantial deregulation will likely drive real GDP growth above 3% in 2026-27.

Key Takeaway: As we have stressed since authoring our 100th-percentile-bullish Paradigm C theme in April, investors should focus less on the slowdown and more on the likely reacceleration. Focus on the forest, not the trees.

2) Fiscal Dominance Requires Structural Regime Change at the Fed

Treasury supply is now consuming roughly 40% of global savings, double the long-term average. With foreign demand declining from Europe, Japan, and China, Darius argued the Fed must participate in fiscal dominance. Markets are already pricing this shift: the floor Fed funds rate has repriced from ~4.5% in January to ~3% today, effectively zero in real terms. He expects real short-term rates to decline to persistently negative territory over time.

Key Takeaway: Paradigm C represents a structural shift toward growth-driven debt reduction, supported by a more accommodative Federal Reserve.

3) As Labor Weakens, Policy Must Step In

Private-sector labor income growth is currently mired in a “strong negative impulse,” and policy uncertainty remains at record highs. Structurally, AI is displacing early-career roles, with recent-graduate unemployment persistently above the national rate since 2022. Darius emphasizes deregulation as the lever that can unlock new credit formation and housing supply.

Key Takeaway: Deregulation is emerging as a tool to counteract labor-market fragility, support credit creation, and expand housing supply.

Final Thought: Positioning for Paradigm C

Paradigm C is reshaping the U.S. economy through tariffs, continued fiscal largesse, a return to monetary largesse, and substantial deregulation. For investors, the imperative is clear: don’t get lost in the noise of short-term volatility. The policy sequence points toward robust growth, persistent above-target inflation, and the need to own assets that outrun financial repression and monetary debasement.

If you are not confident your portfolio is positioned correctly for the evolving macro landscape, partner with 42 Macro for data-driven insights and proven risk management overlays—KISS and Dr. Mo—to help you stay on the right side of market risk.

No catch—just real insights to help you stay ahead in the #Team42 community.

Best of luck out there,

— Team 42