Is the Fed Done Hiking?

Earlier this week, Darius joined Maggie Lake and Andreas Steno on Real Vision to discuss the Fed, Inflation, and more.

If you missed the interview, we have you covered. Here are three key insights that will save your portfolio:

1) We Believe The Narrative Surrounding Inflation Will Change In 3-6 Months

The interplay between immaculate disinflation and rising soft landing expectations has been the driver behind asset markets this year.

We believe any potential shifts in this narrative are not being adequately priced into market forecasts.

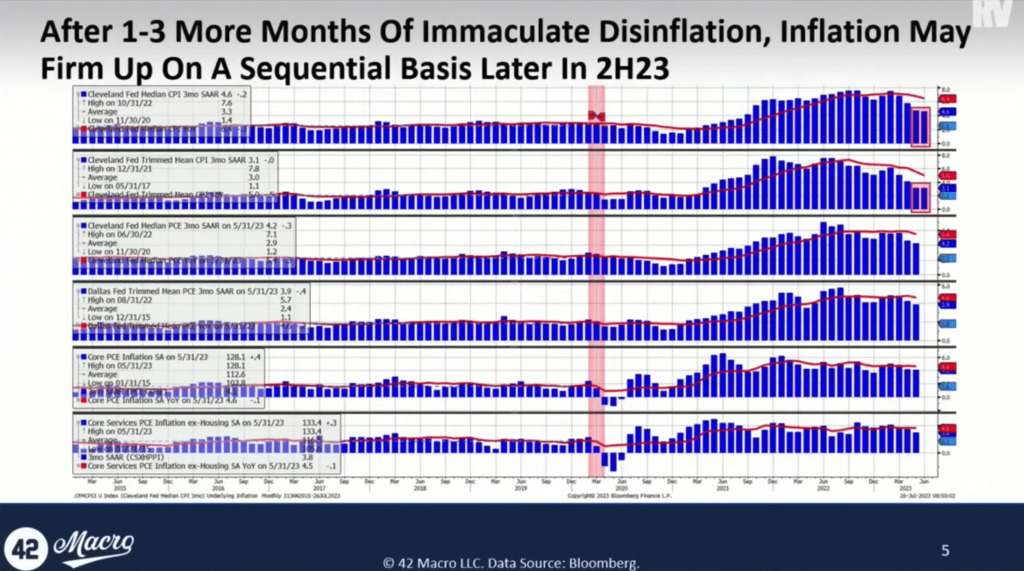

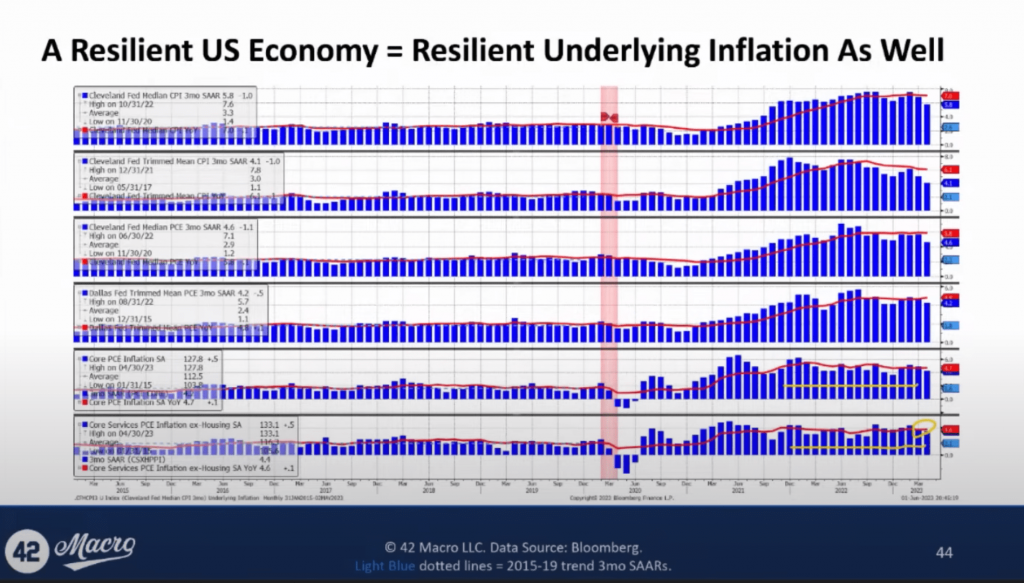

Reviewing several key inflation measures—median CPI, trim mean CPI, median PCE deflator, trim mean PCE, core PCE, and super core PCE—highlights a concerning trend. Sequential trends, especially for median CPI and trim mean CPI, indicate stagnation between 3% to 4%. If this lack of progress continues, it could be problematic for the economy.

Our models indicate that a recession in the US economy is unlikely to begin until Q4 this year or Q1 next year, with the depths of the recession probably not hitting until the second or third quarter of next year.

2) The Rate of Change of Inflation Is Important, Not the Level

Investors should be concerned with inflation’s direction and velocity – not the current level.

Why? Because the rate of change is what markets react to. While the Federal Reserve may concern itself with the actual level of inflation, investors should strive to be one step ahead of the Fed, analyzing shifts in the direction and speed of travel.

3) A Soft Landing In Growth = A Soft Landing In Inflation

Inflationary impulses in the economy take time to permeate fully – this explains why the BLS and BEA measure inflation as they do.

Inflation has subsided back to around 2% when you exclude the lagging housing components of inflation.

Notably, core services ex-housing CPI and the core services ex-housing PCE deflator are showing three-month annualized rates of 1.4% and 3.2%, respectively.

If we do have a soft landing, it will likely be at some point in 1H24 — a scenario that, while not the most probable, is far more likely than a near-term recession.

Under these conditions, we believe we would see metrics like super core CPI, super core PCE, and core PCE firm up and begin accelerating again.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Is A Blow-Off Top In Equities Approaching?

Earlier this week, Darius joined Anthony Crudele to discuss the Recession, Equities, Investor Positioning, and more.

Miss the discussion? No problem. Here are the three most important insights that can help your portfolio:

1) Hard or Soft, the “Landing” in Inflation Will Mirror the Landing in Growth

If we have a recession, inflation will come down swiftly.

On the other hand, if we manage to avoid a recession and see a soft landing, then inflation will decline naturally over time. However, in a soft landing scenario we believe it will decrease to a terminal level higher than the Fed’s 2% target.

Both roads lead to cuts, but the severity of cuts will depend on the outcome: a hard landing will likely lead to 200-300 basis points of rate cuts, while a soft landing only leading to 50-100 basis points of cuts.

2) We Believe There Will Be A Blow-Off Top In Equities

We urge investors to expect a blow-off top in the US equity market, which is a phenomenon that happens ahead of every recession.

Our research surrounding market cycles, specifically around late business cycle turning points, reveals that in the year preceding the equity market’s peak, the S&P rises by approximately 16%, with zero non-double-digit values in a 12-cycle sample.

Typically, the S&P peaks just before the recession, approximately a month before the trough in the unemployment rate and breakout in jobless claims, squeezing bears right up until the last innings of the expansion.

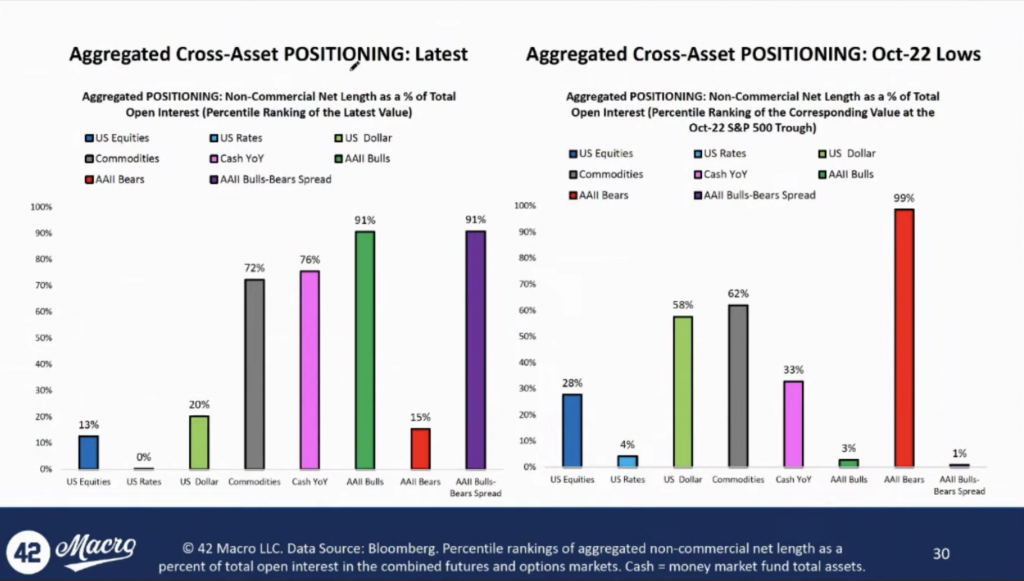

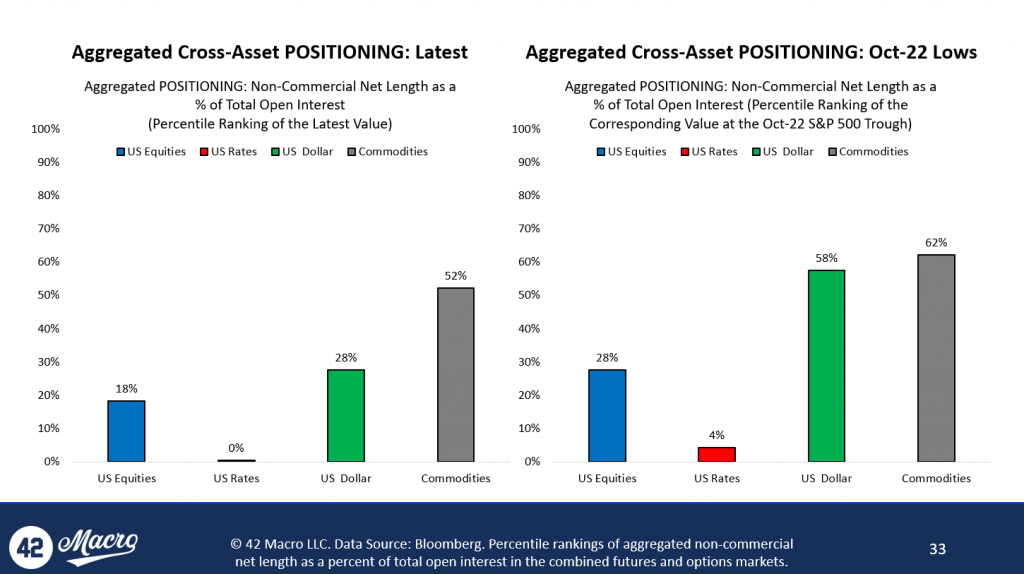

3) Bearish Investor Positioning Is Fueling This Rally

Our 42 Macro Aggregated Cross-Asset Positioning Models indicate that investors are still very bearish from a positioning standpoint.

The most recent data shows investors are more resolute in their bearish positions than at the October 22 lows.

Although those investors may be correct about the market’s destination in six to nine months, the challenge lies in the three to four months leading up to that period.

We believe there is risk of a continued market rally in the back half of the year, not driven by fundamentals but simply because the recession every bear is waiting on has not started yet.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

What Is The Outlook on Inflation?

Earlier this week, Darius joined Anthony Pompliano to discuss Global Liquidity, Inflation, the Housing Market, and more.

In case you missed it, here are five takeaways from the interview every investor needs to see:

1. Global Liquidity Has Been Declining Over The Past Few Months

Our proxy for global liquidity, estimated via central bank balance sheets, broad money supply, and FX reserves minus gold, has been waning over recent months.

Now that we have observed a negative inflection in global liquidity, it is important for investors to ascertain the durability of this nascent trend.

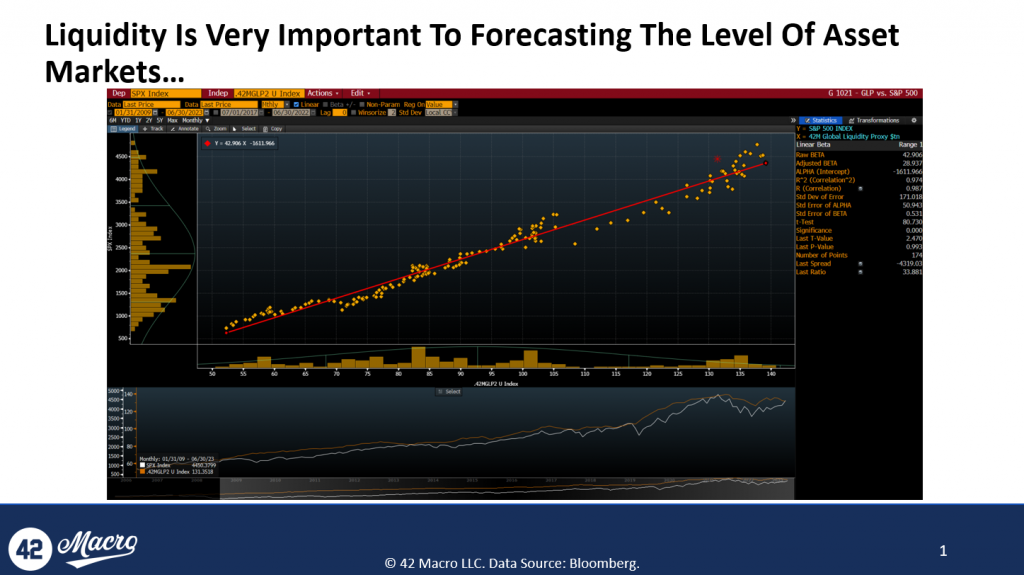

2. Liquidity And Asset Markets Are Correlated On A Levels Basis, But Not On A Rate of Change Basis

The correlation between global liquidity and the S&P500 is substantial on a level basis, explaining 97% of the index’s level since 2009.

However, when regressing global liquidity against the rate of change of the S&P500, there is only a 12% correlation between the two.

When analyzing Bitcoin, we found that liquidity explains 77% of its level but 0% of its rate of change.

So, although liquidity is essential to understanding the long-term trend in asset markets, we should not linearly extrapolate its effects on asset markets in the short to intermediate term.

3. Inflation Will Be The Driver That Causes Asset Markets to Decline

We believe the revival of inflation as an important topic could lead to a downturn in the markets.

Currently, we are seeing favorable inflation outcomes and growth exceeding expectations supporting asset markets.

This dynamic has been beneficial for asset markets in H1, and we believe it will continue through July and possibly into August.

However, we might see inflation data harden afterward, especially relative to consensus expectations.

As the market begins to acknowledge that inflation will be sticky and require more global policy tightening than has been priced in, we expect a market correction.

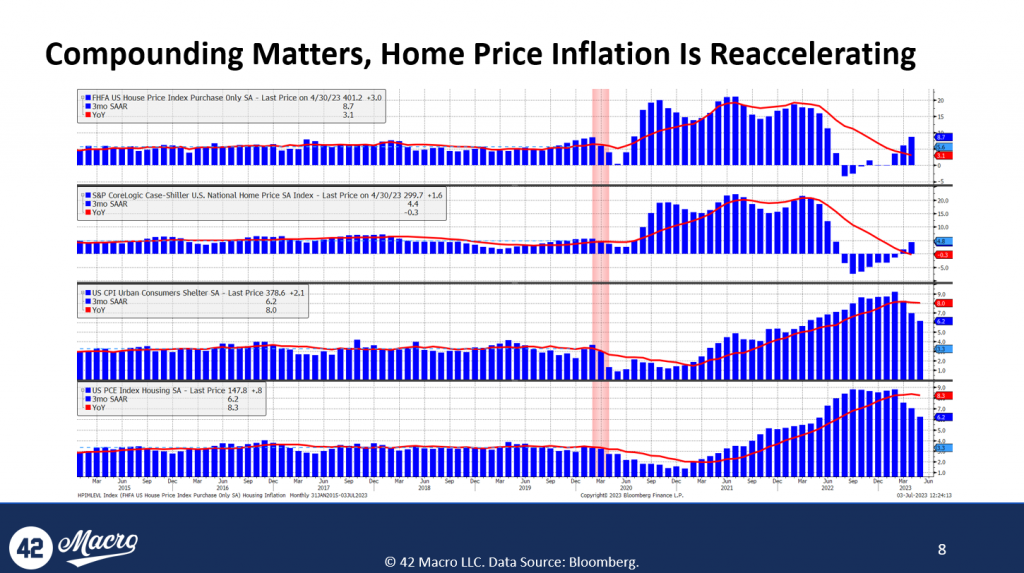

4. Home Prices Are Reaccelerating

According to the FHFA home prices index, home prices are increasing at a rate of 8.7% on a three-month annualized basis after bottoming in the first half of the year.

There is a rising probability we will see housing inflation bottoming out in the next two to three quarters, but at levels that contradict the Fed’s 2% inflation mandate.

The implications of this trend could be concerning, as the Fed might need to do significantly more to counteract the inflation impulse from the housing market.

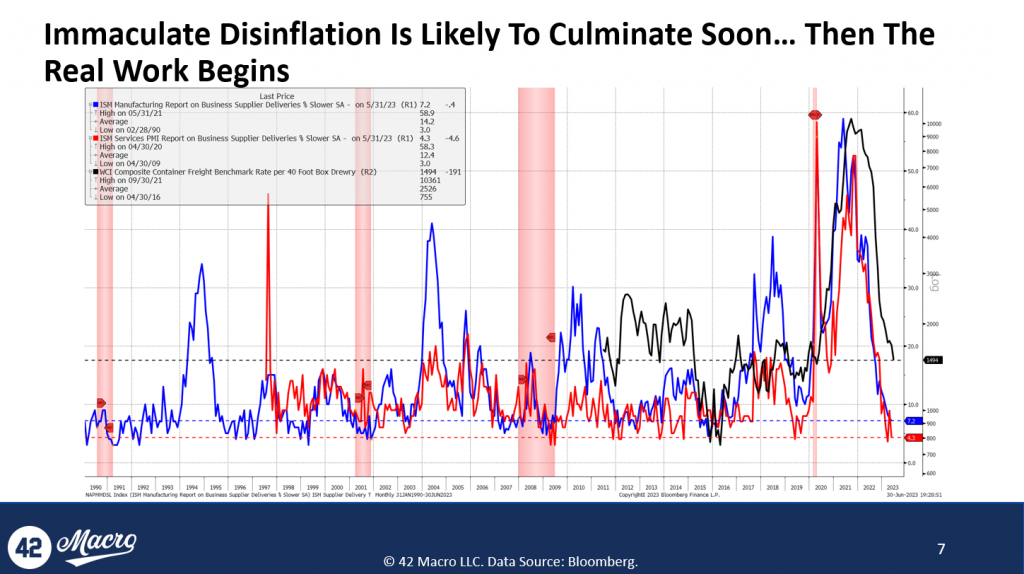

5. The Days of Immaculate Disinflation Are Over

Indices like ISM manufacturing, ISM services, and the supply delivery times index are back at levels consistent with 2% inflation, implying that the period of “immaculate disinflation” driven by pandemic-related factors is coming to an end.

We believe that the easy part of the inflation battle might be over soon.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights.

Is Wall Street Calling The Fed’s Bluff?

Earlier this week, Darius joined Anthony Pompliano to discuss Manufacturing, the U.S. Consumer, Bitcoin, and more.

Miss the discussion? No problem. Here are the three most important insights that can help your portfolio:

1) Healthy Balance Sheets And A Robust Labor Market Are Contributing to a Resilient U.S. Consumer

Since August of 2022, we have consistently maintained the view that the U.S. economy would remain robust, despite recession fears.

June’s retail sales reported a 4.6% increase on a three-month annualized basis and the highest print we have seen in four months – further proof of the resilience of the consumer we have consistently called for.

Additionally, a significant driver of the increase in retail sales, auto sales, accelerated by a striking 23% on a three-month annualized basis.

Two key contributors to this consumer resilience have been healthy consumer balance sheets and a strong labor market.

2) Leading Manufacturing Indicators Point to Near-Term Bottom in the Inventory Cycle

The ISM Manufacturing PMI, the most widely used leading indicator for the broader US manufacturing cycle, recently dropped to 46.0 in June – a new cycle low.

However, the spread between the ISM Manufacturing New Orders PMI and ISM Manufacturing Inventories, which is a leading indicator of the headline index, suggests a bounce in the ISM Manufacturing PMI in the coming months.

A recovery in the inventory cycle would add additional support to the soft landing narrative and incrementally contribute to the epic short squeeze in US equities that we have and continue to call for.

3) S&P 500 and Bitcoin Correlations:

As part of our 42 Macro research, we conduct a multi-factor correlation study, tracking the S&P 500 and Bitcoin in relation to various macro factors.

Recently, the primary driver of the S&P’s performance has been cyclical growth expectations.

Bitcoin, however, is being driven by structural growth expectations, but inversely, and is rallying on potential recession prospects, which would pressure the Fed and other central banks to provide the market with ample liquidity.

Although most investors bundle risk assets into one broader bucket, the reality is that there is often a divergence between what drives different asset markets.

We believe the Fed will begin providing liquidity to the market by the spring of next year, creating a positive environment for risk assets into and through the end of 2024.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Macro Outlook

Darius joined Benjamin Cowen from Into The Cryptoverse earlier this week to discuss Inflation, the Labor, Liquidity, and more.

If you missed the interview, we have you covered. Here are three key insights that are important for your portfolio:

1) Despite The Recent Dovish Print on Inflation, We Believe The Fed Will Hike At The July Meeting

The money markets are currently pricing in approximately an 80% probability that the Federal Reserve will hike at their next meeting.

Generally, the Fed tends to move in sync with asset markets, acting according to what the market has priced in.

However, the Fed’s decisions are not purely inflation-oriented; they take into account labor market conditions as well.

Given these indicators, we believe the Fed will likely push through with the rate hike come July’s meeting.

2) Labor Hoarding Is Contributing to The Resiliency of The U.S. Economy

While the US Total Labor Force SA is trailing behind the pre-pandemic 2009-2019 trend, we have seen the Gross Domestic Income regain the trend shortly after the pandemic concluded.

This disparity tells us that there is an abundance of money in the economy but an inadequate labor force to meet the demand for goods and services.

Additionally, since March 2020, we have experienced labor demand outpace supply, with a staggering 3.9 million more in demand compared to available labor.

This excess demand for labor is causing labor hoarding, further strengthening the resilience of the U.S. economy.

3) We Are In A Liquidity Cycle Upturn; The Global Liquidity Cycle Bottomed In Fall of Last Year

Our 42 Macro Global Liquidity proxy, a sum of global central bank balance sheets, global broad money supply, and global FX reserves minus gold, shows a declining trend in recent months.

However, we believe the liquidity cycle bottomed last fall, and we are currently in the midst of a likely 2.5-year upswing.

Although we may see some turbulence over the next few quarters, Bitcoin, in this environment, could perform exceptionally well, pushing it above the $100,000 level by the end of next year.

In between now and then, we still anticipate a recession will commence in the US economy in the next two to three quarters, likely causing risk assets to fall as the Phase 2 credit cycle downturn sets in – a scenario that we believe has not been priced into the market yet.

We continue to believe risk assets will squeeze higher and peak in Q4 or Q1 of next year.

#respectthexaxis

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!

Where Do We Go From Here?

Where Do We Go From Here?

Last week, Darius joined Erik Townsend from Macro Voices to discuss the Stock Market, Credit, Inflation, and more.

Here are the three biggest takeaways from the interview that are critical for managing risk:

1) The Stock Market Always Rallies Sharply Leading Up to Recessions

When we evaluate the S&P 500 performance a year before its peak preceding a recession, we usually see it in the green, up on a median basis by +16%.

This year’s rally is not abnormal.

Our expectation is that the coming recession could kick off by the end of this year or early next year.

Moreover, we evaluated the S&P 500’s behavior in and around recessions since 1948, and our research shows the index, on a median basis, typically experiences a drawdown of -24%.

What triggers these rallies are not just macro fundamentals but also how investors are positioned in relation to potential outcomes.

Right now, we believe the current positioning dynamics may push the market higher in the short term because investors remain underweight equities to an extreme degree.

Understanding these positioning cycles is essential for getting the investment game right.

2) We Believe That A Phase 2 Credit Cycle Downturn Is Still On The Horizon.

The Silicon Valley Bank crisis, despite its impact, does not suffice as the Phase 2 Credit Cycle Downturn that we expect to see.

We believe there was a substantial decline in credit and lending standards already evident in January’s senior loan officer survey report.

The crisis did trigger further degradation, but only marginally.

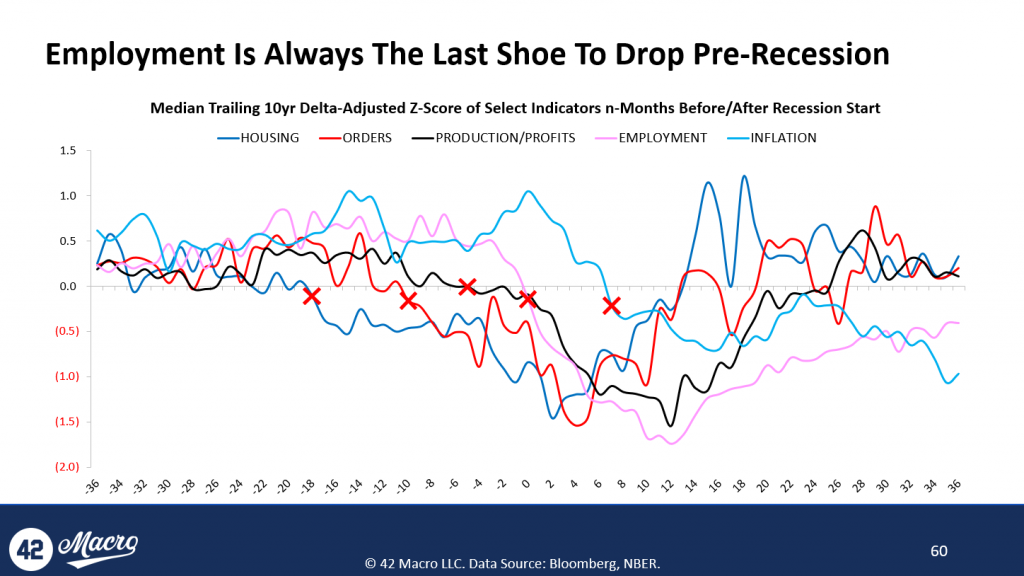

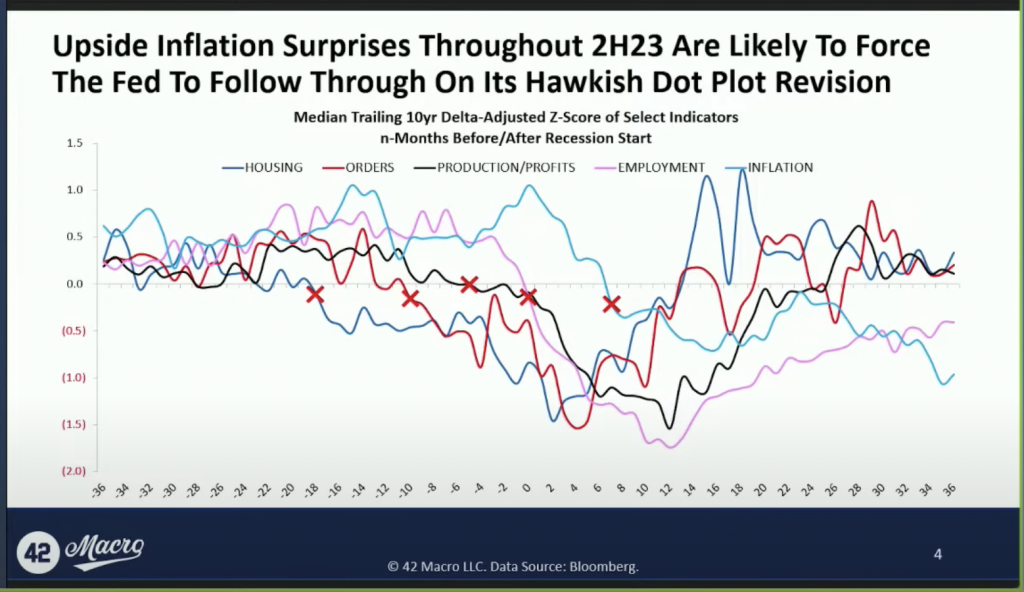

Additionally, we review five key cycles as part of our 42M research – housing, orders, production and profits, employment, and inflation.

The current data indicates a very regular business cycle, with housing, orders, and production and profits already breaking down.

Employment and inflation have yet to break down, and typically do not until the start of (employment) or well into (inflation) a recession, meaning we likely have not seen the start of the recession yet.

As such, the Phase 2 credit cycle downturn is yet to come and recommend incremental patience in terms of respecting the x-axis.

3) Immaculate Disinflation In The US Economy Is Likely To Conclude In 2H23

Over the past few months, we have seen substantial declines in measures of underlying inflation like median CPI, trimmed mean CPI, median PCE, trimmed mean PCE, super core CPI, and super core PCE.

This immaculate disinflation has contributed to the “transitory Goldilocks” theme we’ve observed in asset markets.

We refer to this inflation as ‘Immaculate’ because inflation normally breaks down 6 to 8 months after a recession; here it has meaningfully broken down beforehand.

For a variety of cyclical and structural reasons, we anticipate immaculate disinflation is nearing its end and that we will likely see inflation firm up in 2H23 – relative to expectations and potentially on an absolute basis as well.

We expect soft landing expectations to peak before the “immaculate disinflation” narrative is overtaken by our “resilient US economy = resilient US inflation” theme, contributing a blowoff top that leaves the stock market vulnerable to Phase 2.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Is It Time to Go Risk On?

Is It Time to Go Risk On?

Last week, Darius joined @maggielake from @realvision to discuss #Inflation, the U.S. Consumer, and more.

In case you missed it, here are three takeaways from the interview that are important for your portfolio:

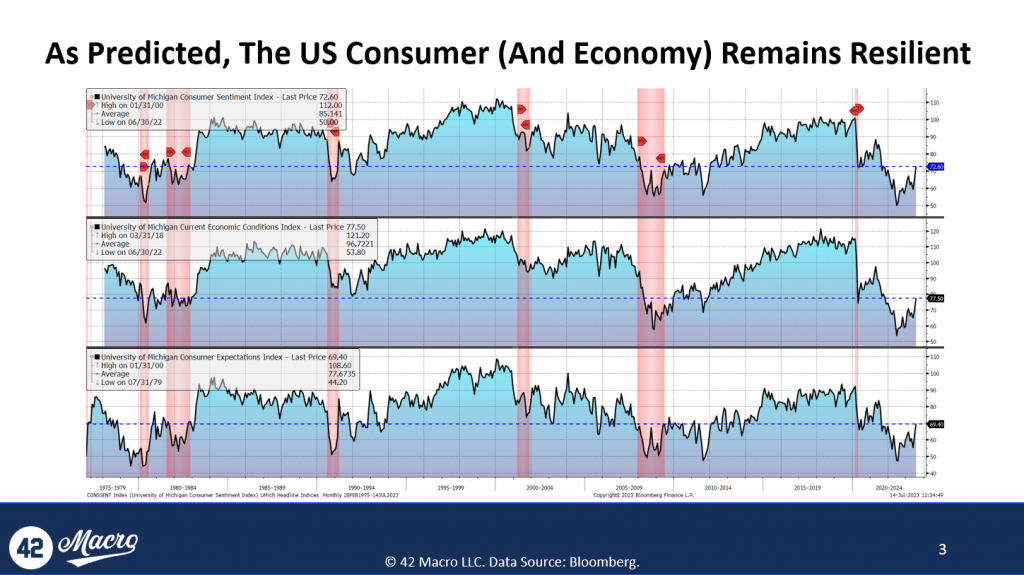

1) Consumer Confidence Is Increasing, And The Consumer Economy Is Resilient

With the University of Michigan Consumer Sentiment Index ticking up by a substantial 8.2 points to 72.6 this month, we are seeing the highest level of consumer confidence since September 2021.

This noteworthy monthly increase represents the most rapid rise since the winter of 2005.

The main contributor to this surge in confidence and the ongoing resilience of the consumer economy has been immaculate disinflation.

2) Immaculate Disinflation Has Caused Consumers to Believe Prices Will Continue to Decline Over The Next Year

The recent period of immaculate disinflation is leading consumers to anticipate a continued decrease in prices over the year ahead.

Despite a slight uptick in the UMich Expected Changes in Prices Index to 3.4, it is significantly down from the 5.5 level a year ago.

This deflationary anticipation is boosting consumers’ expectations of their financial situation, with the UMich Expected Change in Financial Situation in a Year data recording an eight percent month-over-month increase – the highest since July 2021.

Essentially, immaculate disinflation is bolstering consumer incomes, both real and expected.

3) The US Economy Has Been Resilient

This resilience can be attributed to a variety of factors, including:

- near record levels of cash in household and corporate balance sheets

- Limited private sector credit cycle vulnerabilities due to tepid credit growth prior to tightening and a low share of floating-rate debt

- minimal exposure to the volatile manufacturing sector

- labor hoarding, and

- the effects of Bidenomics

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

What’s Propping Up The US Consumer?

Last week, Darius joined Maggie Lake from Real Vision to discuss Rate Hikes, Inflation, the Stock Market, and more.

In case you missed it, here are five takeaways from the interview every investor needs to know:

1) The Market Believes The Fed Is Done Hiking. We Are Fading That View.

Currently, money markets are pricing in the assumption that future inflation data will force the Fed to pause at their July meeting.

Moreover, money markets are pricing in twice as much easing over the next two years by the Fed as they are the ECB (Fed: ~200 basis points; ECB: ~100 basis points)

We believe this is unlikely because 1) the European economy is already in recession, and 2) the European inflation cycle tends to lag the US by two quarters; as a result, they are heading into the most disinflationary part of their Inflation Cycle in 2H23.

While it may not occur in July due to a likely dovish June CPI release, we expect the Fed to continue to raise rates in the coming months.

Consequently, we foresee the dollar grinding higher over the medium term.

2) We Expect A Series of Upside Inflation Surprises Throughout 2023

Throughout the year, erroneous forecasts have caused investor consensus to roll forward the recession starting point; now, consensus estimates call for the recession to begin in Q3.

However, inflation tends to break down 6-8 months after the recession starts – it is the most lagging indicator of the US Business Cycle.

As a result, we believe we will not see any further significant disinflation after the June CPI release without a substantial drawdown in the labor market.

3) A Variety of Factors Are Propping Up The Consumer

We are seeing a wide range of conditions still propping up the US consumer:

- Unemployment is still low; the booming US labor market has allowed consumers to continue spending

- Cash on household and corporate balance sheets is high, currently at 3% of total assets. The last time that ratio was that high was in the 1960s

- Manufacturing as a % of GDP has declined substantially in recent decades. That is important because manufacturing tends to account for 98% of total job loss during recessions. Now only 18% of GDP, this more volatile sector of the economy is a much smaller percentage of total employment too at only 14%.

- Housing is resilient; despite the interest rate increases, outstanding mortgage rate debt is still at 3%. There is a standstill in existing home sales because consumers will not trade lower mortgage rates for the higher current rates – this has increased demand for new homes, thus holding up the housing market.

4) The Phase 2 Credit Cycle Downturn Is Ahead of Us

We believe the recession is still ahead of us.

Since the Great Depression, EVERY recession has had a market crash associated with it as we price in the downturn in the credit cycle.

In addition, on a median basis, markets tend to peak a month before the lowest point in the unemployment rate.

So, we typically see degradation in the labor market and a dip in the stock market simultaneously.

That means investors who share our longer-term (6-12mos) bearish outlook for the stock market must avoid expressing that view with actual trades until we are much closer to the start of recession. Since last fall, we have identified 4Q23 as the quarter with the highest probability of seeing a recession commence in the US economy. The second highest probability is 1Q24.

5) The Stock Market Is Likely Nearing A Local Top

This stock market rally has caught many investors off-guard; most fund managers are hastily rushing to minimize their YTD underperformance.

As a result, the rally can largely be explained by investors chasing the market higher, further squeezing Bears.

Despite the recent uptrend, we advise against chasing stocks now.

We expect a correction in the near term for a variety of fundamental (e.g., declining US and global liquidity) and technical (e.g., the passage of a large, call-heavy OPEX should reverse flows) reasons.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Macro Indicators and Tactics for Uncertain Times

1) The US Economy Remains on a Path to a Recession

At the beginning of the year, most investors expected a first-half recession followed by a recovery in the second half.

Since last summer, our view has consistently been that the U.S. economy had more endurance than what was perceived by most investors.

This belief led us to forecast a later start to the recession, in late-2023, contrary to the general market consensus.

Our view was, and still is, that a recession would likely kick off in Q4 of this year or Q1 of next year.

2) Inflation Will Not Reach 2% Without a Recession

U.S. inflation, a lagging business cycle indicator, usually breaks down during and through a recession.

Our data suggests that it’s improbable we will see evidence of sustainable 2% inflation before a recession hits: our models currently forecast inflation stabilizing at around 3-5%, not the Fed’s 2% target.

This could lead to two potential outcomes: either the Fed acknowledges more action is needed, or the bond market panics over the lack of progress.

Either way, we believe it will result in the Fed applying more pressure, pushing the economy into recession.

3) Europe’s Economic Contraction Will Likely Worsen

The European economy has recently confirmed its recession, primarily due to the effects of monetary tightening.

Despite the assumptions that fiscal stimulus would resolve the situation, Europe’s economy is in decline, with retail sales tracking down 2% to 4% across Europe.

Given the current data, we predict the recession in Europe is likely to worsen over the medium term.

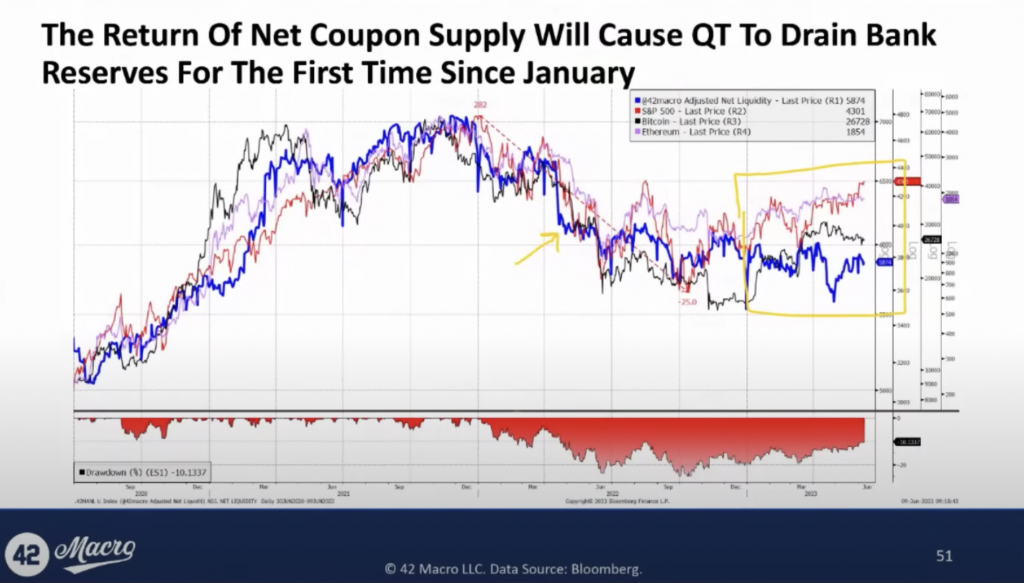

4) Upcoming Quantitative Tightening Will Negatively Impact Asset Markets

The return of net coupon supply will instigate QT, causing it to deplete bank reserves for the first time since January.

Our Adjusted Net Liquidity model, which subtracts the Treasury General Account (TGA) balance and Reverse Repo Facility (RRP) balance, as well as emergency lending from the Fed’s balance sheet, shows a breakdown in the correlation between US public sector liquidity and asset markets at the beginning of the year when QT ceased draining bank reserves.

Up until now, QT has truly been going on in the background.

We believe this correlation will resume in the coming months and negatively affect risk assets.

5) The Stock Market Is Likely To Peak During Q4 (or Early In Q1 At The Latest)

Our study of past recessions shows that the stock market, on a median basis, typically peaks a month before the trough in the unemployment rate.

Historically, the stock market usually rises sharply in the year leading up to the end of a business cycle, with a median return of around +16%.

Equity markets are generally strong preceding a recession.

We maintain the view that the stock market will likely peak in Q4 (or early in Q1 at the latest) and many of today’s too-early bears will fail to profit from the pending Phase 2 Credit Cycle downturn.

At that point, we will be positioning for the next anticipated down leg in the market.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Global Liquidity Decoded

1. China and Japan are Important to the Global Liquidity Cycle:

China and Japan are key contributors to the global liquidity cycle.

Regarding their contributions to the global central bank balance sheet, global narrow money supply, and global FX reserves minus gold – the three metrics that we feature in the @42Macro Global Liquidity Proxy – China makes up ~20%, while Japan makes up ~15%. Understanding their liquidity cycles is vital in forecasting inflections in global liquidity.

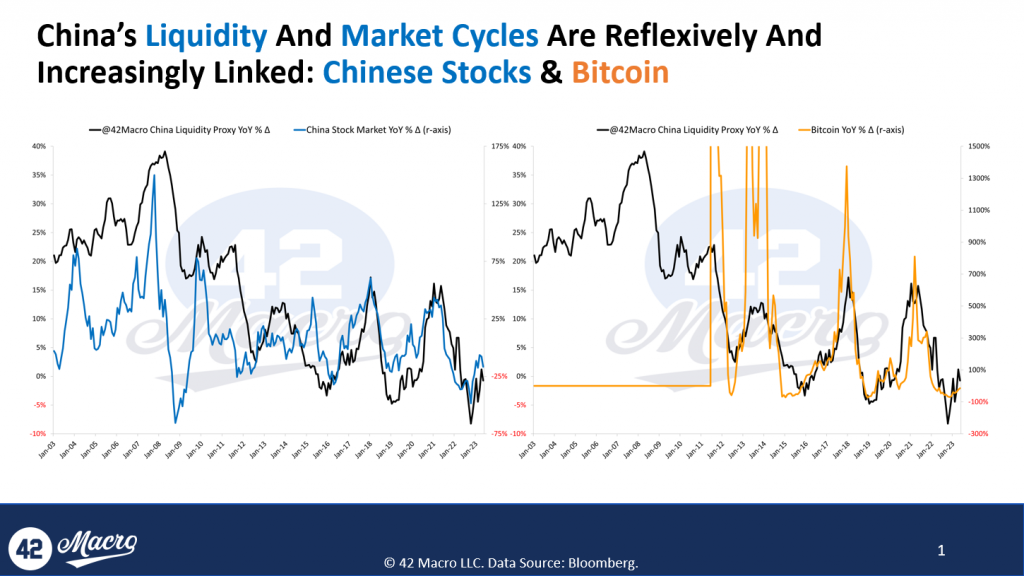

2. The Chinese Liquidity Cycle Has a Big Impact on Asset Markets:

There’s a direct link between China’s liquidity and the global markets, including Bitcoin. Any significant shift in China’s liquidity, positive or negative, can considerably affect asset markets.

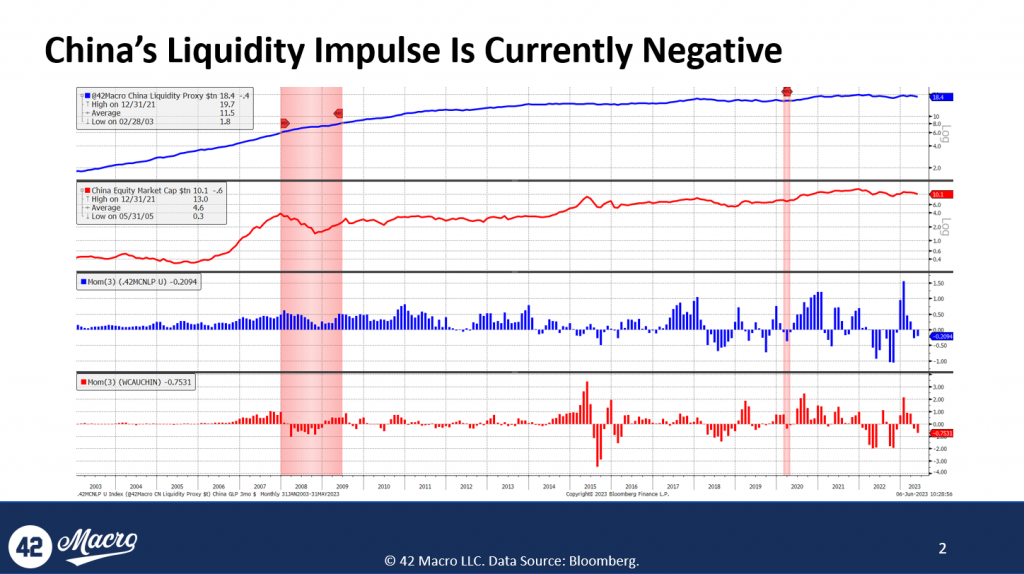

Our research shows that the Chinese economy shifted from adding approximately $1.5 trillion of liquidity in Q1 of this year to removing liquidity in the past few months. The pullback in Chinese liquidity coincides with #Bitcoin failing to continue its rally. We believe we will see another injection of liquidity into the Chinese economy; we just don’t believe it will happen in the short term.

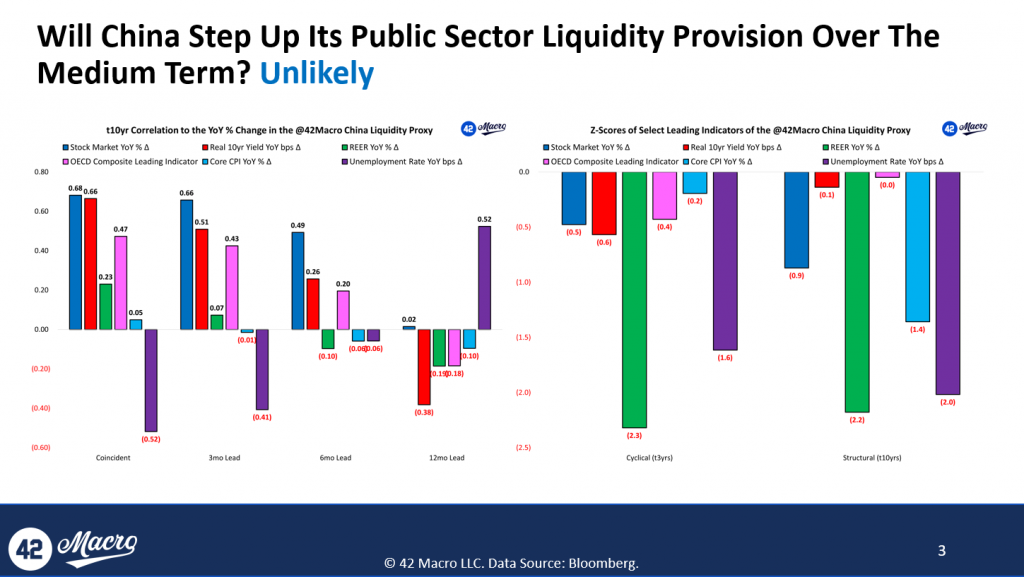

3. Waning Public Sector Liquidity Provision in China:

The Chinese stock market is viewed as a reliable leading indicator of the country’s liquidity cycle because locals often have intelligence regarding future actions of the People’s Bank of China (PBOC).

We believe the recent decline in the Chinese stock market likely signals a decrease in China’s contributions to global liquidity over the medium term (because the market doesn’t anticipate a wave of liquidity from the PBOC).

4. Japan’s Liquidity Cycle Influences Bitcoin Too:

Like China, Japan’s liquidity cycle strongly correlates with Bitcoin and other risk assets.

Our research shows that in October of last year, the Japanese economy was removing $1.5 trillion from global liquidity on a three-month impulse basis.

In Q1 of this year, they shifted to add $2 trillion.

Because inflation is still very high in Japan, we do not foresee a liquidity injection from the BOJ in the near term.

5. It’s Not Just Enough to Monitor Global Liquidity; You Must Forecast It As Well:

The timeline for changes in liquidity inputs to manifest in outputs (values or liquidity changes) varies by the economy.

When an economy is at the bottom of its growth cycle (e.g., unemployment rising on a YoY basis, etc.), lead times are usually shorter because central banks will react with a sense of urgency to support their economies.

Conversely, factors like stock market performance and real interest rates in China may not trigger a similar sense of urgency by the PBOC and/or Chinese commercial banks.

Overall, the objective is to understand these dynamics to forecast the global liquidity impulse, which is currently negative. We believe this negative impulse is the reason Bitcoin hasn’t fully recovered its YTD high.

That’s a wrap!

If you found this thread helpful:

- Go to https://42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!