What Does REFLATION Mean For Your Portfolio?

Darius joined Adam Taggart on Thoughtful Money this week to discuss the current REFLATION Market Regime, the resiliency of the US economy, the US consumer, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Investors Should Position In Line With The Current REFLATION Regime

Our 42 Macro Risk Management Process simplifies complex market dynamics into a straightforward three-step approach:

- Position for the Market Regime

- Prepare for regime change using quantitative signals with our Macro Weather Model

- Prepare for regime change using qualitative signals via our fundamental research

Currently, we are in a REFLATION Market Regime. In this environment, investors should consider the following key portfolio construction considerations:

- Risk Assets > Defensive Assets

- High Beta > Low Beta

- Cyclicals > Defensives

- Growth > Value

- Small & Mid Caps > Large Caps

- International > US

- EM > DM

- Spread Products > Treasurys

- Short Rates > Belly > Long Rates

- High Yield > Investment Grade

- Industrial Commodities > Energy Commodities > Agricultural Commodities

- FX > Gold > USD

To consistently stay on the right side of market risk, investors should position in accordance with the prevailing Market Regime.

2. The Resilient US Economy Does Not Require Rate Cuts, But The Fed Wants To Cut Rates Anyway

According to the March 2024 Fed Dot Plot, the Fed is guiding to three rate cuts in 2024, three in 2025, and three in 2026.

At the same time, the US Economy continues to prove resilient across various metrics, including income, consumption, and the labor market.

While we maintain the view that the resilience of the US economy does not justify rate cuts, the Fed’s inclination towards cutting rates has served as a positive driver for asset markets.

3. The US Consumer is Resilient Because of The West Village-Montauk Effect

The essence of the “West Village-Montauk Effect” can be summarized as follows: With a substantial stock of savings, there is less pressure to save a significant portion of your disposable income.

We are witnessing this effect in relation to the US consumer. Since the close of 2019, both households and corporations have experienced a boost in wealth:

- Household cash reserves have surged by 135%.

- Corporate cash reserves have increased by 51%.

- Household and corporate net worth have soared by approximately 34%, outpacing inflation.

This notable growth primarily occurred due to government spending during 2020 and 2021, which included COVID-related tax breaks, forgivable PPP loans, and extensions of jobless claims. A considerable portion of this expenditure entered private sector balance sheets. Simultaneously, as household and corporate net worth expanded, the monthly flow of US Personal Savings turned negative, demonstrating the eagerness of US consumers to spend a higher share of their disposable income due to the elevated stock of savings.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

What Does “Sticky Inflation” Mean For Your Portfolio?

Darius joined Anthony Pompliano this week to discuss inflation, the “No landing” vs. “Soft landing” debate, the Fed, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. The “No Landing” Scenario Is The Highest Probability Outcome Over The Next 12 Months.

The “Soft landing” vs. “Hard landing” vs. “No landing” debate continues. We define a “Soft landing” as a period of trend or below-trend GDP growth, facilitating a gradual return of inflation to trend over time. Conversely, a “Hard landing” signifies a period of GDP growth significantly below trend, which triggers a contraction in the labor market and ultimately leads to a recession. In contrast, a “No landing” scenario entails GDP growth at or above trend, enabling inflation to decelerate but not return to its 2% target.

Our analysis indicates that a “No landing” scenario is the most probable outcome over the next 12 months.

We employ two distinct models to forecast inflation. While the median forecast from these models suggests incremental disinflation in the upcoming quarters, by the fourth quarter, we anticipate bottoming at a level higher than the Fed’s 2% target. This scenario is likely to inflict pain on asset markets once policymakers react to this new reality.

2. Regarding Inflation, 3% Is Likely To Become The New 2%

In our recent deep dive into our secular inflation model, we found a noteworthy key takeaway: we anticipate that 3% will become the new inflation benchmark, replacing the previous benchmark of 2%.

We believe the Fed will acquiesce to 3% being the new 2%. This shift in perspective seems to be gaining traction, as evidenced by Chair Powell stressing inflation would return to its target “over time” during the March FOMC meeting.

While this transition will not unfold in a linear manner, we foresee that over the next few years, the Fed will embrace 3% inflation as the preferred target over 2% if getting inflation sustainably down to 2% will require a recession. This likely policy regime shift is structurally bullish for risk assets and structurally bearish for Treasury bonds.

3. A Variety Of Factors Have Contributed To The Recent Uptick In Inflation

We analyze several key metrics from the Cleveland Fed: the Median CPI, Trimmed Mean CPI, Median PCE Deflator, and Median Trimmed Mean PCE Deflator. Here is a breakdown of the latest figures:

- The Median CPI stands at 5% on a 3-month annualized basis, approximately double its pre-COVID trend.

- The Trimmed Mean CPI stands at 4.4% on a 3-month annualized basis, more than double its pre-COVID trend.

- The Median PCE Deflator sits at 4.1% on a 3-month annualized basis, approximately double its pre-COVID trend.

- The Trimmed Mean PCE Deflator, also on a 3-month annualized basis, stands at 3.7%, more than double its pre-COVID trend.

The surge in these inflation metrics is suggestive of a broad-based acceleration and a preview of what we are likely to witness towards the end of the year as inflation struggles to bottom at a level consistent with the Fed’s 2% target.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

What Will Push Powell to Cut?

Darius joined Maggie Lake on Real Vision’s Daily Briefing this week to discuss the resiliency of the US economy, Immaculate Disinflation, Bitcoin, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. The US Economy Remains Resilient

In September 2022, we authored our “Resilient US Economy” theme, and the prevailing data today continues to support this narrative.

Furthermore, our research indicates that the Fed is likely to implement easing monetary policies over the medium term. This confluence of factors—a robust economy operating at or above trend coupled with supportive monetary measures—has fostered a bullish environment for asset markets.

We believe asset markets are likely to continue performing well until either our “Resilient US Economy” theme dissipates or the “Immaculate Disinflation” theme concludes, forcing the Fed and Treasury to officially pivot to hawkish forward guidance and net financing policy.

2. Recent Labor Market Data Indicates Evidence of Sticky Inflation

The Feb JOLTS report confirmed that “Immaculate Slackening” persists, but investors should be worried by the apparent bottoming in turnover:

- The Private Sector Hires Rate ticked up from its cycle low to 4.1%

- The Private Sector Quits rate remained unchanged at 2.4%

An increase in employee turnover could disrupt the “Immaculate Disinflation” narrative. Because workers who change jobs tend to have faster wage growth, the bottoming in these indicators suggests that we may be running out of steam concerning the disinflation we have observed in wages.

Despite the February JOLTS report supporting sticky inflation, we continue to believe the “Immaculate Disinflation” theme is likely to persist for another quarter or two.

3. Bitcoin’s Current Correction May Worsen If The “Immaculate Disinflation” Narrative Dissipates

After rallying 75% from Feb 1st to March 10th, Bitcoin is currently in a consolidation period.

We anticipated this pullback. Over the past month, we have highlighted several extended tactical positioning indicators in our positioning model to our clients, such as the AAII Bulls Bears Spread and AAII survey, that suggested markets were likely overbought.

If the “Immaculate Disinflation” narrative loses steam, the current correction could deepen. If that occurs, investors would need to pull forward their timeline expectations of a transition from a risk-on REFLATION Market Regime to a risk-off INFLATION Market Regime.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

How Will The Election Year Impact Asset Markets?

Darius joined Victor Jones this week to discuss the impact of the PBOC’s policies, inflation, the election year, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Policies Coming Out Of The PBOC Have Had A Meaningful Impact On Asset Markets This Year

Since December of last year, we have called for Beijing to implement front-loaded policy support as we entered 2024.

That is what we have witnessed, and that front-loaded policy support has had two significant impacts on global financial markets:

- It has contributed to the uptrend in global liquidity, as evidenced by our 42 Macro Global Liquidity Proxy, an estimate for global liquidity calculated by summing the Global Central Bank Balance Sheet, Global Broad Money Supply, and Global Foreign Exchange Reserves ex-Gold.

- It has supported a rebound in Chinese PMI, suggesting the narrative around the Chinese economy being a black hole is changing at the margins.

2. The “Immaculate Disinflation” Theme Is Likely to Persist For Another Quarter Or Two

Over the past two months, we have seen Headline PCE, Core PCE, and Sepercore PCE Deflator accelerate to well above trend rates on a three-month annualized basis.

However, investors do not need to be highly concerned about those increases at the current juncture because:

- Productivity growth remains above trend.

- Leading indicators such as the “Prices” and “Supply Chain” components of PMIs continue to indicate a likely deceleration in inflation.

- The “Shelter” component of inflation has not meaningfully decelerated despite ample housing price disinflation in the pipeline.

We believe the “Immaculate Disinflation” theme may persist for another quarter or two before inflation bottoms at an unpalatable level relative to the Fed’s mandate. At that point, we believe the narrative around inflation is likely to change, and asset markets are likely to be impacted.

3. Fiscal Policy Is Likely To Continue Supporting Asset Markets Heading Into The Election

One reason we have been bullish on risk assets is that we believed President Biden and Treasury Secretary Yellen would implement favorable fiscal and net financing policies this year, supporting our “Resilient US Economy” theme and US liquidity.

We believe the election remains a risk-on catalyst for now. However, asset markets are likely to face headwinds after the election.

Sometime in Q4, we anticipate the RRP balance to have declined to at or near zero and the TGA balance to have decreased by $250B from current levels. Those estimates represent dangerous starting points ahead of another round of debt ceiling negotiations on the horizon is poised to induce volatility in asset markets.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

The Fed Pivots From Soft Landing To No Landing… And Got Incrementally Dovish

Darius joined Maggie Lake on Real Vision’s Daily Briefing this week to discuss the implications of the recent FOMC meeting, fiscal policy, AI, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. The Federal Reserve Still Anticipates Three Rate Cuts in 2024

In this week’s meeting, the FOMC released its March Summary of Economic Projections.

In their projections, the FOMC:

- Increased the 2024 Real GDP forecast by 70 basis points to 2.1%, 2025 by 20 basis points to 2.0%, and 2026 by 10 basis points to 2.0%

- Lowered 2024 and 2026 Unemployment Rate projections to 4%

- Increased 2025 Headline PCE Inflation by 10 basis points to 2.2%

- Increased 2024 Core PCE Inflation by 20 basis points to 2.6%

- Retained three projected Fed Funds Rate cuts in 2024

- Increase 2025 and 2026 Fed Funds rate projections by one hike each to 3.9% and 3.1%, respectively

Since the summer of 2022, we have maintained our ‘Resilient US Economy’ theme and its potential to contribute to inflation settling at a level unpalatable to the Fed. Based on their revised projections, the Fed now agrees with our no-landing call.

2. The Fiscal Impulse Remains Decidedly Positive

The YoY growth rate of the Fiscal YTD US Treasury Federal Budget Net Receipts remains positive at 7%.

However, that lags the year-over-year growth rate of the Fiscal YTD US Treasury Federal Budget Net Outlays, which is currently 9%. This dynamic is further underscored by the 15% year-over-year increase in the Fiscal YTD US Treasury Federal Budget Balance, translating to an expansion in the budget deficit.

This incremental fiscal impulse we continue to see from the Biden Administration signifies an intentional effort to secure victory in the upcoming election.

3. The AI Theme May Be Overpriced for The Current Pace of Development And Deployment

While our overall outlook for the AI sector remains bullish, we anticipate gains to be increasingly experienced by other sectors, as we expect the market performance to continue broadening out as it has done over the past four to six weeks.

Furthermore, at 42 Macro, we closely monitor various metrics, including the combined S&P500 Tech & Communication Services Mean Price to Trailing Twelve Months (TTM) Earnings and Sales Ratios, along with the Combined Market Cap to S&P500 Market Cap ratio. Although the combined S&P500 Tech & Communication Services Mean Price to TTM Earnings ratio falls below the levels seen during the tech bubble in 2000, the Mean Price to TTM Sales and Market Cap as a % of the S&P 500 ratios exceed or match those observed during that period.

While these ratios may exceed these levels, we expect equity market performance to continue broadening out as investors acknowledge the high probability of the no-landing scenario.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

A Glimpse Into Bitcoin

Darius joined Dylan LeClair last week to discuss the outlook for Bitcoin, how it fits into the 42 Macro KISS Portfolio Construction Process, ETF flows, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Understanding The Correlation Between Bitcoin’s Price And Volatility Is Crucial to Grasping The Dynamics of The Asset Class

Our research at 42 Macro indicates that although equities and fixed income are generally inversely correlated to volatility, Bitcoin tends to be positively correlated to its historical and implied volatility.

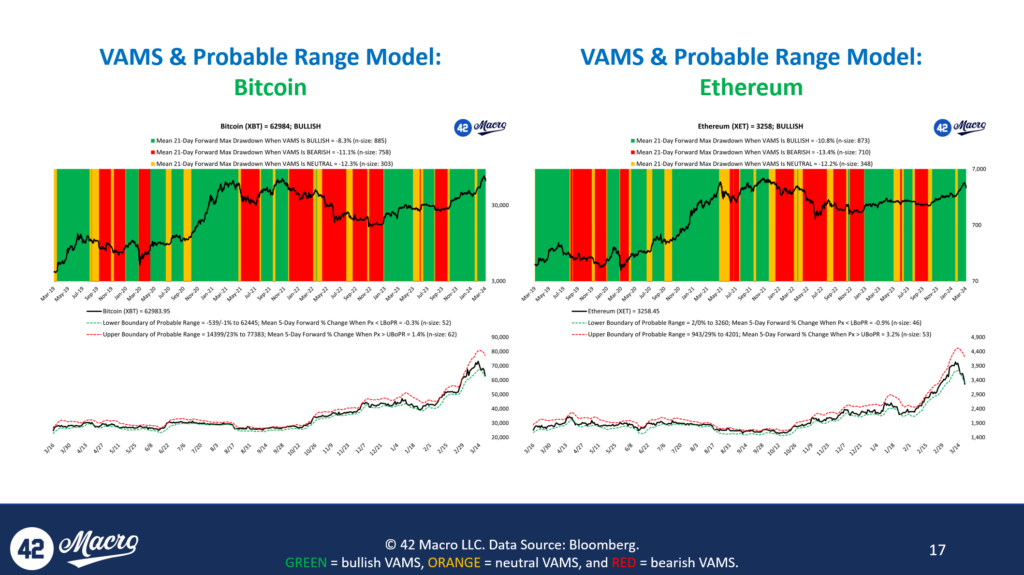

Moreover, our 42 Macro Volatility Adjusted Momentum Signal (VAMS) scores volatility relative to price to determine whether an asset is bullish, bearish, or neutral.

Following our VAMS signals has allowed our clients to be on the right side of market risk and remain long during Bitcoin’s large upswings this year. Investors who plan to add Bitcoin to their traditional multi-asset portfolio would be well advised to understand the correlation between Bitcoin’s price and volatility to ensure they are positioned for its large, volatile moves. At 42 Macro, we can help you do exactly that.

2. Investors Can Prudently Gain Exposure to Bitcoin Through The KISS Portfolio Construction Process

Our KISS Portfolio Construction Process, a 60/30/10 trend-following approach, helps clients gain exposure to Bitcoin from legacy strategies such as the traditional 60/40 portfolio.

The current allocation of our KISS Portfolio, determined using our Global Macro Risk Matrix and VAMS for dynamic position sizing, is 10% in Bitcoin, 60% in SPY, 15% in AGG, and 15% in USFR.

Although we have a positive outlook on Bitcoin’s future performance, mere belief is not sufficient to allow us to take a position. Our decision-making process relies on signals derived from the current market regime and signals from our VAMS. At 42 Macro, we help investors make money and protect gains in financial markets, and it is through strategies like KISS that we have empowered our clients to achieve these objectives.

3. The 2024 Bitcoin ETF Inflows Have Far Exceeded Expectations

The immediate success of the Bitcoin ETF out of the gate has been remarkable.

IBIT has been the most successful ETF launch in history, gaining an impressive $15 billion in AUM in the first two months.

However, Dylan informed our audience that the current demand for Bitcoin has primarily originated from Blackrock, Fidelity, and other institutional investors. Additionally, ETF issuers have indicated that the current buyers of BTC ETFs do not represent some of the largest pools of capital; those significant investors have yet to enter the market. As a result, we anticipate a fresh surge of capital inflows into the asset class in the coming quarters, which is poised to drive prices even higher.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

Bitcoin, Stocks All-Time Highs: Remain Bullish?

Darius joined Anthony Pompliano last week to discuss the outlook for inflation, global liquidity, asset markets, and more.

If you missed the interview, here are the three most important takeaways from the conversation that has significant implications for your portfolio:

1. The February CPI Report Showed Signs of Sticky Inflation

The February CPI report did incremental damage to the immaculate disinflation narrative.

Headline CPI accelerated to 3.9% on a three-month annualized basis, more than double its pre-covid trend. The spike was largely driven by an acceleration in Energy CPI to 4.5% on a three-month annualized basis.

Moreover, Core CPI accelerated to 4.1% on a three-month annualized basis. The increase was largely driven by Services CPI, which remained at 6.0% on a three-month annualized basis, and Super Core CPI, which accelerated to 6.7% on a three-month annualized basis, more than triple its pre-Covid trend.

2. The February NFIB Small Business Optimism Survey Supported The Soft Landing Scenario

The February NFIB Small Business Optimism survey, a monthly survey that provides insights into the confidence levels and outlook of small business owners, indicates that inflation may continue declining over the medium term.

The sub-indices of the survey, including the Higher Prices, Price Plans Next Three Months, Compensation, and Compensation Plans indices, all slowed sequentially and are at multi-year lows.

These readings suggest that although we see signs of sticky inflation in the CPI and PCE Deflator reports, stickiness is likely to be transitory and that inflation will resume its downtrend over the medium term.

3. Global Liquidity Is Likely to Continue Trending Higher Over The Next One to Two Quarters

The monetary policies implemented by the PBOC this year have been very positive for global liquidity. Additionally, China recently revealed ambitious economic targets for 2024, aiming for a 5% GDP growth, the creation of over 12 million jobs, and a 3% inflation rate. To meet these aggressive economic targets, the PBOC will likely continue easing policy, and that is likely to continue supporting global liquidity.

Moreover, several key countercyclical drivers of global liquidity have supported liquidity creation in the private sector.

The dollar, bond market volatility, and currency market volatility have all trended in directions that support private sector liquidity creation, and we believe these trends are likely to continue over the next quarter or two.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

China’s Role In The Global GOLDILOCKS Market Regime

Darius joined Nicole Petallides on Schwab Network last week to discuss the outlook for asset markets, China, inflation, and more.

If you missed the interview, here is the most important takeaway from the conversation that has significant implications for your portfolio:

Although There Is An Elevated Risk of A Short-Term Correction, We Are Unlikely to Exit The Risk-On Market Regime Until Mid-year, At The Earliest

- China has been a positive contributor to the current GOLDILOCKS Market Regime. In mid-December, we authored a view that China would front-load policy support at the beginning of this year. That is what we have witnessed, as the PBOC has been actively implementing monetary policies to support the economy. Moreover, China has revealed ambitious economic targets for 2024, aiming for a 5% GDP growth, the creation of over 12 million jobs, and a 3% inflation rate. To meet these targets, the PBOC will likely continue easing policy, and that is likely to continue supporting global liquidity.

- We remain in the GOLDILOCKS Market Regime that we have been in since November, and we see further upside potential ahead to at least mid-year. That said, a short-term correction would be healthy and would allow the market to extend its bullish momentum further into the year.

- Looking further out, we believe inflation is likely to rise in the second half of the year. As a result, we believe the Fed is unlikely to achieve the three rate cuts this year currently projected in the Fed’s Dot Plot, and any rate cuts the Fed implements will likely come in June and July and are likely to be the only ones. This rise in inflation, if it does occur, is likely to prompt both the Fed and asset markets to readopt the “higher for longer” narrative, putting an end to the current GOLDILOCKS Market Regime.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

Will Rate Cuts Come in 2024?

Darius sat down with Maggie Lake on Real Vision’s Daily Briefing this week to discuss asset markets, productivity growth, Immaculate Disinflation, and more.

If you missed the interview, here are three takeaways from the conversation that have significant implications for your portfolio:

1. A Tug-of-War Has Emerged Between The No-Landing And Soft-Landing Scenarios

Asset markets have pivoted to a soft-landing as consensus since late October, driven by positive surprises in growth, global liquidity, and productivity, as well as favorable treasury net issuance policy.

At the current juncture, the probability of a soft-landing scenario is in the process of peaking, and the no-landing scenario is gaining share.

The no-landing scenario is not yet the modal outcome, however. The February ISM Services Report provided insight into various metrics, including the Headline ISM Services PMI, Prices, New Orders, Employment, Number of Industries Reporting Growth, and Supplier Delivery Times. Collectively, these metrics supported the soft-landing scenario at the expense of the no-landing scenario.

2. Above-Trend Productivity Growth Will Likely Be Sustained For The Next Few Quarters

The recent surge in AI, coupled with decreased employee turnover rates and the thawing of global supply chains between the manufacturing and services sectors, has collectively fueled above-trend productivity growth.

We anticipate that this momentum in productivity is likely to be sustained over the medium term.

This is important for investors because higher productivity puts less pressure on corporate margins, reducing the need for corporations to shed costs and/or pass on price increases to consumers.

3. Immaculate Disinflation Is Likely to Dissipate In The Second Half of This Year

Immaculate Disinflation persists.

Despite the two hot inflation prints from last month’s CPI and PCE Deflator reports, the Fed recognizes that a single month’s data does not establish a trend. They prefer to see sustained patterns over multiple months before considering a policy shift.

That said, we believe that the “Immaculate Disinflation” narrative is likely to come to an end in the second half of this year.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!

Is Bitcoin Going to $250k?

Darius sat down with Anthony Pompliano last week to discuss the outlook for Bitcoin, global liquidity, reducing portfolio risk, and more.

If you missed the interview, here are three takeaways from the conversation that have significant implications for your portfolio:

1. Our Models Indicate Bitcoin Is Likely to Remain Bullish Until At Least Mid-Year

The 42 Macro Weather Model is currently generating a bullish outlook for Stocks, Bonds, and Bitcoin over the next three months. These bullish signals suggest each asset class is likely to experience above-median returns over the next three months relative to baseline.

Given these favorable conditions, now is an excellent time to take risks in the markets – a stance we have advocated to our audience since November.

2. China Has Been A Dominant Driver of Global Liquidity This Year

In mid-December, we authored a view that China would front-load policy support at the beginning of this year.

That is what we have witnessed, as the PBOC has been actively implementing monetary policies to support the economy. Its balance sheet is expanding, claims on banks are rising, and it is reducing various policy rates while committing to providing additional lending to specific sectors of the economy.

However, we believe the positive global liquidity impulse is likely to dissipate in the second half of the year. To stay on the right side of market risk, investors must identify these shifts in global liquidity in real time and position their portfolios accordingly. Our Macro Weather Model and Global Macro Risk Matrix are among the best available tools for that.

3. Bitcoin Is Best Managed In The Context of A Traditional Multi-Asset Portfolio With Risk Management Overlays

Bitcoin ETFs have seen record-breaking volumes since their launch in January. As of the market close on February 28th, ETFs reached a volume of $7.6 billion, surpassing previous records.

However, investors in ETFs lack the risk management overlays offered by our 42 Macro KISS Portfolio Construction Process. As a result, many may find themselves max-long Bitcoin during significant drawdowns. Bitcoin has experienced four drawdowns of -75% or more and another two in excess of -50%. That is six times investors could have lost half-to-four-fifths of their money in the asset class.

In contrast, our KISS portfolio, a 60/30/10 trend-following portfolio comprising SPY, AGG, and FBTC, has delivered an average annual return of +13% since 2018, with a maximum drawdown of -11%. Without our risk management overlays, investors would have seen similar returns in a 60/30/10 SPY/AGG/Bitcoin portfolio with a maximum drawdown of -26% and three crashes in excess of -20% since the start of 2019.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!