Conditions Are In Place For Market Crash In 2025

Darius recently joined David Lin to discuss the impact of tariffs, the outlook for inflation, the role of gold in our KISS Portfolio Construction Process, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. How Are Tariffs Likely To Impact Asset Markets In 2025?

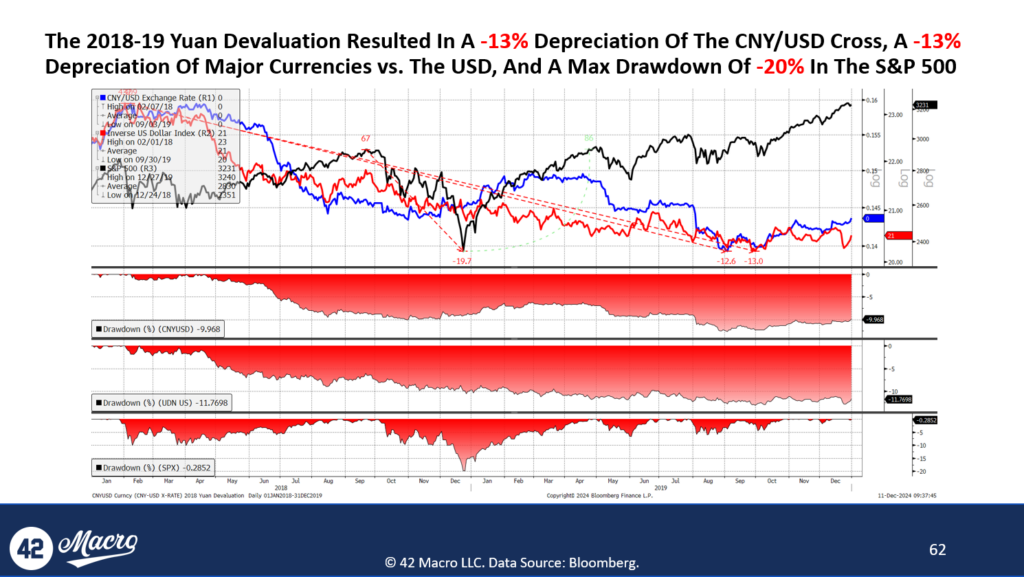

We believe China is likely to respond to tariffs by significantly devaluing the yuan, which carries profound implications for global asset markets. Historically, when China devalues the yuan, other major economies follow suit with sympathy devaluations to maintain competitiveness. During the 2018-2019 trade war, this dynamic led to broad-based declines in the euro, Japanese yen, British pound, and Swiss franc—on top of the yuan’s depreciation—resulting in a materially stronger U.S. dollar.

If a similar pattern emerges in 2025, we could see a sharp appreciation of the U.S. dollar in the second half of the year, potentially reinforced by a less hawkish Federal Reserve. This would likely lead to higher interest rates, rising bond market volatility, elevated currency market volatility, and a stronger U.S. dollar – all of which are headwinds for global liquidity.

Given the historic scale of global refinancing needs in 2025, we believe any liquidity contraction is likely to trigger a severe market correction – and potentially even a full-scale crash.

2. What Is The Outlook For Inflation?

According to our GRID Model projections for Headline CPI and the econometric study of all the postwar economic cycles in and around recession we conducted, we believe US inflation is unlikely to return durably to trend in the absence of a recession, which implies the highest probability outcome is inflation firming over the medium term against easing base effects.

Leading indicators of inflation also support our hawkish NTM inflation outlook. Core PPI, a reliable leading indicator for inflation in this business cycle, began breaking down approximately 18 months before Core CPI and Core PCE. Core PPI bottomed in December 2023 and has been trending higher since.

Moreover, Core CPI and Core PCE deflator appear to be stabilizing at an above-trend level. These metrics may accelerate in 2025 before resuming the longer-term downtrend, and the key risk is that consensus expects inflation to keep falling, and a rebound in inflation—however modest—could force markets to price out additional Fed rate cuts for 2025 and 2026.

3. Why Did We Replace Core Fixed-Income Exposure with Gold in Our KISS Portfolio?

We incorporate gold into the portfolio to enhance diversification by reducing overall beta and introducing non-correlated asset classes, which helps mitigate drawdowns and volatility while also providing exposure to Fourth Turning monetary policy dynamics. Gold serves as a low-beta asset, with a trailing six-month beta of approximately 0.3 to the S&P 500.

Moreover, the addition of gold to KISS reflects our understanding that if our Investing During A Fourth Turning Regime analysis proves true over the long term and the Fed is forced to accelerate financial repression and monetary debasement, it is highly unlikely that bonds will outperform other assets on a real, risk-adjusted basis.

We expect monetary debasement and financial repression to be tools that the Fed employs to address the challenges of excessive sovereign debt and a robust economy that leaves little incentive for buyers of government bonds, and we believe gold will prove to be a far better hedge against accelerated monetary debasement and financial repression than bonds.

Since our bullish pivot in November 2023, the QQQs have surged 44% and Bitcoin is up +201%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

What Are The Key Risks To Asset Markets In 2025?

Darius recently joined Maggie Lake to break down the key risks to asset markets in 2025, the outlook for inflation, investor positioning insights from the 42 Macro Positioning Model, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Are The Key Risks To Asset Markets In 2025?

We believe 2025 will be a year in which the distribution of probable economic outcomes is both wide and widening. This is largely driven by an anticipated series of significant changes to fiscal and regulatory policy.

Specifically, factors such as tariffs, securing the border, and a hawkish shift in Treasury net financing (i.e., less bills + more coupons) are likely to contribute negative supply shocks to the economy and asset markets. At the same time, tax cuts, deregulation, and accelerated energy production could generate positive supply-side shocks.

Investors should closely monitor the size, sequence, and scope of these policy changes, as they will have a significant impact on asset markets throughout 2025. If enough of the left-tail risk economic scenarios materialize, we believe it is likely to lead to a crash in risk assets.

2. What Is The Outlook For Inflation?

At 42 Macro, we conducted an econometric study of all the postwar economic cycles in and around recession. That process consisted of normalizing the policy, profits, liquidity, growth, stocks, employment, credit, and inflation cycles, and comparing current trends to historical patterns late in the business cycle, leading into, and through a recession.

In that study, we found that inflation is the most lagging indicator of the business cycle, as it usually breaks down below trend 12 to 15 months after a recession starts.

According to our GRID Model projections for Headline CPI and the deep dive study referenced above, US inflation is unlikely to return durably to trend in the absence of a recession, which implies the highest probability outcome is inflation firming over the medium term against easing base effects. Per our GRID Model, late-Q2/early-Q3 is when inflation is likely to accelerate appreciably enough to cause serious problems in asset markets.

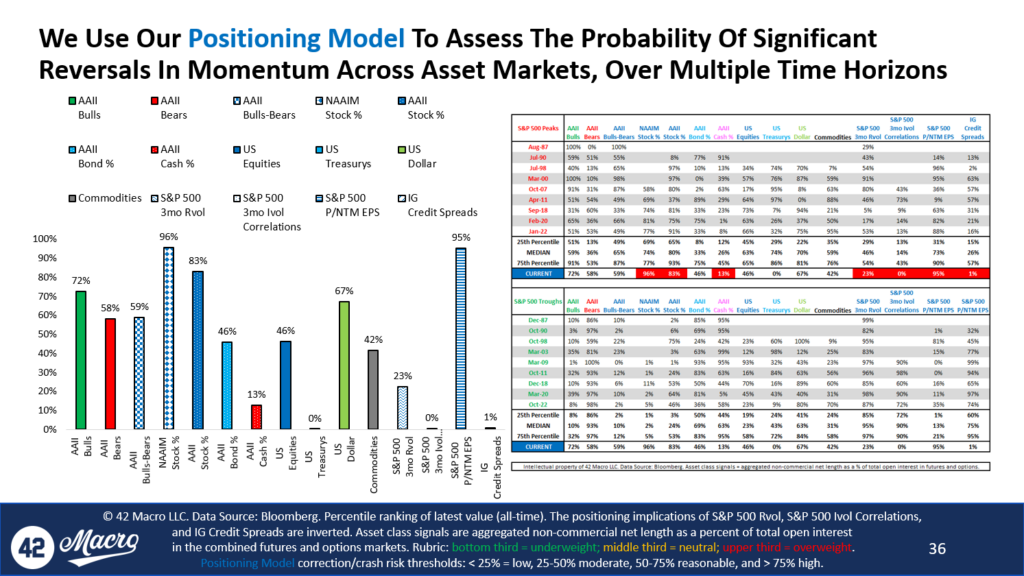

3. What Does The 42 Macro Positioning Model Reveal About Current Risks To Asset Markets?

Our 42 Macro Positioning Model analyzes 15 long-term time series, comparing their current levels to the median values observed at major bull market peaks and troughs.

Currently, many of the time series we track are breaching levels that have consistently been observed at major bull market peaks:

- AAII stock allocation exceeds the median value observed at major bull market peaks in the nine market cycles since Jan-98.

- AAII bond allocation is nearing the low level typically observed at major bull market peaks.

- AAII cash allocation is below the median value observed at major bull market peaks.

- S&P 500 realized volatility—an inverse proxy for systematic fund exposure—is nearing the level seen at prior bull market peaks.

- S&P 500 implied volatility correlations—an inverse proxy for market-neutral hedge fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 price/NTM EPS ratio sits in the 92nd percentile of all historical data, dating back to the late 1980s, and is well above the median value observed at major bull market peaks.

- Investment-grade credit spreads are in the 2nd percentile of all historical data, also dating back to the late 1980s, and are well below the median value observed at major bull market peaks.

These metrics collectively signal a positioning cycle that is highly asymmetric, with participants who are bullish and are heavily betting on positive outcomes across growth, inflation, policy, and liquidity.

As previously stated, if enough of the left-tail risk economic scenarios materialize in succession, combined with the extreme bullish condition we currently observe in the positioning cycle, we believe it is likely to lead to a crash in risk assets.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +185%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Bitcoin And Stocks Are In For A Wild 2025

Darius recently joined Anthony Pompliano to discuss the outlook for global liquidity, the influence of the U.S. dollar on global liquidity, the potential economic impact of Trump administration immigration policies, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Is The Outlook For Global Liquidity?

At 42 Macro, we track global liquidity using our Global Liquidity Proxy, which aggregates global central bank balance sheets, global broad money supply, and global FX reserves (excluding gold). We then add a global bond market volatility overlay to simulate the impact of the expansion and contraction of the global repo market.

Our models currently indicate that liquidity is currently moderating—not just globally, but also within most major economies.

We also track the leading indicators of global liquidity, such as stock and crypto market capitalizations, the U.S. dollar and currency volatility, global interest rates and bond market volatility, as well as global growth, inflation, and unemployment.

Our analysis of these leading indicators currently suggests a modest decline in global liquidity over the medium term. Combined with the current downtrend in liquidity across most major economies, this signals an environment that is unfavorable for asset markets from a global liquidity perspective. Rising US liquidity may offset that early in 2025.

2. What Role Will The US Dollar Play In Driving Global Liquidity?

Our research at 42 Macro includes comparing the year-over-year rate of change in our Global Liquidity Proxy to that of the USD Real Effective Exchange Rate and the CVIX. Our analysis indicates there is an inverse correlation between the dollar and global liquidity, as well as between currency volatility and global liquidity.

Currently, the strong U.S. dollar and rising currency volatility are exerting downward pressure on global liquidity. Looking ahead, potential policies under the new administration, such as tariffs and pro-growth, reflationary initiatives, could prompt the Federal Reserve to adopt a less-dovish monetary policy outlook relative to current market pricing, which may further strengthen the dollar.

If these scenarios unfold and we see sustained dollar strength and higher currency volatility, it would create an additional headwind for global liquidity, compounding the pressures already signaled by our leading indicators.

3. How Would Trump Administration Policies On Immigration Likely Impact the Economy?

We have recently highlighted in our research that one positive outcome of open borders and the influx of illegal immigrants has been a significant deceleration in wage growth.

Specifically, the Private Sector Employment Cost Index peaked at around 6% in 2022 and has since slowed to approximately 3%. This decline also drove a sharp deceleration in Unit Labor Cost Inflation, from roughly 6% in late 2021/early 2022 to approximately 1% today.

Reducing the influx of illegal immigrants, even modestly, would likely lead to a tighter labor market, faster wage growth, and higher unit labor cost inflation. Without a corresponding increase in productivity growth, corporate profit growth would likely slow as a result.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +176%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it’s time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Here’s Why 2025 Will Be A Tricky Year For Investors

Darius recently joined Cheryl Casone on Fox Business to discuss the current risk-on Market Regime, the medium-term drivers of asset markets, the impact of upcoming fiscal and regulatory policy changes, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

- We are currently in a risk-on Market Regime, and we anticipate that risk-on condition may generally persist for the next ~three months due in large part to a likely $700-800bn decline in the Treasury General Account (TGA). In risk-on Market Regimes, investors are typically rewarded for taking on high-beta, cyclical exposures, such as consumer discretionary, technology, financials, and industrials.

- As we move further into 2025, the key issue for asset markets is likely to be the significant changes coming from fiscal and regulatory policies. Some of these initiatives should be positive for asset markets, including tax cuts, much more M&A, and DOGE, while others, such as tariffs, a too-strong USD, and stagflation lowering the strike price of the “Fed put,” may have negative implications. For investors, the challenge is to understand the size, sequence, and scope of these policy changes. Ultimately, navigating the sequence of policy changes effectively will determine whether you make or lose money as an investor over the medium term.

- Earlier this month, Fed Chairman Jerome Powell’s press conference marked the end of the Fed’s asymmetrically dovish reaction function, which they had effectively maintained from November 2023 through December 18, 2024. This reaction function supported the buoyant asset market performance throughout the year that we have persistently called for. However, the Fed’s approach to monetary policy moving forward will likely be more balanced, with a nuanced view of labor market and inflation risks. This shift places the responsibility back to us as investors to accurately forecast where the labor market and inflation are headed, as these will ultimately determine policy decisions.

Since our bullish pivot in November 2023, the QQQs have surged 43% and Bitcoin is up +169%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Why Crypto Is An Important Asset Class For Millennials

Darius recently joined Charles Payne on Fox Business to discuss the impact of last week’s FOMC decision and Chair Powell’s press conference, the outlook for liquidity, how to invest successfully during this Fourth Turning, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

- While the Fed’s reaction function remains dovish, we believe it is likely no longer asymmetric. With the Fed now adopting a more balanced assessment of risks, the responsibility shifts back to us as investors to accurately forecast where the labor market and inflation are headed, as these will ultimately determine policy decisions.

- The outlook for US liquidity remains positive. As long as the Democrats do not extend or eliminate the debt ceiling during Biden’s administration – and it appears they will not – the Treasury General Account balance is likely to be spent down to zero within the first four to five months of 2025. This development would be bullish for asset markets.

- The current Fourth Turning is defined by factors such as excessive fiscal policy, monetary debasement, and financial repression. This macroeconomic backdrop is structurally bullish for stocks, credit, cryptocurrencies, and commodities. It is structurally bearish for Treasury bonds and the U.S. dollar. We believe the crypto asset class holds significant importance for Millennials because they recognize that the current system is not working in their favor, and investing in crypto is a “calculated gamble” on an alternative future in which the gap between the haves and have-nots is much narrower.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +167%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

What Must Be Done To Prevent DOGE From Failing?

Darius recently sat down with FFTT Founder and President Luke Gromen to discuss how marketable U.S. treasury market dynamics have shifted over recent years, the likelihood of a meaningful reduction in the federal budget deficit in this Fourth Turning, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. How Have Changes In Ownership Structure Contributed To Price And Yield Dynamics In The Treasury Market?

At 42 Macro, one of the ways we analyze the marketable U.S. Treasury market is by segmenting it into various investor cohorts:

- The Federal Reserve: The Fed’s share has been declining due to balance sheet runoff, peaking at 25% in late 2021 and now at only 15% of total marketable Treasury securities.

- Commercial Banks: Banks’ market share decreased from early 2022 until late 2023, when it began to stabilize. This stabilization was driven by programs like the Bank Term Funding Program (BTFP) and expectations that the Federal Reserve would dramatically lower interest rates. Currently, their share is around 15%, well south of the peak of 33% in 2003.

- Foreign Central Banks: The decline in global trade and the steady shift away from global dollar recycling led by the BRICS member nations caused foreign central banks’ share to steadily decline to 14% from a peak of 40% during the 2008 global financial crisis.

- Global Private Non-Bank Sector (Investors): This cohort has become the largest holder of marketable U.S. Treasury securities, with its share increasing from 36% in late 2021 to 55% today.

This shift in ownership has structurally altered the Treasury market. Unlike banks—such as the Fed, foreign central banks, and commercial banks which purchase Treasurys to satisfy policy or regulatory mandates (e.g., Dodd Frank, Basel III and IV)—global investors demand ex ante returns to compensate for taking risk in their portfolios.

As a result of this seismic shift, upward pressure on yields has intensified, signaling a more acute phase in the evolution of Treasury market dynamics and expectations.

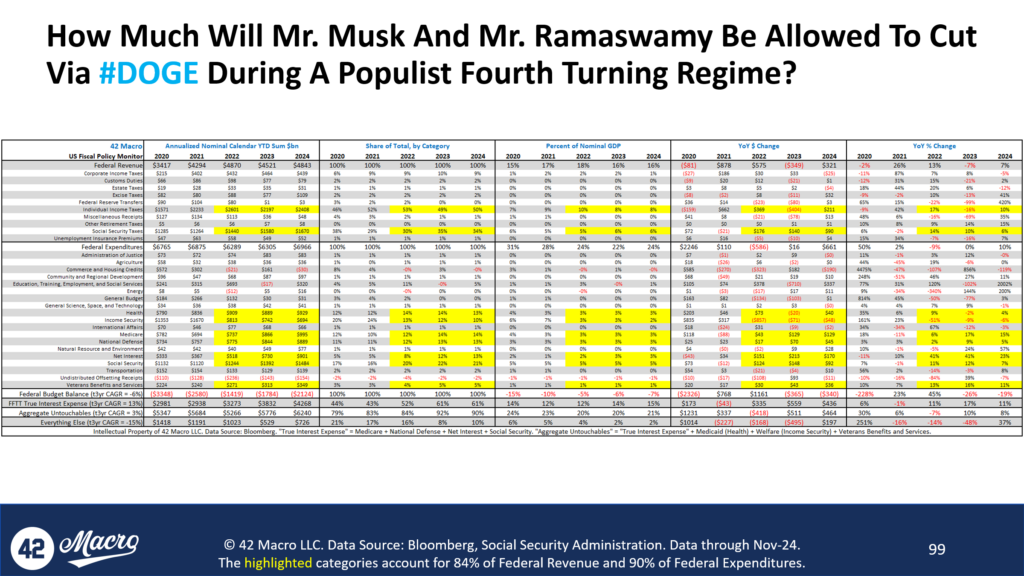

2. How Likely Is Significant Reduction In The Federal Budget Deficit During This Fourth Turning?

Our analysis of U.S. federal budget dynamics highlights significant challenges to achieving meaningful deficit reduction.

First, U.S. federal expenditures currently represent roughly a quarter of U.S. GDP—the highest share since at least 1970 excluding COVID and the GFC. Thus, significant cuts would likely catalyze a downturn in the economy—however beneficial a smaller government would be in the long run, which is something both Darius and Luke agree with. Per Luke, the last three recessions saw the U.S. federal budget deficit widen by 600bps, 800bps, and 1,200bps.

Secondly, our research indicates that approximately 90% of the budget is effectively untouchable. This “Aggregated Untouchables” category includes “True Interest Expense”—comprising Medicare, National Defense, Net Interest, and Social Security—along with Medicaid, Welfare, and Veterans’ Benefits. Collectively, these expenditures represent programs unlikely to face cuts under the current pro-populist political climate and are compounding at a rate of +3% per year (+13% per year in the “True Interest Expense” category). The remaining 10% of the budget, which largely includes discretionary spending, amounts to just over $700 billion and has already been shrinking at a compound rate of -15% per year over the past three years.

Lastly, demographic trends are exacerbating the fiscal burden. By 2025, 160,000 people will join the retirement-age population each month, compared to just 32,000 entering the working-age population.

Given these dynamics, meaningful deficit reduction appears improbable without tackling politically protected categories. This leads us to believe that meaningful austerity is an unlikely path forward in the context of this current Fourth Turning environment—especially without a significant devaluation of the US dollar preceding it.

Since our bullish pivot in November 2023, the QQQs have surged 42% and Bitcoin is up +190%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Why Tariffs Are Much Worse For Investors Than You Likely Realize

Darius recently sat down with Bleakley Financial Group CIO Peter Boockvar to discuss the impact of the Trump administration’s proposed tariffs, insights from the 42 Macro Positioning Model, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. What Are The Second And Third Order Effects Of Tariffs And How Might They Cause Problems For Asset Markets?

According to data from the Committee for a Responsible Federal Budget, the Trump administration’s proposed tariffs are expected to generate nearly $3 trillion in revenue to help offset the ~$4+ trillion cost of permanently extending the Tax Cuts and Jobs Act (TCJA).

We believe the market is underestimating both the likelihood and scale of these tariffs given that the Congressional budget reconciliation process – specifically the Byrd Rule – will require pay fors to offset the lost revenue from tax cuts. An equally important but often overlooked factor is the potential for retaliation, particularly from China.

Historical examples, such as the Trump-era trade war, illustrate how heightened tariffs can lead to significant devaluations of the Chinese yuan. If this pattern repeats, it is likely to trigger competitive devaluations among other major currencies, resulting in an excessively strong U.S. dollar. In our view, such dollar strength is likely to suppress global capital formation and weigh heavily on U.S. corporate earnings, ultimately creating a significant headwind for asset markets.

2. What Insights Does The 42 Macro Positioning Model Provide About The Current State of Asset Markets?

Our 42 Macro Positioning Model analyzes a 15 long-term time series, comparing their current levels to the median values observed at major bull market peaks and troughs. Currently, the model indicates several red flags for positioning and sentiment:

- AAII stock allocation exceeds the median value observed at major bull market peaks in the seven market cycles since Jan-98.

- AAII cash allocation is also below the median value observed at major bull market beaks.

- S&P 500 realized volatility—an inverse proxy for systematic fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 implied volatility correlations—an inverse proxy for market-neutral hedge fund exposure—is below the median value seen at prior bull market peaks.

- S&P 500 price/NTM EPS ratio sits in the 95th percentile of all historical data, dating back to the late 1980s, and is well above the median value observed at major bull market peaks.

- Investment-grade credit spreads are in the first percentile of all historical data, also dating back to the late 1980s, and are well below the median value observed at major bull market peaks.

From a positioning perspective, although these metrics do not necessarily serve as immediate catalysts for reversing the bullish momentum of risk assets, they represent significant potential energy once bearish catalysts emerge. When momentum does reverse, we believe positioning is asymmetric enough to unwind in an aggressive-enough manner to cause a stock market crash.

Since our bullish pivot in November 2023, the QQQs have surged 48% and Bitcoin is up +203%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

What Are the Biggest Risks To Investors As This Fourth Turning Evolves?

Darius recently sat down with Michael Gayed from Lead-Lag Report to discuss how the 42 Macro Investment Process differs from other approaches, inflation, the likelihood of a meaningful federal budget deficit reduction under President Trump, and much more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. How Does The 42 Macro Investment Process Differ From Other Traditional Approaches?

At 42 Macro, we take a fundamentally different approach to investment research and risk management.

While many investors rely on predictions, reacting only after those predictions are invalidated by subsequent macro or micro data, we utilize a Bayesian inference process that focuses on nowcasting evolving market conditions to inform our and our clients’ asset allocation and portfolio construction decision-making.

By embracing this Bayesian inference process, we deliver actionable insights that drive better outcomes for our clients. We believe that success in today’s market requires constant observation, adaptability, and the discipline to question assumptions. That is what we do at 42 Macro, and it is why thousands of investors worldwide achieve better investment outcomes with our proven risk management overlays (KISS and Dr. Mo).

2. Will The Fed Achieve Its Inflation Mandate Anytime Soon?

In short, no. We conducted a deep-dive empirical analysis of the business cycle, examining the median path of various indicators relative to recessions.

Our research indicates inflation is the most lagging indicator of the business cycle, historically breaking down durably below trend only four to five quarters after a recession begins.

Based on our deep understanding of how the business cycle works, we do not see a high probability of recession in the medium term. That implies inflation is unlikely to decline significantly from here and may even accelerate in the coming quarters.

3. How Likely Is Significant Federal Budget Deficit Reduction Under President Trump?

Our research indicates that key government spending areas—Medicare, National Defense, Net Interest, and Social Security—comprise 61% of total federal expenditures.

When including additional categories like Medicaid, Welfare, and Veterans’ Benefits—programs unlikely to face cuts under the current political climate—90% of the federal budget becomes effectively untouchable.

The remaining spending accounts for only approximately 10% of federal expenditures. Even if cut entirely, the deficit would still be -4% of GDP, making a balanced budget highly improbable without addressing politically untouchable categories. As a result, we believe a meaningful deficit reduction is unlikely under President Donald Trump – or any president for that matter in a Fourth Turning.

Since our bullish pivot in November 2023, the QQQs have surged 43%, and Bitcoin is up +176%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

What Are The Hidden Dangers Looming Over Asset Markets?

Darius recently sat down with Anthony Pompliano to discuss the risks of a stronger US dollar, a potential global refinancing air pocket, and more.

If you missed the interview, here are the two most important takeaways from the conversation that have significant implications for your portfolio:

1. How Can A Stronger US Dollar Cause Problems For Asset Markets?

Our research indicates one significant implication of a strong US dollar is that it pressures foreign investors to repatriate dollar-denominated assets to service the 70% of global debt and 60% of cross-border lending that rely on the US dollar.

The events of 2022 provide a clear example of the potential consequences in such an environment. During a major US dollar rally from January to September of that year, the dollar appreciated by 18%, leading to a reduction in liquidity and severe declines across asset classes, as Gold fell 10%, US equities dropped 25%, US Treasury bonds declined 31%, and Bitcoin plummeted approximately 58%.

Moreover, tariff policies introduced by the Trump Administration, along with potential changes in the Treasury’s net financing policy, may accelerate dollar strength. Coupled with ongoing US economic exceptionalism—driven by tax cuts and deregulation—these factors could push the dollar even higher, increasing the pressure on markets and global financial stability.

If the Federal Reserve’s policy options are constrained by a resilient economy or persistent inflation, it may struggle to prevent the dollar from trending higher, creating significant challenges for asset markets.

2. Is A Global Refinancing Air Pocket On The Horizon?

At 42 Macro, we conducted a deep-dive empirical study on the global refinancing cycle and found it is, in fact, a key leading indicator of global liquidity.

By tracking the year-over-year growth rate of world total non-financial sector debt, lagged by four and a half years to align with typical refinancing timelines, we observe a strong correlation with fluctuations in global liquidity growth. Currently, the lagged growth rate of global non-financial sector debt is accelerating sharply, and our models project this trend to continue through late 2025.

While conventional wisdom suggests this is likely to catalyze an increase in global liquidity, the risk remains that liquidity may fail to expand meaningfully, thus creating a global refinancing air pocket, similar to the divergences observed in 2008-2009, 2011, 2015-2016, 2018-2019, and 2022. If global liquidity fails to follow the path of the year-over-year growth rate of world total non-financial sector debt, we believe it is likely to lead to severe disruptions—or even a meltdown—in global financial markets, negatively impacting asset markets along the way.

Since our bullish pivot in November 2023, the QQQs have surged 44% and Bitcoin is up +184%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it is time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass.

No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.

Decoding The Macro Puzzle

Darius recently joined Sebastian Purcell on Real Vision to discuss how to utilize key economic cycles to anticipate Market Regime shifts, our “Resilient US Economy” theme, global liquidity, and much more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. What Role Do Economic Cycles Play in Navigating Market Regimes?

At 42 Macro, we analyze six key economic cycles—growth, inflation, policy, corporate profits, liquidity, and positioning—to assess the sustainability of the current Market Regime and anticipate future shifts.

These cycles do not directly dictate our clients’ portfolio positioning, but they do provide context for how our core risk management signals – KISS and Dr. Mo – might evolve in the future.

By analyzing where we stand within each cycle, investors can assess the durability of the current Market Regime and prepare for potential changes across various time horizons.

2. How Does The US Economy’s Shrinking Reliance On The Manufacturing Sector Contribute To Our “Resilient US Economy” Theme?

One key pillar of our 28-month-old “Resilient US Economy” theme is the US economy’s limited reliance on the manufacturing sector, which has historically been the most cyclical part of the economy.

Manufacturing’s share of nominal GDP has declined from 28% in the 1950s to just 10% today. Furthermore, its share of total nonfarm payrolls has dropped from 44% in the 1940s to 14%.

Unlike manufacturing, the services sector—driven by population growth and migration—rarely contracts, providing stability and cushioning the economy from the sharp downturns often seen in manufacturing-led recessions.

The manufacturing sector has accounted for a median 98% of net job losses during postwar US recessions. Thus, limited exposure to the more-cyclical manufacturing sector equals limited risk of an economic downturn. It is not clear to us why so many investors failed to anticipate this obvious upside risk in the data.

3. What Is The Outlook For Global Liquidity?

At 42 Macro, we track global liquidity using our Global Liquidity Proxy, which aggregates global central bank balance sheets, global broad money supply, and global FX reserves (excluding gold). We then add a global bond market volatility overlay to simulate the impact of the expansion and contraction of the global repo market.

Our research also indicates there are leading indicators of global liquidity, such as equity and crypto market caps, US dollar, FX volatility, interest rates, fixed income volatility, and global growth, inflation, and employment.

Currently, our model analyzing those indicators indicates a modest increase in global liquidity over the medium term, suggesting the supportive backdrop for asset markets is likely to persist into early 2025.

Since our bullish pivot in November 2023, the QQQs have surged 43% and Bitcoin is up +175%.

If you have fallen victim to bear porn and missed part—or all—of this rally, it’s time to explore how our KISS Portfolio Construction Process or Discretionary Risk Management Overlay aka “Dr. Mo” will keep your portfolio on the right side of market risk going forward.

Thousands of investors around the world confidently make smarter investment decisions using our clear, accurate, and affordable signals—and as a result, they make more money.

If you are ready to learn more about how our clients incorporate macro into their investment process and how you can do the same, we invite you to watch our complimentary 3-part macro masterclass. No catch, just high-quality insights to help you grow your portfolio—our way of saying thanks for being part of our global #Team42 community of thoughtful investors.