Darius joined Dylan LeClair last week to discuss the outlook for Bitcoin, how it fits into the 42 Macro KISS Model Portfolio, ETF flows, and more.

If you missed the interview, here are the three most important takeaways from the conversation that have significant implications for your portfolio:

1. Understanding The Correlation Between Bitcoin’s Price And Volatility Is Crucial to Grasping The Dynamics of The Asset Class

Our research at 42 Macro indicates that although equities and fixed income are generally inversely correlated to volatility, Bitcoin tends to be positively correlated to its historical and implied volatility.

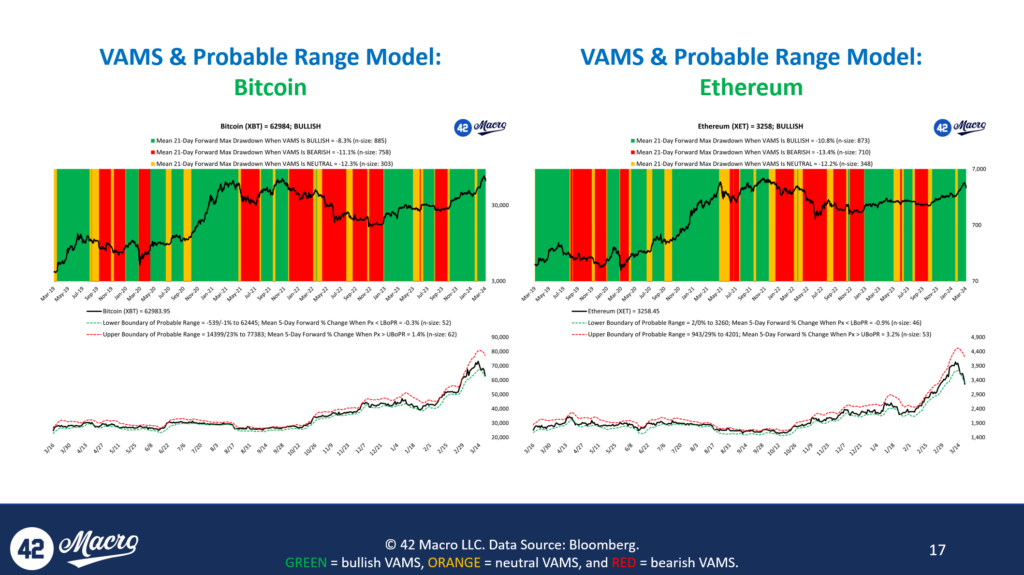

Moreover, our 42 Macro Volatility Adjusted Momentum Signal (VAMS) scores volatility relative to price to determine whether an asset is bullish, bearish, or neutral.

Following our VAMS signals has allowed our clients to be on the right side of market risk and remain long during Bitcoin’s large upswings this year. Investors who plan to add Bitcoin to their traditional multi-asset portfolio would be well advised to understand the correlation between Bitcoin’s price and volatility to ensure they are positioned for its large, volatile moves. At 42 Macro, we can help you do exactly that.

2. Investors Can Prudently Gain Exposure to Bitcoin Through The KISS Model Portfolio

Our KISS Model Portfolio, a 60/30/10 trend-following approach, helps clients gain exposure to Bitcoin from legacy strategies such as the traditional 60/40 portfolio.

The current allocation of our KISS Model Portfolio, determined using our Global Macro Risk Matrix and VAMS for dynamic position sizing, is 10% in Bitcoin, 60% in SPY, 15% in AGG, and 15% in USFR.

Although we have a positive outlook on Bitcoin’s future performance, mere belief is not sufficient to allow us to take a position. Our decision-making process relies on signals derived from the current market regime and signals from our VAMS. At 42 Macro, we help investors make money and protect gains in financial markets, and it is through strategies like KISS that we have empowered our clients to achieve these objectives.

3. The 2024 Bitcoin ETF Inflows Have Far Exceeded Expectations

The immediate success of the Bitcoin ETF out of the gate has been remarkable.

IBIT has been the most successful ETF launch in history, gaining an impressive $15 billion in AUM in the first two months.

However, Dylan informed our audience that the current demand for Bitcoin has primarily originated from Blackrock, Fidelity, and other institutional investors. Additionally, ETF issuers have indicated that the current buyers of BTC ETFs do not represent some of the largest pools of capital; those significant investors have yet to enter the market. As a result, we anticipate a fresh surge of capital inflows into the asset class in the coming quarters, which is poised to drive prices even higher.

That’s a wrap!

If you found this blog post helpful:

1. Go to www.42macro.com to unlock actionable, hedge-fund-caliber investment insights.

2. RT this thread and follow @DariusDale42 and @42Macro.

3. Have a great day!