Is It Time to Go Risk On?

Is It Time to Go Risk On?

Last week, Darius joined @maggielake from @realvision to discuss #Inflation, the U.S. Consumer, and more.

In case you missed it, here are three takeaways from the interview that are important for your portfolio:

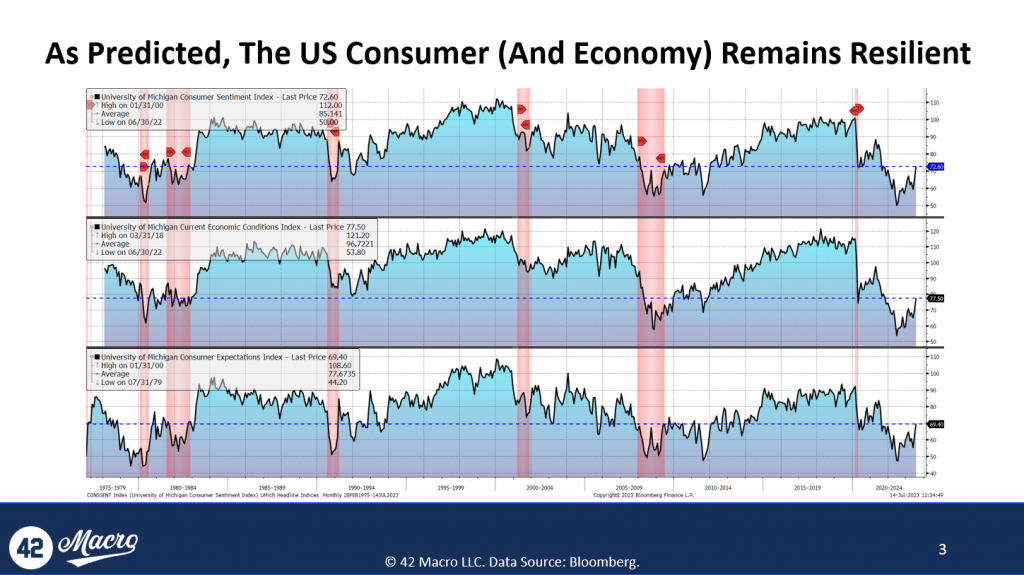

1) Consumer Confidence Is Increasing, And The Consumer Economy Is Resilient

With the University of Michigan Consumer Sentiment Index ticking up by a substantial 8.2 points to 72.6 this month, we are seeing the highest level of consumer confidence since September 2021.

This noteworthy monthly increase represents the most rapid rise since the winter of 2005.

The main contributor to this surge in confidence and the ongoing resilience of the consumer economy has been immaculate disinflation.

2) Immaculate Disinflation Has Caused Consumers to Believe Prices Will Continue to Decline Over The Next Year

The recent period of immaculate disinflation is leading consumers to anticipate a continued decrease in prices over the year ahead.

Despite a slight uptick in the UMich Expected Changes in Prices Index to 3.4, it is significantly down from the 5.5 level a year ago.

This deflationary anticipation is boosting consumers’ expectations of their financial situation, with the UMich Expected Change in Financial Situation in a Year data recording an eight percent month-over-month increase – the highest since July 2021.

Essentially, immaculate disinflation is bolstering consumer incomes, both real and expected.

3) The US Economy Has Been Resilient

This resilience can be attributed to a variety of factors, including:

- near record levels of cash in household and corporate balance sheets

- Limited private sector credit cycle vulnerabilities due to tepid credit growth prior to tightening and a low share of floating-rate debt

- minimal exposure to the volatile manufacturing sector

- labor hoarding, and

- the effects of Bidenomics

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

What’s Propping Up The US Consumer?

Last week, Darius joined Maggie Lake from Real Vision to discuss Rate Hikes, Inflation, the Stock Market, and more.

In case you missed it, here are five takeaways from the interview every investor needs to know:

1) The Market Believes The Fed Is Done Hiking. We Are Fading That View.

Currently, money markets are pricing in the assumption that future inflation data will force the Fed to pause at their July meeting.

Moreover, money markets are pricing in twice as much easing over the next two years by the Fed as they are the ECB (Fed: ~200 basis points; ECB: ~100 basis points)

We believe this is unlikely because 1) the European economy is already in recession, and 2) the European inflation cycle tends to lag the US by two quarters; as a result, they are heading into the most disinflationary part of their Inflation Cycle in 2H23.

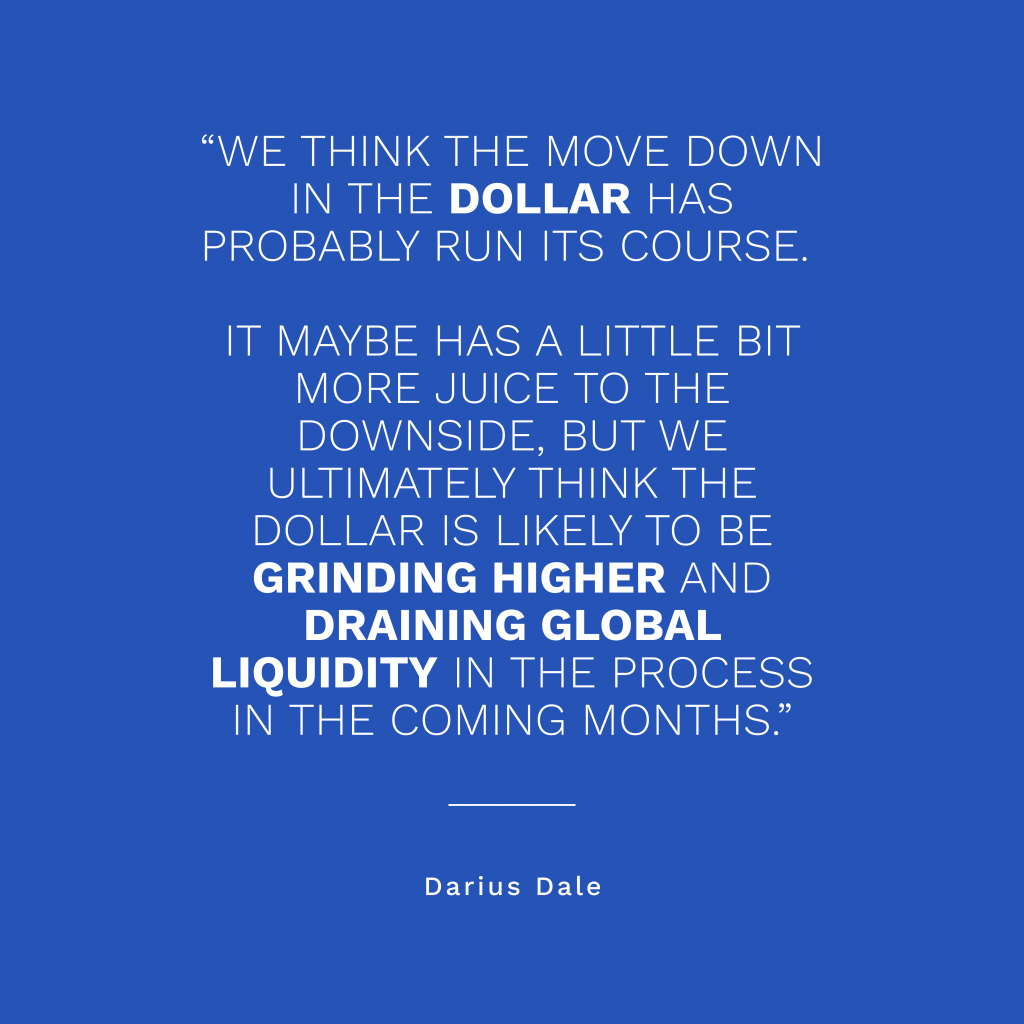

While it may not occur in July due to a likely dovish June CPI release, we expect the Fed to continue to raise rates in the coming months.

Consequently, we foresee the dollar grinding higher over the medium term.

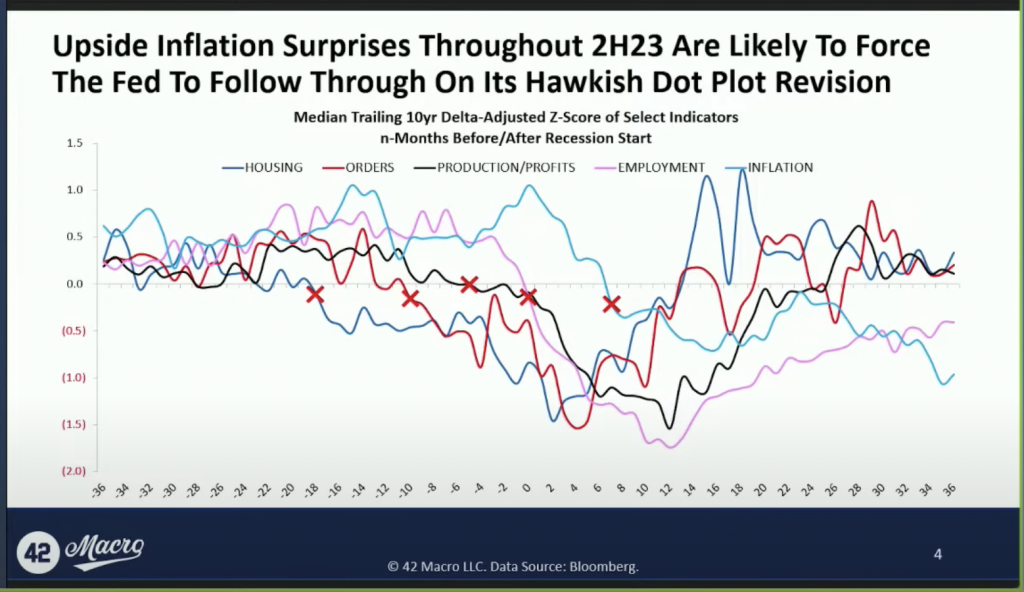

2) We Expect A Series of Upside Inflation Surprises Throughout 2023

Throughout the year, erroneous forecasts have caused investor consensus to roll forward the recession starting point; now, consensus estimates call for the recession to begin in Q3.

However, inflation tends to break down 6-8 months after the recession starts – it is the most lagging indicator of the US Business Cycle.

As a result, we believe we will not see any further significant disinflation after the June CPI release without a substantial drawdown in the labor market.

3) A Variety of Factors Are Propping Up The Consumer

We are seeing a wide range of conditions still propping up the US consumer:

- Unemployment is still low; the booming US labor market has allowed consumers to continue spending

- Cash on household and corporate balance sheets is high, currently at 3% of total assets. The last time that ratio was that high was in the 1960s

- Manufacturing as a % of GDP has declined substantially in recent decades. That is important because manufacturing tends to account for 98% of total job loss during recessions. Now only 18% of GDP, this more volatile sector of the economy is a much smaller percentage of total employment too at only 14%.

- Housing is resilient; despite the interest rate increases, outstanding mortgage rate debt is still at 3%. There is a standstill in existing home sales because consumers will not trade lower mortgage rates for the higher current rates – this has increased demand for new homes, thus holding up the housing market.

4) The Phase 2 Credit Cycle Downturn Is Ahead of Us

We believe the recession is still ahead of us.

Since the Great Depression, EVERY recession has had a market crash associated with it as we price in the downturn in the credit cycle.

In addition, on a median basis, markets tend to peak a month before the lowest point in the unemployment rate.

So, we typically see degradation in the labor market and a dip in the stock market simultaneously.

That means investors who share our longer-term (6-12mos) bearish outlook for the stock market must avoid expressing that view with actual trades until we are much closer to the start of recession. Since last fall, we have identified 4Q23 as the quarter with the highest probability of seeing a recession commence in the US economy. The second highest probability is 1Q24.

5) The Stock Market Is Likely Nearing A Local Top

This stock market rally has caught many investors off-guard; most fund managers are hastily rushing to minimize their YTD underperformance.

As a result, the rally can largely be explained by investors chasing the market higher, further squeezing Bears.

Despite the recent uptrend, we advise against chasing stocks now.

We expect a correction in the near term for a variety of fundamental (e.g., declining US and global liquidity) and technical (e.g., the passage of a large, call-heavy OPEX should reverse flows) reasons.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Macro Indicators and Tactics for Uncertain Times

1) The US Economy Remains on a Path to a Recession

At the beginning of the year, most investors expected a first-half recession followed by a recovery in the second half.

Since last summer, our view has consistently been that the U.S. economy had more endurance than what was perceived by most investors.

This belief led us to forecast a later start to the recession, in late-2023, contrary to the general market consensus.

Our view was, and still is, that a recession would likely kick off in Q4 of this year or Q1 of next year.

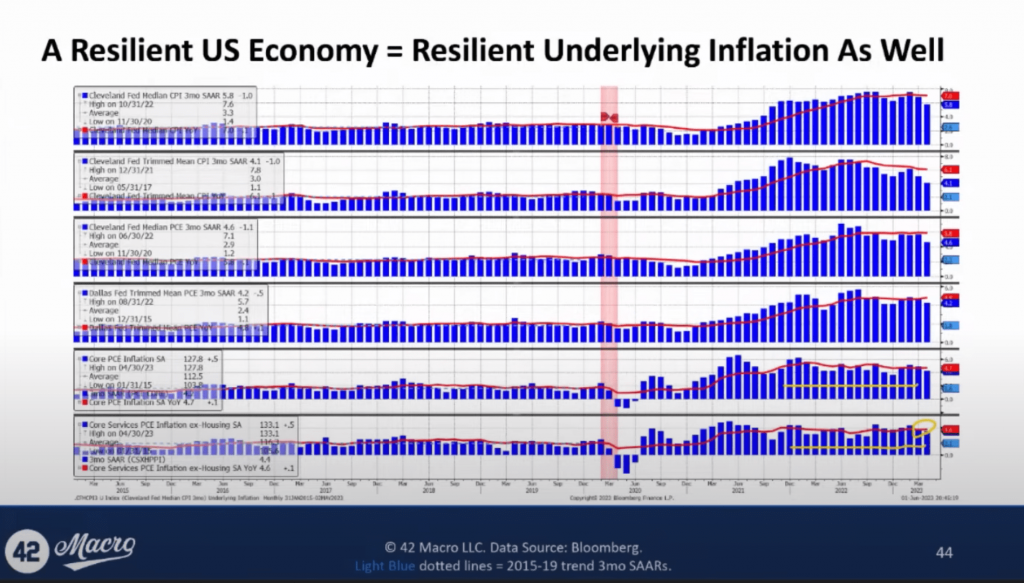

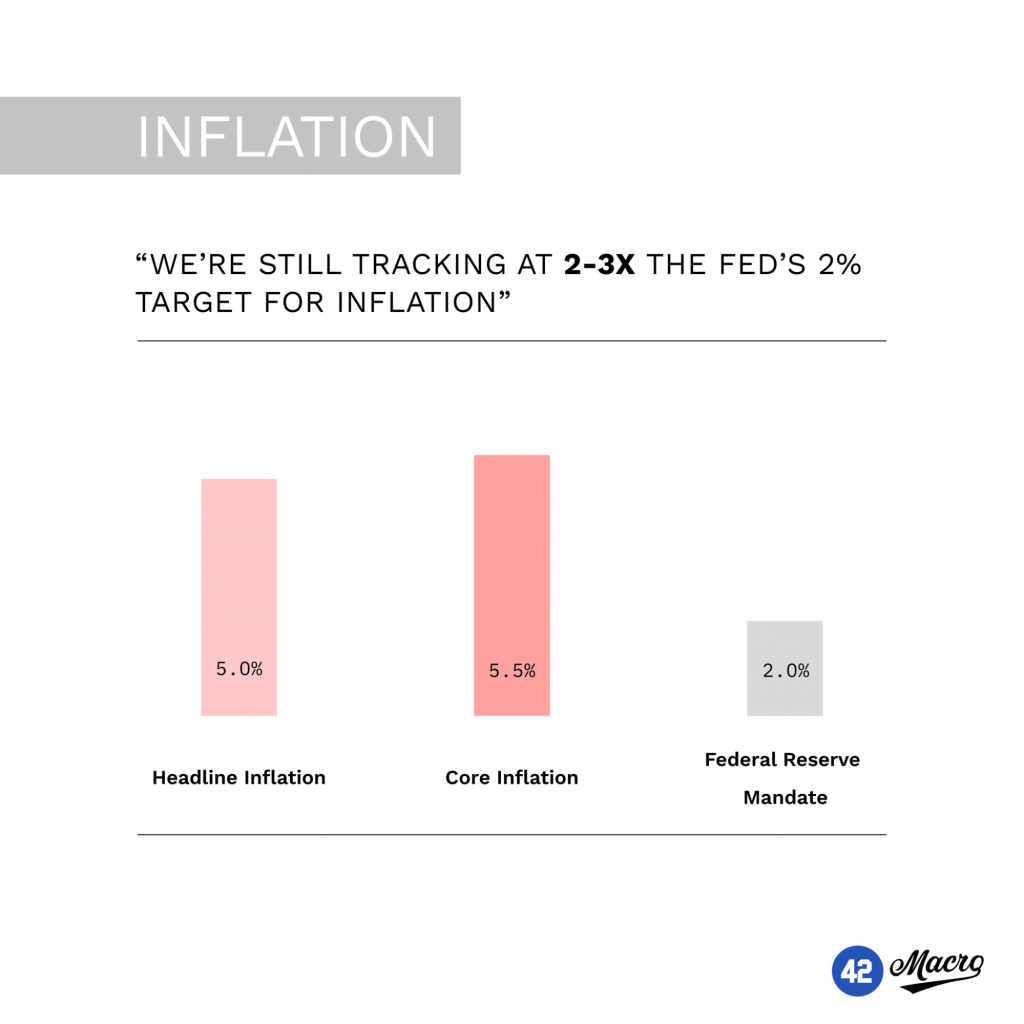

2) Inflation Will Not Reach 2% Without a Recession

U.S. inflation, a lagging business cycle indicator, usually breaks down during and through a recession.

Our data suggests that it’s improbable we will see evidence of sustainable 2% inflation before a recession hits: our models currently forecast inflation stabilizing at around 3-5%, not the Fed’s 2% target.

This could lead to two potential outcomes: either the Fed acknowledges more action is needed, or the bond market panics over the lack of progress.

Either way, we believe it will result in the Fed applying more pressure, pushing the economy into recession.

3) Europe’s Economic Contraction Will Likely Worsen

The European economy has recently confirmed its recession, primarily due to the effects of monetary tightening.

Despite the assumptions that fiscal stimulus would resolve the situation, Europe’s economy is in decline, with retail sales tracking down 2% to 4% across Europe.

Given the current data, we predict the recession in Europe is likely to worsen over the medium term.

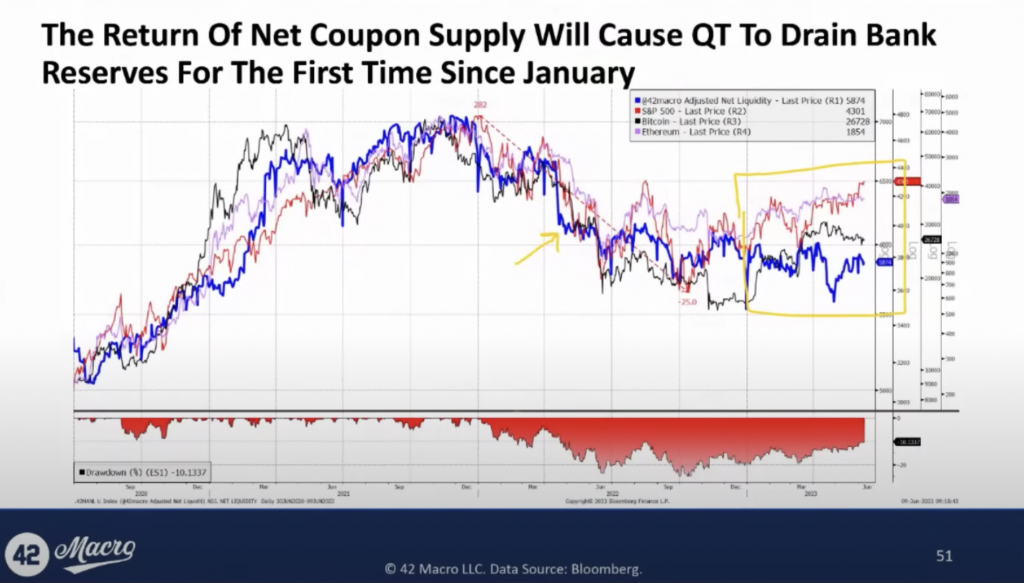

4) Upcoming Quantitative Tightening Will Negatively Impact Asset Markets

The return of net coupon supply will instigate QT, causing it to deplete bank reserves for the first time since January.

Our Adjusted Net Liquidity model, which subtracts the Treasury General Account (TGA) balance and Reverse Repo Facility (RRP) balance, as well as emergency lending from the Fed’s balance sheet, shows a breakdown in the correlation between US public sector liquidity and asset markets at the beginning of the year when QT ceased draining bank reserves.

Up until now, QT has truly been going on in the background.

We believe this correlation will resume in the coming months and negatively affect risk assets.

5) The Stock Market Is Likely To Peak During Q4 (or Early In Q1 At The Latest)

Our study of past recessions shows that the stock market, on a median basis, typically peaks a month before the trough in the unemployment rate.

Historically, the stock market usually rises sharply in the year leading up to the end of a business cycle, with a median return of around +16%.

Equity markets are generally strong preceding a recession.

We maintain the view that the stock market will likely peak in Q4 (or early in Q1 at the latest) and many of today’s too-early bears will fail to profit from the pending Phase 2 Credit Cycle downturn.

At that point, we will be positioning for the next anticipated down leg in the market.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Global Liquidity Decoded

1. China and Japan are Important to the Global Liquidity Cycle:

China and Japan are key contributors to the global liquidity cycle.

Regarding their contributions to the global central bank balance sheet, global narrow money supply, and global FX reserves minus gold – the three metrics that we feature in the @42Macro Global Liquidity Proxy – China makes up ~20%, while Japan makes up ~15%. Understanding their liquidity cycles is vital in forecasting inflections in global liquidity.

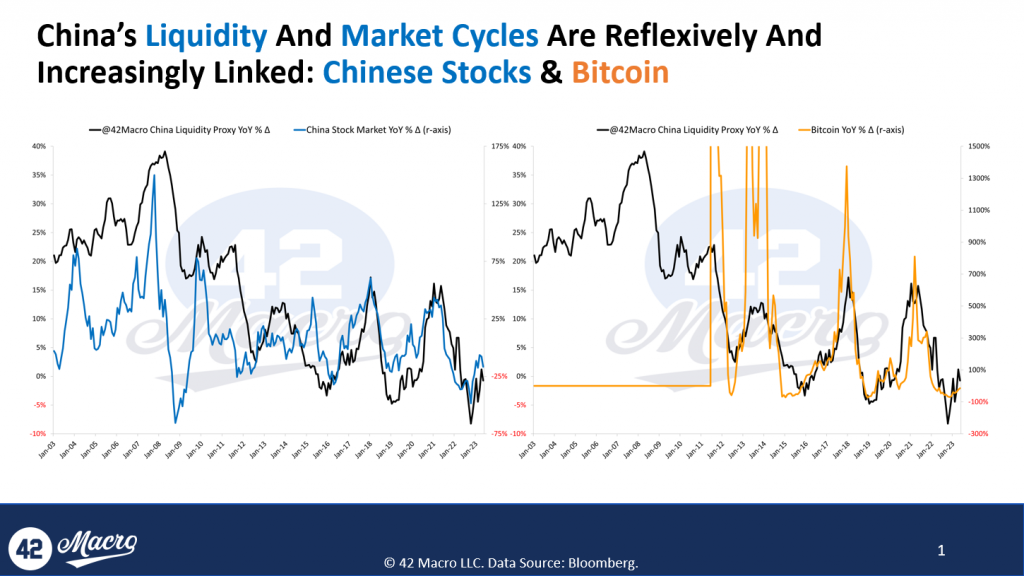

2. The Chinese Liquidity Cycle Has a Big Impact on Asset Markets:

There’s a direct link between China’s liquidity and the global markets, including Bitcoin. Any significant shift in China’s liquidity, positive or negative, can considerably affect asset markets.

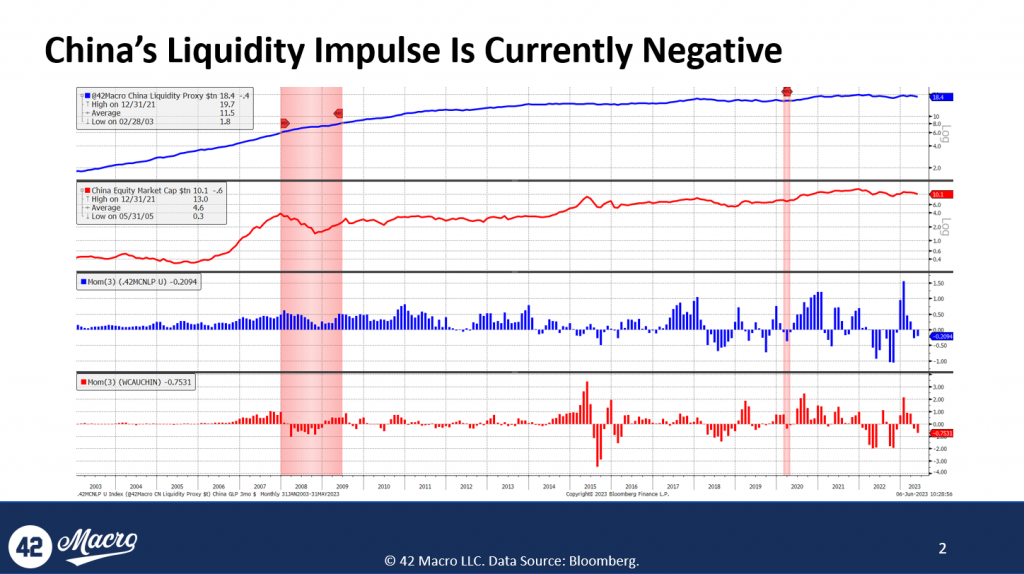

Our research shows that the Chinese economy shifted from adding approximately $1.5 trillion of liquidity in Q1 of this year to removing liquidity in the past few months. The pullback in Chinese liquidity coincides with #Bitcoin failing to continue its rally. We believe we will see another injection of liquidity into the Chinese economy; we just don’t believe it will happen in the short term.

3. Waning Public Sector Liquidity Provision in China:

The Chinese stock market is viewed as a reliable leading indicator of the country’s liquidity cycle because locals often have intelligence regarding future actions of the People’s Bank of China (PBOC).

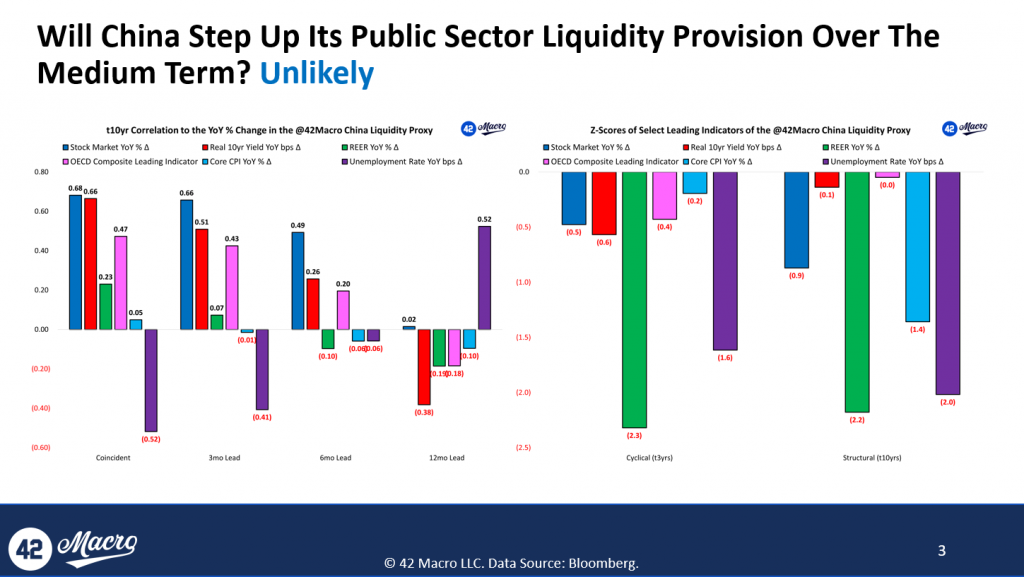

We believe the recent decline in the Chinese stock market likely signals a decrease in China’s contributions to global liquidity over the medium term (because the market doesn’t anticipate a wave of liquidity from the PBOC).

4. Japan’s Liquidity Cycle Influences Bitcoin Too:

Like China, Japan’s liquidity cycle strongly correlates with Bitcoin and other risk assets.

Our research shows that in October of last year, the Japanese economy was removing $1.5 trillion from global liquidity on a three-month impulse basis.

In Q1 of this year, they shifted to add $2 trillion.

Because inflation is still very high in Japan, we do not foresee a liquidity injection from the BOJ in the near term.

5. It’s Not Just Enough to Monitor Global Liquidity; You Must Forecast It As Well:

The timeline for changes in liquidity inputs to manifest in outputs (values or liquidity changes) varies by the economy.

When an economy is at the bottom of its growth cycle (e.g., unemployment rising on a YoY basis, etc.), lead times are usually shorter because central banks will react with a sense of urgency to support their economies.

Conversely, factors like stock market performance and real interest rates in China may not trigger a similar sense of urgency by the PBOC and/or Chinese commercial banks.

Overall, the objective is to understand these dynamics to forecast the global liquidity impulse, which is currently negative. We believe this negative impulse is the reason Bitcoin hasn’t fully recovered its YTD high.

That’s a wrap!

If you found this thread helpful:

- Go to https://42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!

Why is the stock market ripping?

Last week, we joined Real Vision’s Raoul Pal and Maggie Lake to discuss Liquidity, Debt Monetization, Recession Risk, and MUCH more.

In case you missed it, here are seven highlights from what many are calling “the best Real Vision Daily Briefing yet”:

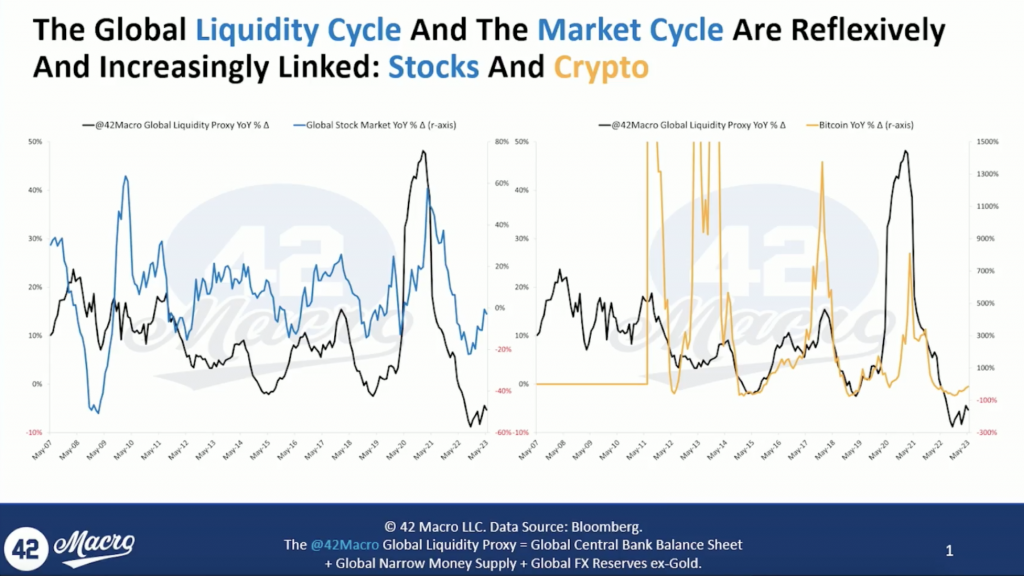

Liquidity Drives Asset Markets

Although we believe the stock market will continue to squeeze bears well into the fall, poor liquidity conditions will likely drag asset markets down this summer.

Additionally, we are not sure we’ve seen this market cycle’s ultimate lows because we did not price in a recession last year. What we priced in, in our opinion, was a change in the Liquidity Cycle.

The markets will eventually need to price in the credit cycle downturn associated with the liquidity drain we’ve experienced in 2021 – 2022. We expect that to start in Q4 2023 – Q1 2024.

Understanding and Monitoring Liquidity

Changes in liquidity, driven by factors like central bank policy and the activities of commercial banks, can significantly impact asset markets.

We have tested this extensively: our proxy for liquidity has a 97% correlation with the S&P 500 since 2009 and an 89% correlation with #Bitcoin since inception.

Over the short and medium term, we expect liquidity to fall with the return of Uncle Sam to the international capital markets.

We do not believe we have reached a durable positive inflection in the liquidity cycle yet. Liquidity bottomed in October, but we haven’t met those conditions yet in terms of getting an unimpeded rise in liquidity.

Central Banks and the Concept of Debt Monetization

Debt monetization is when a government issues bonds and the central bank purchases them, thus increasing the money supply. This mechanism can prevent the public sector from crowding out the private sector.

“Crowding out” happens when the government borrows so much that it drives up interest rates, making borrowing more expensive for businesses and individuals.

We believe the central banks are currently playing a Debt Monetization game. However, we do not believe central banks are purposely causing economic deterioration to monetize public sector interest payments. Instead, we believe they are responding as crises occur.

The Liquidity Cycle

Our research shows there’s a three and 1/2-year cycle in global liquidity, with approximately 2 ½ years from trough to peak.

Assuming the most recent trough occurred last fall, we expect the cycle’s peak to occur sometime in the first half of 2025.

Similar to Raoul, we’re bullish in terms of the destination. We just differ on the path to get there and believe there will be pain in asset markets along the way.

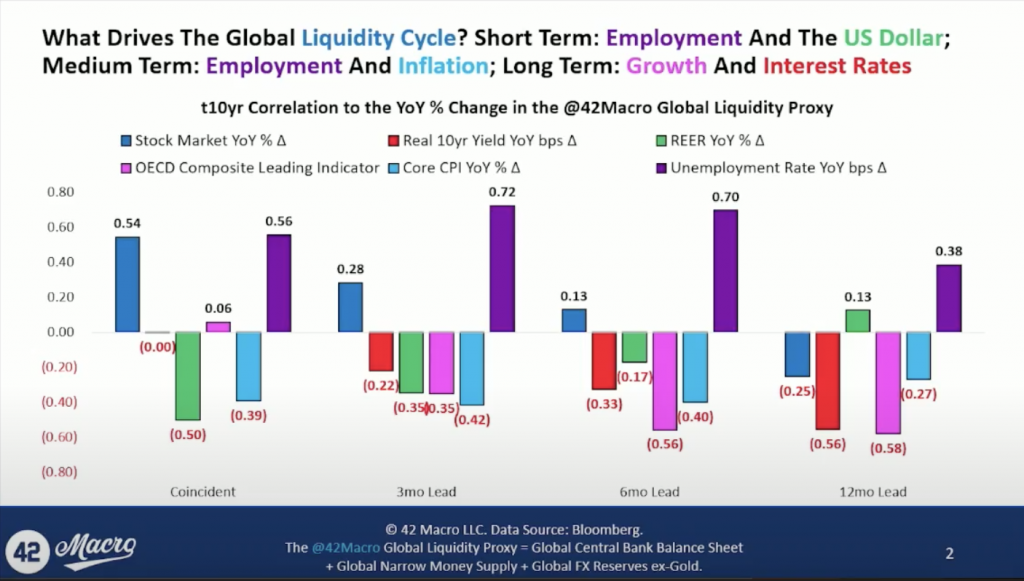

The Drivers of the Global Liquidity Cycle

To forecast global liquidity, we analyze the YoY change of a group of proven leading indicators, including equity market performance, real 10-year yield, real effective US dollar exchange rate, OECD composite leading indicator, core CPI, and the unemployment rate.

All of those factors combined imply that:

- Short Term: no liquidity

- Medium Term: falling liquidity

- Long Term: potential for rising liquidity

Although we expect the liquidity environment to be positive in 2024, we expect there will be a period of 2022-style liquidity conditions along the way.

Recession Expectations

We believe the recession will commence in Q4 2023 or Q1 2024 and will overwhelm whatever favorable liquidity conditions are present at the time.

When the economy goes into recession, and people start losing jobs, risk assets decline (the median S&P decline in a recession is -24%).

Even if liquidity is increasing, there can still be corrections. And we expect that will happen at some point over the next year. The maximum drawdowns of the S&P 500 and Bitcoin during the Liquidity Cycle upturns experienced since 2009 are -34% and -74%, respectively.

When will this rally end?

We still believe most investors have the recession playbook on too early.

The economy will likely stay resilient until sometime around Q4 2023 – Q1 2024. History shows that the stock market is NOT forward-looking heading into recession – largely because it is busy squeezing bears. Rather, it tends to peak on a coincident basis with the peak of the Employment Cycle.

That’s a wrap!

If you found this thread helpful, go to https://42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!

Macro Market Outlook: Pivot Soon?

We joined Paul Barron last week to discuss inflation, the jobs market, crypto outlook, and much more.

In case you missed it, here are 7 takeaways that will SIGNIFICANTLY help your portfolio over the next 6 months:

1) Although inflation is moving in the right direction, we still have some work to do.

Given the stock market’s (relatively) high current valuation and the bond market pricing in a quick Fed pivot, the inflation numbers we are currently at are scary.

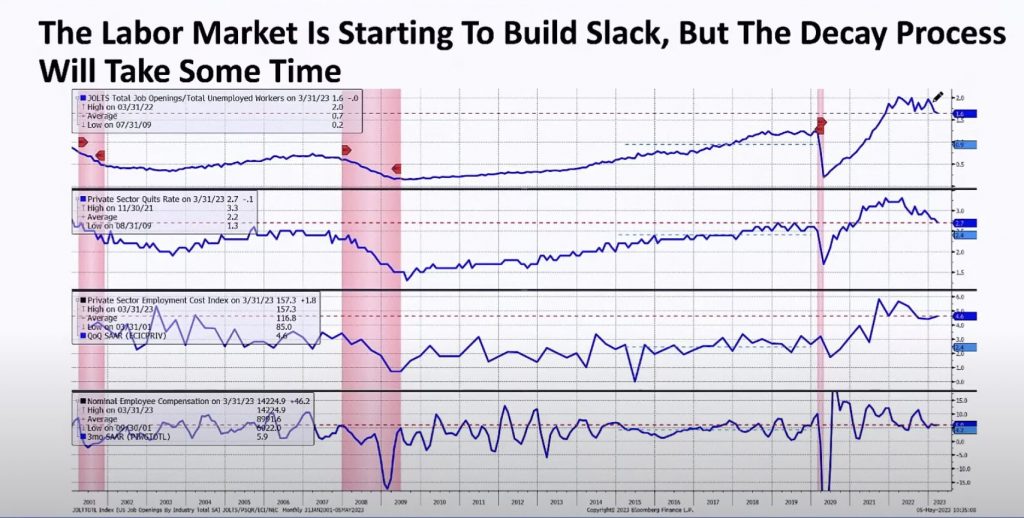

2) “The Fed has been explicit about waiting to see slack emerge in the labor market.”

Two significant labor metrics, Job Openings / Unemployed Workers & the Employment Cost index are 2x their pre-covid levels.

The Fed won’t pivot to rate cuts & QE until they see change.

3) The Fed doesn’t have enough data yet to determine the damage we will see in regional bank lending.

Pausing is how they can buy themselves time & assess those effects.

Given its change in guidance at the May FOMC, we believe the Fed has already implemented the pause pivot.

4) “Inflation tends to peak at or in recessions. It’s a very late cycle indicator, like the labor market itself.”

We’re currently experiencing an unusual inflation cycle – a lot of inflation was pandemic and fiscal stimulus-related.

Pandemic and fiscal stimulus-related inflation aside, we still have structural ~4% core inflation.

We’re going to need a recession to get that structural inflation back to where the Fed wants it to be.

5) What’s the outlook on Crypto?

Pre-halving years are extremely volatile for Bitcoin; there are usually several large drawdowns throughout the year

On top of that, global liquidity isn’t ubiquitously improving anymore (and it will likely worsen throughout Q3).

The liquidity narrative that propelled BTC from $16k to $30k made sense; liquidity was improving back then.

But, it’s not anymore.

Bitcoin needs more liquidity to go higher.

Realistically, that likely won’t happen until next year.

6)Will there be opportunities to find outperforming single stocks?

Absolutely.

When the yield curve is inverted, we’re typically in the late stages of the economic cycle.

When you’re in the late stages, you usually see good companies continue to grow, while other firms increasingly fall by the wayside.

It becomes a stock pickers market.

7) How long will the recession last?

The recession will most likely happen in Q4 or Q1 of next year.

But, there’s a lot of time before then; we can easily see a short squeeze at some point.

So, be patient.

Remember, these are the times when great wealth is made.

That’s a wrap!

If you found this article helpful, go to https://42macro.com/macro-bundleto unlock actionable, hedge-fund caliber investment insights.

Have a great day!

Whose portfolios are at risk over the next six months? The bulls or the bears?

1) The Bond markets are pricing in significant Federal Reserve easing in the coming 12-18 months.

In addition, the Fed Funds futures show easing is likely to start as early as November of this year.

But, our view on liquidity and factors in the real economy show that market positioning should change over the medium term.

As a result, we expect to see an increase in bond market volatility over the next quarter or two before we get into a recession.

2) The US consumer has been resilient.

Real PCE, which measures the value of goods and services purchased by households in the US, adjusted for inflation, is growing at twice its pre-covid trend.

Real Income is also growing at a three-month annualized rate of 7.6%.

The uptick in real PCE and Income signals increased demand for goods and services. This increase in demand can lead to higher prices, causing inflation to persist.

So, a resilient US consumer means sticky inflation.

3) The recession is likely to be delayed relative to investor consensus.

Many investors have been calling for a recession for over a year.

On top of that, many analysts are predicting negative GDP growth in the second quarter of the year.

But, our research shows the economy is resilient and will likely stay resilient until at least Q4.

And this delay could trap both bulls and bears, leading to significant volatility in both the stock and bond markets.

4) The AI bubble will eventually meet the wrong part of the Liquidity cycle.

The rise of AI is similar to the internet boom in the early 2000s. We could see a similar blow-off top in late-2023.

And while emerging technologies bring about significant societal changes, they don’t prevent market downturns. Investors would be wise to sell into strength later this year.

5) Is the bad news priced in? Are markets forward-looking?

We’ve backtested asset markets extensively and found that markets only look 2-3 months ahead at most.

Despite what people think, markets are more reactive than predictive.

And they’re most reactive to changing liquidity conditions. Since 2009, equity markets have been highly correlated to global liquidity.

Liquidity drives markets, and we believe the recovery in liquidity might not be as linear as many investors believe.

6) We expect a negative liquidity backdrop over the next few months.

We’ve probably seen a medium-term high in liquidity.

The expected increase in the Treasury General Account and the return to net coupon issuance by the US Treasury are negative for liquidity.

As a result, the Dollar could trend higher in the near term, harming #Bitcoin and other risk assets.

That’s a wrap!

If you found this article helpful, go to https://42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights.

Have a great day

Rough Summer Ahead?

We joined Anthony Pompliano earlier this week to discuss the Debt Ceiling, Recession, Global Liquidity, and more.

Every investor will want to review the following six highlights from the interview:

1. We expect the Debt Limit Crisis to negatively impact global liquidity.

The US government will return to the international capital markets to borrow more money (after resolving the crisis).

When that happens, a material amount of liquidity will be removed from the system, driving asset prices down.

2. Understanding the Treasury General Account Balance

The Treasury General Account Balance, essentially the checking account of the US federal government, is a crucial component of global liquidity.

When this balance decreases, it signifies that the government is spending more, increasing liquidity in the economy.

The TGA has declined for the past few quarters, supporting global liquidity and risk assets.

We anticipate a significant increase in TGA in the coming months, which will drain liquidity from the private sector.

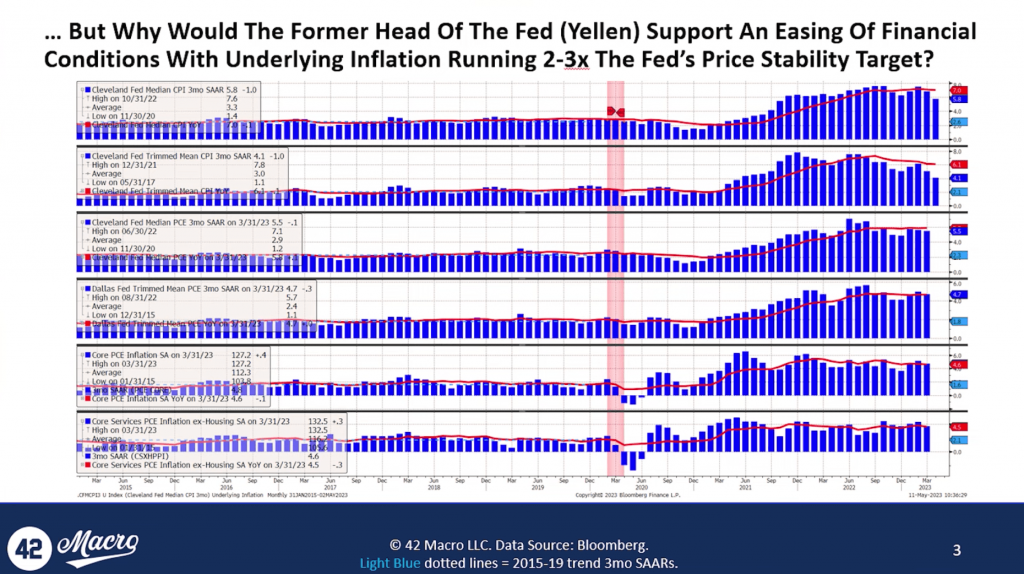

3. Inflation is running at 2-3 times the Federal Reserve’s price stability target.

Given current inflation rates, it doesn’t make sense for Secretary Yellen to support financial easing by flooding the market with T-bills.

Easing financial conditions would drive asset markets higher, only making inflation worse.

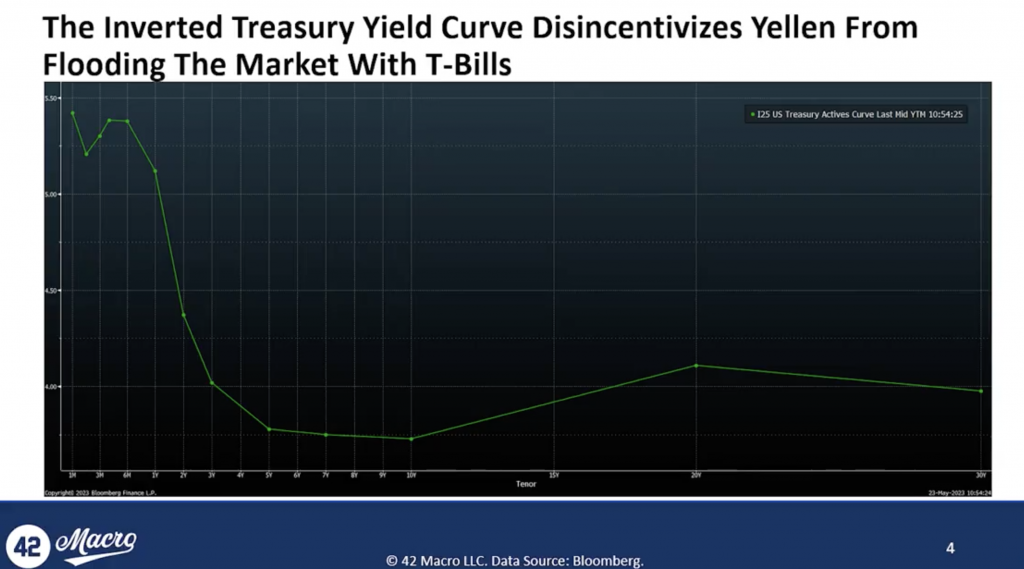

4. The Impact of the Inverted Yield Curve

An inverted yield curve occurs when short-term debt instruments (like T-bills) have a higher yield than long-term debt. It’s often seen as a predictor of an upcoming recession.

Because the Treasury needs to pay interest on issued debt, they are incentivized to lock in the lowest rates, which are currently notes maturing in the 3-10 year range.

This is another reason we believe Secretary Yellen is unlikely to flood the market with T-bills, supporting our view of lower asset prices in the quarters ahead.

5. Changes in Global Central Bank Policies

Global Central Banks also have massive implications for global liquidity and, therefore, asset markets.

We foresee another headwind for asset markets:

The two central banks responsible for the improvement in global liquidity the most over the past year, the People’s Bank of China (PBOC) and the Bank of Japan (BOJ), have been draining liquidity over the past quarter (on a trailing 3-month impulse basis).

The impulses take time to flow through financial markets, but we expect the actions of the PBOC and BOJ are likely to serve as a headwind for risk assets in short order.

6. Potential for a Rough Summer

We expect a shift in liquidity conditions from a very positive trailing six months to a more challenging period over the next two to four months.

The actions of the Fed, Treasury, and Foreign Central Banks over the next 1-2 quarters are not supportive of a positive liquidity environment.

Our advice to you is: if you are invested in risk assets, be careful.

That’s a wrap!

If you found this thread helpful:

1. Go to https://42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights

2. Have a great day!