New Headwinds for Asset Markets

Last week, Darius joined Nicole Petallides on the TD Ameritrade Network to discuss market headwinds, tailwinds, inflation, and more.

In case you missed it, here are three takeaways from the interview you need to know:

1) Asset Markets Face Three New Headwinds That Arose Over The Past Few Weeks

We have seen a lot of recent volatility in asset markets as they digest three new headwinds that arose over the past couple of weeks:

- The Bank of Japan (BOJ) tweaked its Yield Curve Control (YCC) policy and will allow interest rates to rise more freely

- The Treasury Department positively revised the number of treasuries that they will supply in Q3 from an estimated $733bn in May to $1.007 in August

- Fitch downgraded the US credit rating from AAA to AA+

2) We Believe The Existing Asset Market Tailwinds Will Push Stocks Higher Over The Next Quarter

In addition to the “Resilient US Economy” theme and the high likelihood that the immaculate disinflation trend will continue, two additional readings that came out last week contribute to our theory:

- Jobless claims, the number of people filing weekly to receive unemployment insurance due to not having a job, came in at 227k and well below its recession signaling threshold when analyzed on a three-month annualized basis

- Continued claims, the number of people who have already filed an initial claim and who have experienced a week of unemployment and then filed a continued claim to claim benefits for that week of unemployment, came in at 1.7M and well below its recession signaling threshold when analyzed on a three-month annualized basis

Although a few of last week’s readings disprove the Transitory Goldilocks theme, specifically the ISM Services PMI coming in at 52.7, a 2-month low, and the ISM Services Prices PMI coming in at 56.8, a 3-month high, we believe the Transitory Goldilocks theme is likely to persist well into Q4.

3) The Return of Inflation Pressure Will Cause The “Risk On” Regime to Dissipate

The large amount of immaculate disinflation we have seen since Q4 of last year has been a key contributor to the Transitory Goldilocks theme and asset market performance.

Last week, we received incremental inflation data that supports further immaculate disinflation:

- Unit Labor Costs came in at 1.6% QoQ annualized, the lowest number since Q4 of last year

- The Median Annual Pay for Job Changers slowed 110 basis points to 10.2% YoY, the lowest number since July 2021

However, we expect the immaculate disinflation process will conclude within 3-6 months.

Any threat to the “immaculate disinflation” narrative threatens to unravel the “resilient US economy” narrative because market participants will start to come around to the view that the Fed needs to engineer a recession to achieve its price stability mandate.

That’s a wrap!

If you found this blog post helpful:

- Go to www.42macro.com to unlock actionable, hedge-fund caliber investment insights.

- RT this thread and follow @42Macro and @42MacroWeather.

- Have a great day!

The Most Important Number In Today’s Jobs Report

The spread between Labor Demand (Household Survey Employment + JOLTS) and Labor Supply (Total Labor Force) rose to 3.7mil in July from 3.6mil in June. This statically rare phenomenon of excess labor demand is the key reason wage growth remains robust amid trending “immaculate disinflation” and improving Nonfarm Productivity (3.7% QoQ SAAR in Q2; highest since 3Q20).

The US Economy Is Very Strong

Yesterday, Darius joined Anthony Pompliano to discuss Consumer Spending, Personal Income, Inflation, and more.

In case you missed it, here are the three most important takeaways from the interview:

1. Consumer Spending Has Accelerated In Recent Months

Consumer spending, the total value of all goods and services purchased by households, makes up 68% of GDP.

Last week’s PCE report indicated that Real Personal Consumption Expenditures accelerated to 2.9% in June, primarily driven by a rebound in goods consumption – a three-month high.

In addition, Real Goods PCE accelerated to 5.4% on a three-month annualized basis, also a three-month high.

Both readings suggest US consumers remain incredibly resilient.

2) Accelerating Income Growth Supports Our “Resilient US Economy” Theme

Even if individual real wages are declining, as we have seen recently, overall consumer income can still grow from increased employment, government support, and other income sources.

Nominal Employee Compensation, the broadest nominal measure of income published about the labor market every month, accelerated to 6.2% three-month annualized in June – the highest reading since September last year.

Additionally, Personal Interest Income, the income individuals receive from interest-bearing assets like savings accounts and bonds, accelerated to 8.8% three-month annualized basis in June.

This figure is the highest number we have seen since January of this year and signals that consumers may have more disposable income to spend.

3) The Inflation Fight Is Improving Significantly

Typically, inflation breaks down AFTER a recession. This year, we have seen the opposite – a term referred to as “immaculate disinflation”.

In Friday’s PCE report:

- Core PCE, the Fed’s preferred measure of inflation, decelerated to 3.3% on a three-month annualized basis, the lowest print since February 2021.

- Super Core PCE decelerated to 3.2% on a three-month annualized basis, the lowest print since July 2022.

- Median PCE decelerated to 3.8% on a three-month annualized basis, the lowest print since August 2021.

- Trim Mean PCE decelerated to 3.4% on a three-month annualized basis, the lowest print since August 2021.

We expect the YoY inflation numbers to follow the low three-month annualized rates over the coming months, strengthening the immaculate disinflation narrative supporting asset markets.

That’s a wrap!

If you found this blog post helpful:

- Go to www.42macro.com to unlock actionable, hedge-fund caliber investment insights.

- RT this thread and follow @42Macro and @42MacroWeather.

- Have a great day!

From Recession to Goldilocks

Over the weekend, Darius joined Andreas Steno Larsen on the Macro Sunday podcast to discuss the resiliency of the U.S. economy, Recession, and more.

In case you missed it, here are three takeaways from the interview you need to know:

1. Despite Most Investors Calling For Recession, The US Economy Is Actually Accelerating

The Q2 GDP advance estimate report, released last week, indicates that GDP increased at a 2.4% annualized pace in the second quarter, surpassing the 2% estimate.

Further, the recent advance report on the latest Durable goods and CapEx data also supports our “Resilient US Economy” theme. Specifically, we saw:

- Durable Goods New Orders accelerated to +32% on a 3-month annualized basis (highest since Sep-20)

- Core Capital Goods New Orders accelerated to 5.7% on a 3-month annualized basis (highest since Aug-22)

- Jobless Claims surprised to the downside, supporting the “Transitory Goldilocks” theme

- Real Personal Consumption Expenditures accelerated to +2.9% on a 3-month annualized basis (highest since Mar-23)

- Nominal Employee Compensation accelerated to 6.2% on a 3-month annualized basis (highest since Sep-22)

Last week’s data suggests an accelerating economy; we urge bears out there to manage risk and #respectthexaxis regarding calls for a recession.

2. US Economic Resiliency Should Continue Into Q4 And Potentially Well Into Q1:

The economy has been and will continue to be resilient for the following reasons:

- Near-record cash on household balance sheets

- Near-record cash on corporate balance sheets

- Private sector income and wealth have outpaced inflation on a structural basis

- Limited credit cycle vulnerabilities

- Limited exposure to the volatile manufacturing sector

- Longer, long and variable lags

- Bidenomics

- Labor hoarding

We expect the economy to remain strong well into Q4 of 2023 and possibly well into Q1 of 2024. By then, we believe the recession will commence.

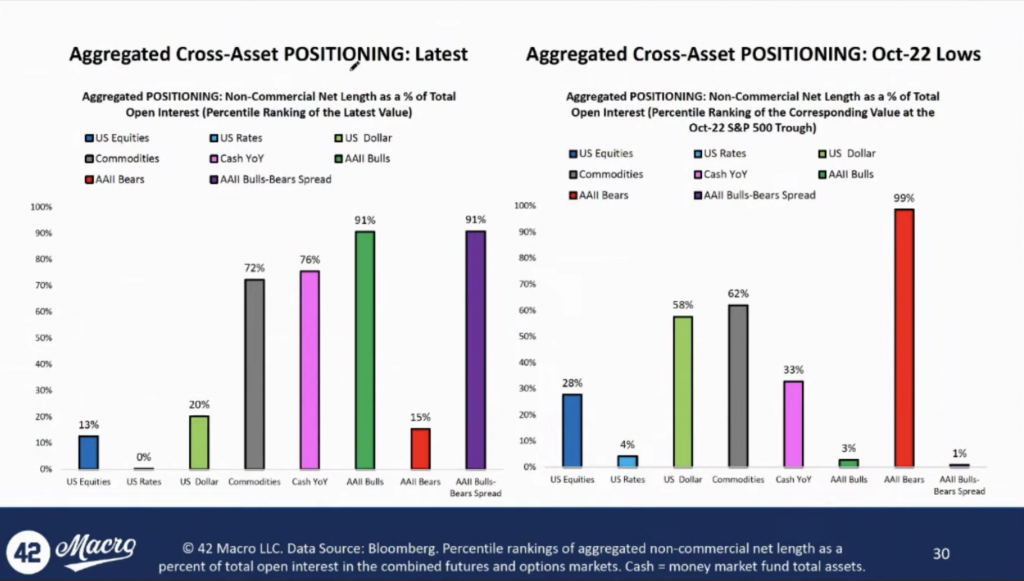

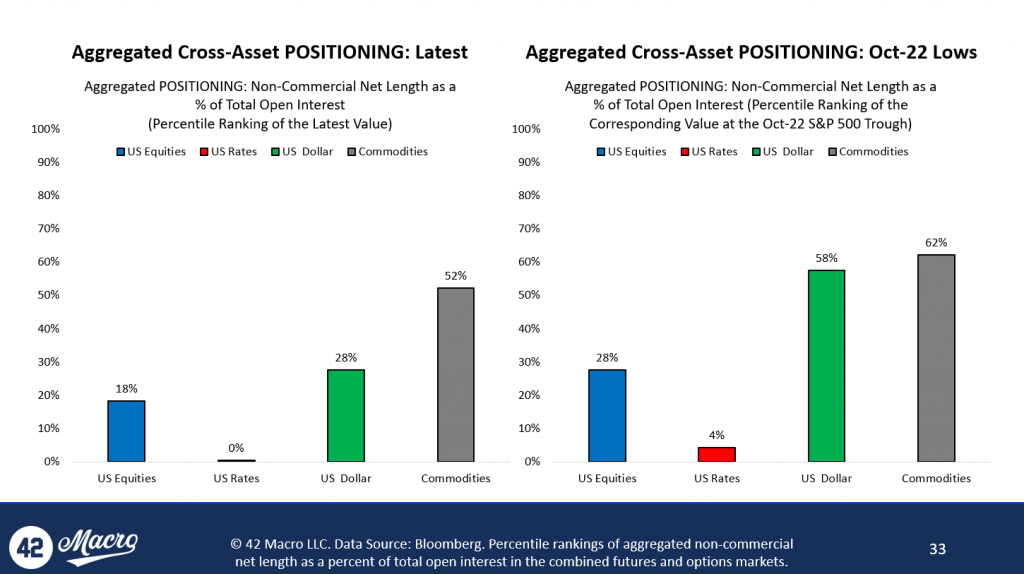

3. Investor Positioning Is Incongruent With the Rising Probability of a Soft Landing

Our research tracking aggregated US equities positioning across the various equity instruments suggests that the market is currently net short approximately -7%.

That reading is in the 13th percentile of all historical readings in the time series since 1998, which suggests investors are deeply entrenched in the bearish narrative.

If there is going to be a soft landing in the economy – which we believe is a higher probability than a recession that starts in less than three months – investor positioning is currently and extremely under-positioned for it.

That’s a wrap!

If you found this blog post helpful:

- Go to www.42macro.com to unlock actionable, hedge-fund caliber investment insights.

- RT this thread and follow us on Twitter @42Macro and @42MacroWeather.

- Have a great day!

Is the Fed Done Hiking?

Earlier this week, Darius joined Maggie Lake and Andreas Steno on Real Vision to discuss the Fed, Inflation, and more.

If you missed the interview, we have you covered. Here are three key insights that will save your portfolio:

1) We Believe The Narrative Surrounding Inflation Will Change In 3-6 Months

The interplay between immaculate disinflation and rising soft landing expectations has been the driver behind asset markets this year.

We believe any potential shifts in this narrative are not being adequately priced into market forecasts.

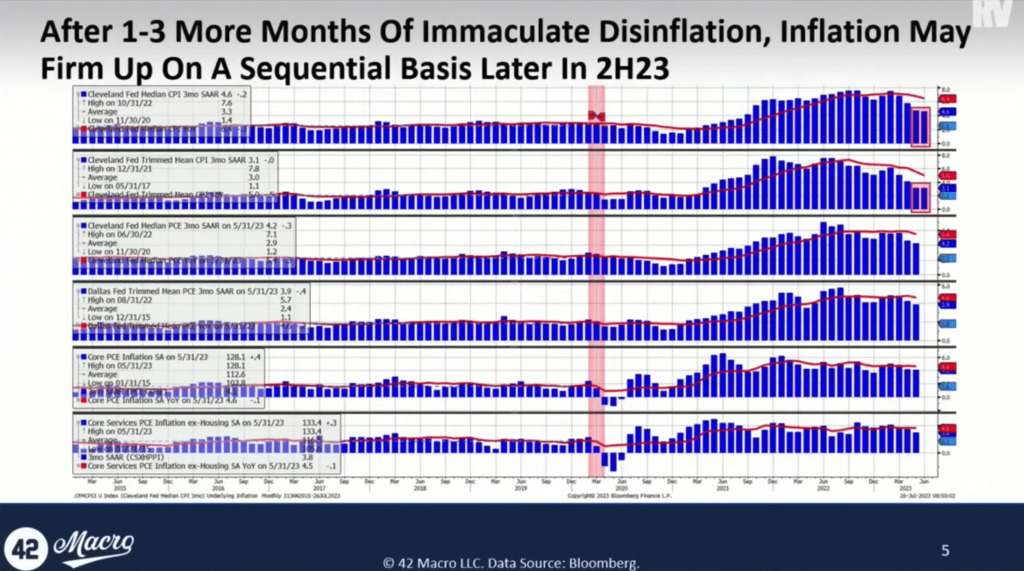

Reviewing several key inflation measures—median CPI, trim mean CPI, median PCE deflator, trim mean PCE, core PCE, and super core PCE—highlights a concerning trend. Sequential trends, especially for median CPI and trim mean CPI, indicate stagnation between 3% to 4%. If this lack of progress continues, it could be problematic for the economy.

Our models indicate that a recession in the US economy is unlikely to begin until Q4 this year or Q1 next year, with the depths of the recession probably not hitting until the second or third quarter of next year.

2) The Rate of Change of Inflation Is Important, Not the Level

Investors should be concerned with inflation’s direction and velocity – not the current level.

Why? Because the rate of change is what markets react to. While the Federal Reserve may concern itself with the actual level of inflation, investors should strive to be one step ahead of the Fed, analyzing shifts in the direction and speed of travel.

3) A Soft Landing In Growth = A Soft Landing In Inflation

Inflationary impulses in the economy take time to permeate fully – this explains why the BLS and BEA measure inflation as they do.

Inflation has subsided back to around 2% when you exclude the lagging housing components of inflation.

Notably, core services ex-housing CPI and the core services ex-housing PCE deflator are showing three-month annualized rates of 1.4% and 3.2%, respectively.

If we do have a soft landing, it will likely be at some point in 1H24 — a scenario that, while not the most probable, is far more likely than a near-term recession.

Under these conditions, we believe we would see metrics like super core CPI, super core PCE, and core PCE firm up and begin accelerating again.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Is A Blow-Off Top In Equities Approaching?

Earlier this week, Darius joined Anthony Crudele to discuss the Recession, Equities, Investor Positioning, and more.

Miss the discussion? No problem. Here are the three most important insights that can help your portfolio:

1) Hard or Soft, the “Landing” in Inflation Will Mirror the Landing in Growth

If we have a recession, inflation will come down swiftly.

On the other hand, if we manage to avoid a recession and see a soft landing, then inflation will decline naturally over time. However, in a soft landing scenario we believe it will decrease to a terminal level higher than the Fed’s 2% target.

Both roads lead to cuts, but the severity of cuts will depend on the outcome: a hard landing will likely lead to 200-300 basis points of rate cuts, while a soft landing only leading to 50-100 basis points of cuts.

2) We Believe There Will Be A Blow-Off Top In Equities

We urge investors to expect a blow-off top in the US equity market, which is a phenomenon that happens ahead of every recession.

Our research surrounding market cycles, specifically around late business cycle turning points, reveals that in the year preceding the equity market’s peak, the S&P rises by approximately 16%, with zero non-double-digit values in a 12-cycle sample.

Typically, the S&P peaks just before the recession, approximately a month before the trough in the unemployment rate and breakout in jobless claims, squeezing bears right up until the last innings of the expansion.

3) Bearish Investor Positioning Is Fueling This Rally

Our 42 Macro Aggregated Cross-Asset Positioning Models indicate that investors are still very bearish from a positioning standpoint.

The most recent data shows investors are more resolute in their bearish positions than at the October 22 lows.

Although those investors may be correct about the market’s destination in six to nine months, the challenge lies in the three to four months leading up to that period.

We believe there is risk of a continued market rally in the back half of the year, not driven by fundamentals but simply because the recession every bear is waiting on has not started yet.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

What Is The Outlook on Inflation?

Earlier this week, Darius joined Anthony Pompliano to discuss Global Liquidity, Inflation, the Housing Market, and more.

In case you missed it, here are five takeaways from the interview every investor needs to see:

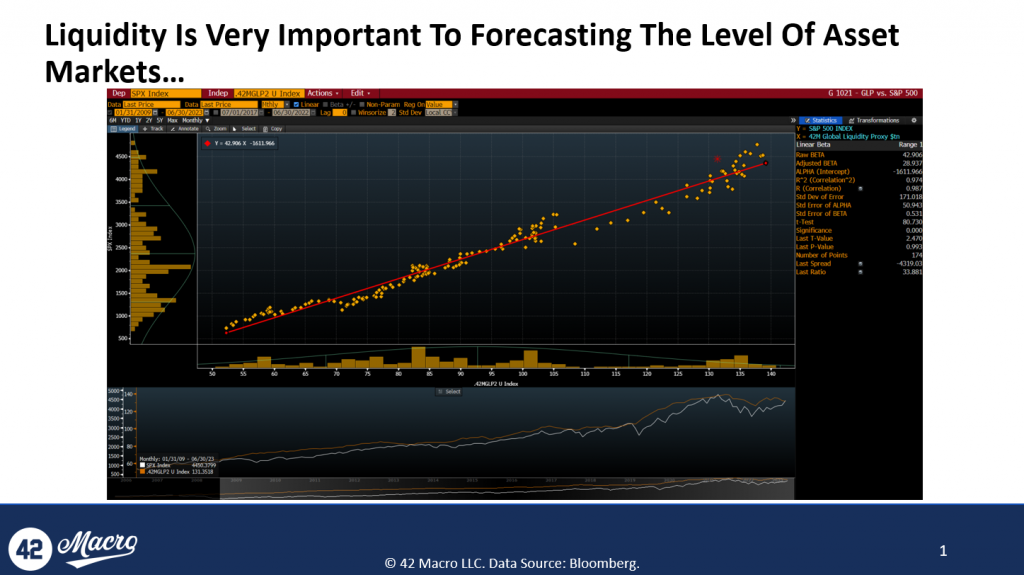

1. Global Liquidity Has Been Declining Over The Past Few Months

Our proxy for global liquidity, estimated via central bank balance sheets, broad money supply, and FX reserves minus gold, has been waning over recent months.

Now that we have observed a negative inflection in global liquidity, it is important for investors to ascertain the durability of this nascent trend.

2. Liquidity And Asset Markets Are Correlated On A Levels Basis, But Not On A Rate of Change Basis

The correlation between global liquidity and the S&P500 is substantial on a level basis, explaining 97% of the index’s level since 2009.

However, when regressing global liquidity against the rate of change of the S&P500, there is only a 12% correlation between the two.

When analyzing Bitcoin, we found that liquidity explains 77% of its level but 0% of its rate of change.

So, although liquidity is essential to understanding the long-term trend in asset markets, we should not linearly extrapolate its effects on asset markets in the short to intermediate term.

3. Inflation Will Be The Driver That Causes Asset Markets to Decline

We believe the revival of inflation as an important topic could lead to a downturn in the markets.

Currently, we are seeing favorable inflation outcomes and growth exceeding expectations supporting asset markets.

This dynamic has been beneficial for asset markets in H1, and we believe it will continue through July and possibly into August.

However, we might see inflation data harden afterward, especially relative to consensus expectations.

As the market begins to acknowledge that inflation will be sticky and require more global policy tightening than has been priced in, we expect a market correction.

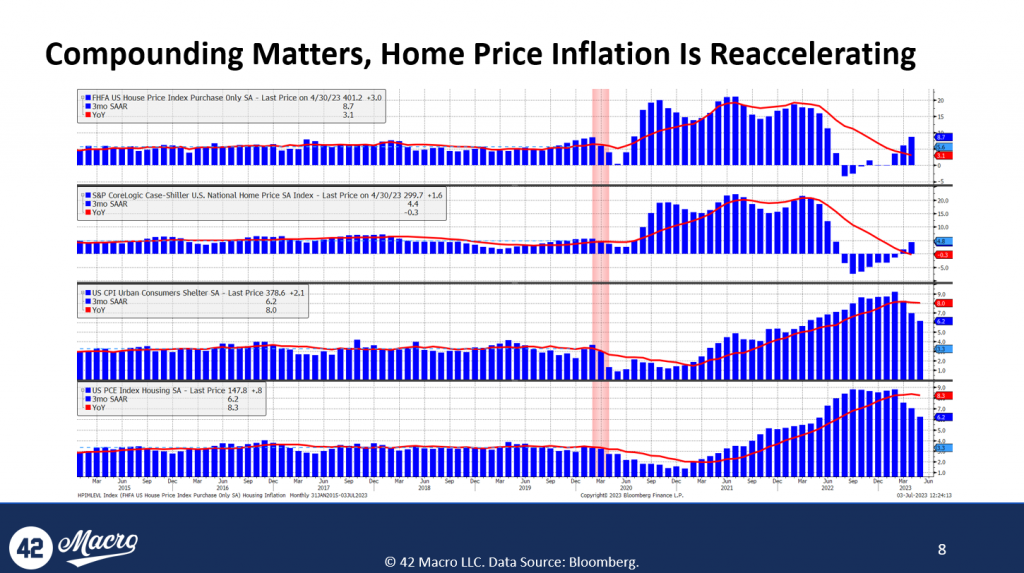

4. Home Prices Are Reaccelerating

According to the FHFA home prices index, home prices are increasing at a rate of 8.7% on a three-month annualized basis after bottoming in the first half of the year.

There is a rising probability we will see housing inflation bottoming out in the next two to three quarters, but at levels that contradict the Fed’s 2% inflation mandate.

The implications of this trend could be concerning, as the Fed might need to do significantly more to counteract the inflation impulse from the housing market.

5. The Days of Immaculate Disinflation Are Over

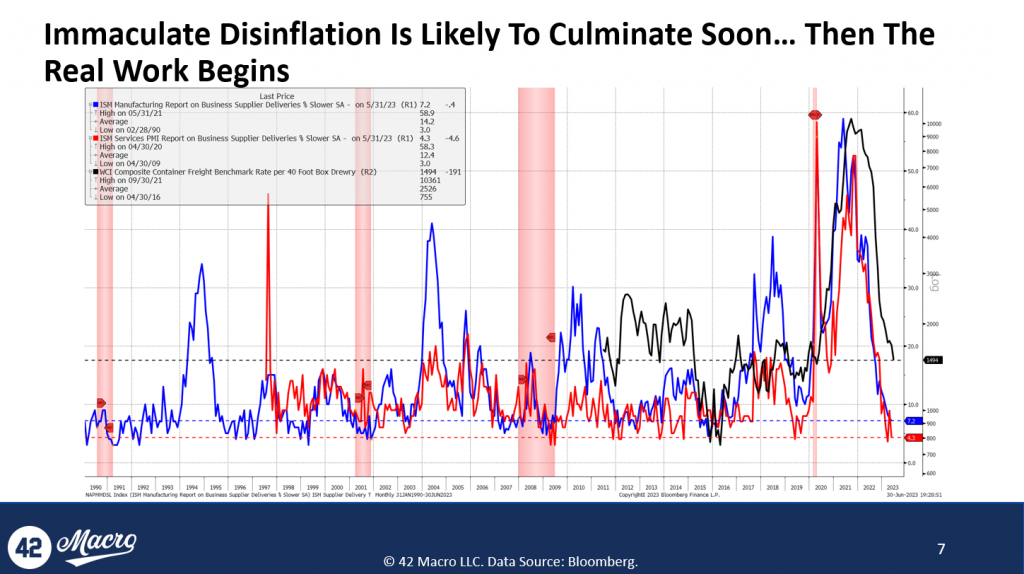

Indices like ISM manufacturing, ISM services, and the supply delivery times index are back at levels consistent with 2% inflation, implying that the period of “immaculate disinflation” driven by pandemic-related factors is coming to an end.

We believe that the easy part of the inflation battle might be over soon.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights.

Is Wall Street Calling The Fed’s Bluff?

Earlier this week, Darius joined Anthony Pompliano to discuss Manufacturing, the U.S. Consumer, Bitcoin, and more.

Miss the discussion? No problem. Here are the three most important insights that can help your portfolio:

1) Healthy Balance Sheets And A Robust Labor Market Are Contributing to a Resilient U.S. Consumer

Since August of 2022, we have consistently maintained the view that the U.S. economy would remain robust, despite recession fears.

June’s retail sales reported a 4.6% increase on a three-month annualized basis and the highest print we have seen in four months – further proof of the resilience of the consumer we have consistently called for.

Additionally, a significant driver of the increase in retail sales, auto sales, accelerated by a striking 23% on a three-month annualized basis.

Two key contributors to this consumer resilience have been healthy consumer balance sheets and a strong labor market.

2) Leading Manufacturing Indicators Point to Near-Term Bottom in the Inventory Cycle

The ISM Manufacturing PMI, the most widely used leading indicator for the broader US manufacturing cycle, recently dropped to 46.0 in June – a new cycle low.

However, the spread between the ISM Manufacturing New Orders PMI and ISM Manufacturing Inventories, which is a leading indicator of the headline index, suggests a bounce in the ISM Manufacturing PMI in the coming months.

A recovery in the inventory cycle would add additional support to the soft landing narrative and incrementally contribute to the epic short squeeze in US equities that we have and continue to call for.

3) S&P 500 and Bitcoin Correlations:

As part of our 42 Macro research, we conduct a multi-factor correlation study, tracking the S&P 500 and Bitcoin in relation to various macro factors.

Recently, the primary driver of the S&P’s performance has been cyclical growth expectations.

Bitcoin, however, is being driven by structural growth expectations, but inversely, and is rallying on potential recession prospects, which would pressure the Fed and other central banks to provide the market with ample liquidity.

Although most investors bundle risk assets into one broader bucket, the reality is that there is often a divergence between what drives different asset markets.

We believe the Fed will begin providing liquidity to the market by the spring of next year, creating a positive environment for risk assets into and through the end of 2024.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!

Macro Outlook

Darius joined Benjamin Cowen from Into The Cryptoverse earlier this week to discuss Inflation, the Labor, Liquidity, and more.

If you missed the interview, we have you covered. Here are three key insights that are important for your portfolio:

1) Despite The Recent Dovish Print on Inflation, We Believe The Fed Will Hike At The July Meeting

The money markets are currently pricing in approximately an 80% probability that the Federal Reserve will hike at their next meeting.

Generally, the Fed tends to move in sync with asset markets, acting according to what the market has priced in.

However, the Fed’s decisions are not purely inflation-oriented; they take into account labor market conditions as well.

Given these indicators, we believe the Fed will likely push through with the rate hike come July’s meeting.

2) Labor Hoarding Is Contributing to The Resiliency of The U.S. Economy

While the US Total Labor Force SA is trailing behind the pre-pandemic 2009-2019 trend, we have seen the Gross Domestic Income regain the trend shortly after the pandemic concluded.

This disparity tells us that there is an abundance of money in the economy but an inadequate labor force to meet the demand for goods and services.

Additionally, since March 2020, we have experienced labor demand outpace supply, with a staggering 3.9 million more in demand compared to available labor.

This excess demand for labor is causing labor hoarding, further strengthening the resilience of the U.S. economy.

3) We Are In A Liquidity Cycle Upturn; The Global Liquidity Cycle Bottomed In Fall of Last Year

Our 42 Macro Global Liquidity proxy, a sum of global central bank balance sheets, global broad money supply, and global FX reserves minus gold, shows a declining trend in recent months.

However, we believe the liquidity cycle bottomed last fall, and we are currently in the midst of a likely 2.5-year upswing.

Although we may see some turbulence over the next few quarters, Bitcoin, in this environment, could perform exceptionally well, pushing it above the $100,000 level by the end of next year.

In between now and then, we still anticipate a recession will commence in the US economy in the next two to three quarters, likely causing risk assets to fall as the Phase 2 credit cycle downturn sets in – a scenario that we believe has not been priced into the market yet.

We continue to believe risk assets will squeeze higher and peak in Q4 or Q1 of next year.

#respectthexaxis

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/appearances to unlock actionable, hedge-fund caliber investment insights and have a great day!

Where Do We Go From Here?

Where Do We Go From Here?

Last week, Darius joined Erik Townsend from Macro Voices to discuss the Stock Market, Credit, Inflation, and more.

Here are the three biggest takeaways from the interview that are critical for managing risk:

1) The Stock Market Always Rallies Sharply Leading Up to Recessions

When we evaluate the S&P 500 performance a year before its peak preceding a recession, we usually see it in the green, up on a median basis by +16%.

This year’s rally is not abnormal.

Our expectation is that the coming recession could kick off by the end of this year or early next year.

Moreover, we evaluated the S&P 500’s behavior in and around recessions since 1948, and our research shows the index, on a median basis, typically experiences a drawdown of -24%.

What triggers these rallies are not just macro fundamentals but also how investors are positioned in relation to potential outcomes.

Right now, we believe the current positioning dynamics may push the market higher in the short term because investors remain underweight equities to an extreme degree.

Understanding these positioning cycles is essential for getting the investment game right.

2) We Believe That A Phase 2 Credit Cycle Downturn Is Still On The Horizon.

The Silicon Valley Bank crisis, despite its impact, does not suffice as the Phase 2 Credit Cycle Downturn that we expect to see.

We believe there was a substantial decline in credit and lending standards already evident in January’s senior loan officer survey report.

The crisis did trigger further degradation, but only marginally.

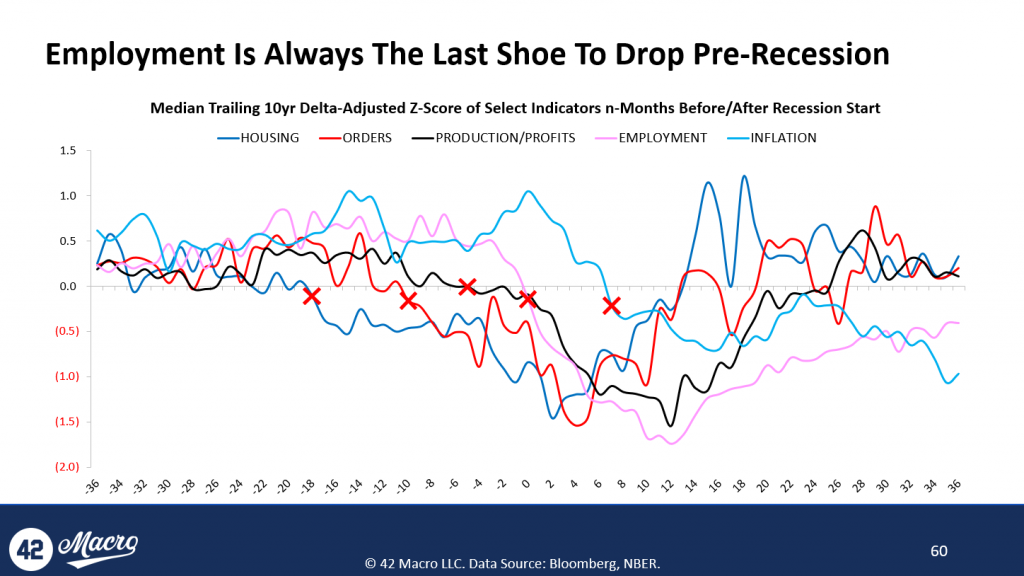

Additionally, we review five key cycles as part of our 42M research – housing, orders, production and profits, employment, and inflation.

The current data indicates a very regular business cycle, with housing, orders, and production and profits already breaking down.

Employment and inflation have yet to break down, and typically do not until the start of (employment) or well into (inflation) a recession, meaning we likely have not seen the start of the recession yet.

As such, the Phase 2 credit cycle downturn is yet to come and recommend incremental patience in terms of respecting the x-axis.

3) Immaculate Disinflation In The US Economy Is Likely To Conclude In 2H23

Over the past few months, we have seen substantial declines in measures of underlying inflation like median CPI, trimmed mean CPI, median PCE, trimmed mean PCE, super core CPI, and super core PCE.

This immaculate disinflation has contributed to the “transitory Goldilocks” theme we’ve observed in asset markets.

We refer to this inflation as ‘Immaculate’ because inflation normally breaks down 6 to 8 months after a recession; here it has meaningfully broken down beforehand.

For a variety of cyclical and structural reasons, we anticipate immaculate disinflation is nearing its end and that we will likely see inflation firm up in 2H23 – relative to expectations and potentially on an absolute basis as well.

We expect soft landing expectations to peak before the “immaculate disinflation” narrative is overtaken by our “resilient US economy = resilient US inflation” theme, contributing a blowoff top that leaves the stock market vulnerable to Phase 2.

That’s a wrap!

If you found this thread helpful, go to www.42macro.com/macro-bundle to unlock actionable, hedge-fund caliber investment insights and have a great day!